Introduction

Ten years ago many of us were struggling with the “unthinkable” Japanese scenario of lower interest rates for longer. What if the same would happen in Europe? Most of us faced problems integrating this very unlikely possibility in a strategic decision process dominated by traditional Asset Liability Modelling (ALM). Today, we know that what was “unthinkable” back then became reality. Going forwards, we need a better decision process that helps us to make the “unthinkable” thinkable. In this article we will outline a multi-disciplinary factor approach that will help trustees to better understand the consequences of different “unthinkable” economic scenarios and help investment professionals to manage the portfolio in more robust way.

Ten years ago many of us were struggling with the “unthinkable” Japanese scenario of lower interest rates for longer. What if the same would happen in Europe? Most of us faced problems integrating this very unlikely possibility in a strategic decision process dominated by traditional Asset Liability Modelling (ALM). Today, we know that what was “unthinkable” back then became reality. Going forwards, we need a better decision process that helps us to make the “unthinkable” thinkable. In this article we will outline a multi-disciplinary factor approach that will help trustees to better understand the consequences of different “unthinkable” economic scenarios and help investment professionals to manage the portfolio in more robust way.

There are many ways to achieve this goal and we outline an approach based on our experience in the UK over the last nine years. Our approach is based on first principle understanding of how the economic drivers, such as price inflation and economic growth, impact the price of assets. We are also aware that investor behaviour and interaction result in bubbles forming and subsequently bursting. Based on these understandings we outline a methodology where diversity is key to handling dominant and unpredictable risks. This provides a set of tools for trustees that will make the dominant risks more tangible, thereby allowing trustees to take actions that will result in a more robust funding ratio.

We need a decision process that helps us to make the “unthinkable” thinkable

Strengths and weaknesses of factor models

Factor models are useful statistical tools for capturing common drivers (dominant risks) impacting the funding ratios of pension funds. To find the relevant common factors investors search for evidence in financial theory, economics and behavioural science, investigating empirical rules of thumb and exploring statistical relationships. Based on the chosen factors, the investor specifies and estimates a linear statistical model using historical observations.

The interest in factor models has grown rapidly since Litterman and Scheinkman (1991) introduced three yield curve factors; level, slope and curvature. Their yield curve factors explained more than 99% of the yield of an individual government bond issue. For equities, a similar factor approach was proposed by Fama-French (1992). They introduced a three factor model (market, size, value) which explains around 40% of the returns of a specific stock. In contrast to modelling the yield of government bonds, a large portion of the variability of a single equity is driven by stock specific information. Over time, factor modelling techniques have developed dramatically and a recent overview is provided by Ang (2014).

Factor models help investors to capture different risk premia by tracking the movement of a limited set of factors. This is just another way to cut the pie compared to the classical approach where financial assets are bundled together into asset classes (cash, bonds, real estate and stocks). The factor approach provides the investor with a better articulation of the risk drivers, helping investors achieve better diversification by allocating risk between the factors instead of allocating capital between asset classes.

Factor models are useful tools, but what are the limitations?

- Persistence versus spurious correlation. Is there really a structural relationship or is it just some random effect that is accidentally occurring in historical data (i.e. data mining)?

- A missing factor. If many of the factors are partly dependent (multicollinearity) it could be the case that an underlying common factor is missing.

- Model specification and parameter estimation error. There is a practical trade-off between building a more complex model and the availability of historical data. More parameters require more historical observations.

- Structural shifts and non-linearity. If, from time to time, the world enters into a new regime, then historical observations from the previous regime do not necessarily provide guidance in the new regime. As complexity economics – and practical experience during past financial crises – teaches us, this often leads us astray just when we need our models the most.

The fundamental idea behind factor models makes perfect sense, but there is an outstanding question. How can we robustly operationalize it to manage the funding ratio of a pension fund in a world where structural shifts and uncertainty is in the very fabric of the economy and financial markets?

Multi-disciplinary approach

Keynes’ famous words “It is better to be roughly right than precisely wrong” illustrates the main challenge with building factor models. We could paraphrase Keynes as “It is better to get model specification about right than precisely reducing estimation error”. Applying this to the funding ratio of a pension fund means that we need robust intervals of possible outcomes, instead of precise point estimates which we already know never will be the exact outcome.

Fundamental economic drivers such as inflation and growth are, together with changing risk premia, the main drivers of asset prices. The dynamics of financial markets are affected by cyclical growth and inflation pressures (business cycle), long-term debt cycles as well as investors’ behaviour based on emotions. Shiller (1981) noticed that stock prices were more volatile than dividends. Soros (2013) introduced the concept reflexivity which means that the investor behaviour influences the risk premia which influences investor behaviour. This leads to bubbles in which particular investments experience huge capital inflows which are not related to the anticipated impact of fundamental economic growth or inflation. Ambachtsheer (2016) argues that there have been eight capital market eras since World War I, each driven by a persistent pessimistic or optimistic mind-set of investors. Although history does not repeat itself, there are similar patterns emerging and consequently disappearing over time. This is particularly clear in times of financial bubbles, from the tulip mania of the 17th century to the relatively recent subprime mortgage crisis.

The truth is that we simply do not know the future

The truth is that we simply do not know the future and therefore a certain degree of uncertainty is always present. In addition there are also situations without clear parallels in recent history, which make it even more difficult to assess how investors will react and thereby influence markets. The quantitative easing programs implemented by central banks are unprecedented and we know that the economy will eventually need to deleverage. This, combined with the growing populism (anti-globalisation), aging demographics, a shift away from industrial economy to a service-dominated economy and geo-political instability, makes the world even more uncertain and unpredictable today than we are used to. At least, it appears this way.

In today’s economic situation and current valuations of financial markets, the challenge for investors is to identify possible patterns that could emerge in the short and mid-term future. Longterm predictions are more or less futile since different patterns emerge and disappear over time. To make each of these potential patterns more tangible we illustrate them as economic scenarios – a simple painting of a plausible future. Working with scenarios is an adaptive process as when new information becomes available, new scenarios might emerge and existing scenarios may either evolve or disappear. The scenarios are intended to capture mid-term potential development, and from history it is clear that the current state of the economy can be quite persistent before it eventually disappears and another pattern emerges. Scenarios have become an integral part of strategic business decision making processes in large multinational companies.

In today’s economic situation and current valuations of financial markets, the challenge for investors is to identify possible patterns that could emerge in the short and mid-term future. Longterm predictions are more or less futile since different patterns emerge and disappear over time. To make each of these potential patterns more tangible we illustrate them as economic scenarios – a simple painting of a plausible future. Working with scenarios is an adaptive process as when new information becomes available, new scenarios might emerge and existing scenarios may either evolve or disappear. The scenarios are intended to capture mid-term potential development, and from history it is clear that the current state of the economy can be quite persistent before it eventually disappears and another pattern emerges. Scenarios have become an integral part of strategic business decision making processes in large multinational companies.

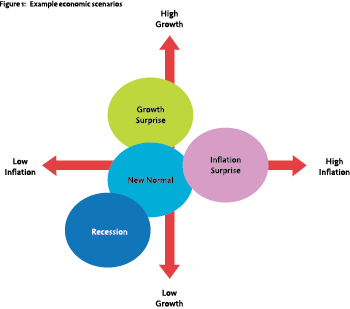

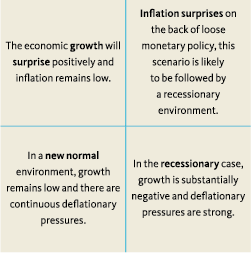

A set of plausible economic scenarios is briefly illustrated in Figure 1.

Translating each economic scenario into potential financial market returns requires a multidisciplinary mind-set since we need to build a specific economic model for each scenario. This approach combines current market valuations as well as scenario specific growth and inflation expectations. This provides us with indications on how the main drivers of the economy, in each economic scenario, could impact major markets. This is not an exact science, but it provides us with an understanding of the direction and interaction between major markets in different economic scenarios. To quantify the sensitivity of an individual investment, a detailed traditional factor model is specified for each scenario based on the major markets and other factors. These factor models are, when possible, estimated on historically similar periods. Economic and financial market knowledge (academic and experience based) is also required when specifying and estimating these factor models.

The four economic scenarios mentioned in Figure 1 do not capture all possible futures. They are what we consider most plausible based on our current assessment of the drivers of the economy. To assess the consequences of potential tail risks on the balance sheet, investors should apply specific tail scenarios designed to capture unlikely events which would have a large impact on the financial markets. These tail scenarios are less detailed than economic scenarios – they are more a sketch than a painting of a plausible future. The tail scenarios could be based on historical events, global warming, technological developments or geopolitical changes. Developing tail scenarios helps us to better understand the properties of tail risks in a concrete way, but it requires a truly multi-disciplinary mind-set to define and build plausible scenarios. Working with tail scenarios helps us to make the “unthinkable” thinkable and we can prepare contingency plans. In addition it keeps us alert and adaptive which make us better equipped to deal with those events that we did not consider. As Oscar Wilde once put it “To expect the unexpected shows a thoroughly modern intellect”.

The four economic scenarios mentioned in Figure 1 do not capture all possible futures. They are what we consider most plausible based on our current assessment of the drivers of the economy. To assess the consequences of potential tail risks on the balance sheet, investors should apply specific tail scenarios designed to capture unlikely events which would have a large impact on the financial markets. These tail scenarios are less detailed than economic scenarios – they are more a sketch than a painting of a plausible future. The tail scenarios could be based on historical events, global warming, technological developments or geopolitical changes. Developing tail scenarios helps us to better understand the properties of tail risks in a concrete way, but it requires a truly multi-disciplinary mind-set to define and build plausible scenarios. Working with tail scenarios helps us to make the “unthinkable” thinkable and we can prepare contingency plans. In addition it keeps us alert and adaptive which make us better equipped to deal with those events that we did not consider. As Oscar Wilde once put it “To expect the unexpected shows a thoroughly modern intellect”.

This approach is sensitive to choices and priorities that have been made at each step of the process. It is a qualitative approach with the goal to create a robust framework starting from first principle understanding without heavily relying on model assumptions. At a first glance it may appear subjective, but taking all available information into account this is the best we can do. It is worth keeping in mind that the underlying assumptions behind a purely data driven approach are also subjective, as a single model is only as strong as its weakest assumption. It is therefore important to have a multi-disciplinary mind-set and make use of a diverse set of models and theories.

Pension fund applications

Interest rate movements and changes to a variety of risk premiums are the main risk drivers for a pension fund. By focusing on inflation and growth as the key drivers it is possible to better understand how the funding ratio could develop in the short and mid-term future. To make it more tangible, we first use it as a diagnostic tool to test the robustness of the funding ratio. After that, the methodology described previously is used to build an investment portfolio where the funding ratio will be more robust across different economic scenarios and resilient in terms of weathering tail risks.

Application 1: Diagnostic test

According to AON/Pensioen Thermometer,2 the average pension fund in the Netherlands has a longterm asset mix consisting of roughly 10% real estate, 30% stocks, 55% fixed income and 5% other assets. The average interest rate hedging ratio is around 50%. An active mandate with a tracking error around 2% is expected to deliver approximately 0.5% additional annual return which is independent of the long-term asset mix. The dominant risks in such a portfolio are clear: equity risk and interest rate risk.

Pension funds with a funding ratio below 105% must submit a recovery plan which should include; additional contributions, restrictions on indexation and assumptions on future expected investment returns. The official recommendations are to be found in the “Advies Commissie Parameters”3 report. In the 2014 version of this report it is recommend that: Expected inflation steadily increases towards the ECB target of 2% within a 5 year period. Forward rates are used as interest rate predictions. Stocks and directly held Real Estate are expected to yield an annual return of 7% and 6% respectively. Based on these assumptions, it is clear that the “Commissie Parameters” advocates an economic scenario quite similar to the growth surprise scenario shown in Figure 1. To get a deeper understanding of this particular scenario and the tail risks associated with it, the “Commissie Parameters” recommend a stochastic analysis along the lines of Koijen, Nijman & Werker (2010).

In short, the average Dutch pension fund is exposed to two dominant risk (equity risk and interest rate risk) and the average portfolio is clearly positioned to do well in a very specific scenario. However most would agree that it’s not particularly unlikely that another economic scenario could materialise. What if this happens? If we consider a new normal scenario with lower growth rates than historically and inflation remaining at the current low levels, translating to low (or marginally falling) interest rates and a global stock market which, at best, returns around 3% with high volatility. For an average pension fund, this would lead to a much longer recovery period and probably result in modest cuts of pension rights over the next couple of years. In a gloomier recession scenario, we would face falling growth and deflationary pressure. This would significantly erode the funding ratio, since both dominant risks will have negative impact on the balance sheet. The unpleasant consequence of this scenario would be significant reductions of pension rights.

In addition, we need to quantify the possible, but unexpected tail events that could materialise. These tail scenarios are unlikely, but they could have a large impact on the portfolio. Is the fund able to cope with the consequences of a market crash similar to 2008? What are the consequences of an EU break up? To capture the consequences of these extreme risks requires a multi-disciplinary and diverse approach, which is quite different from applying stochastic analysis as recommended by “Commissie Parameters”.

After applying the diagnostic test, pension fund trustees gain insights into how the funding ratio could develop under different possible economic scenarios and stress situations. Based on these insights the natural follow-up question is: How do you adjust the portfolio in an adaptive way to get towards a more robust position?

Search for diversity instead of statistical diversification

Application 2: Portfolio Construction

The world is uncertain and unpredictable which means that any future scenario is the result of a subjective assessment. It is necessary to stay humble regarding our abilities to predict the future, since history shows that we frequently have been wrong. Ilmanen (2011) emphasizes in his book that it is important for a successful investor to be equipped with humility, pragmatism and diverse perspectives when approaching a complex world. Instead of “betting the farm” on one very specific economic scenario, it seems more sensible to build a portfolio that is robust across a multitude of plausible economic scenarios.

The liabilities are defined in the pension contract which implicitly results in an unintended exposure towards interest rate movements. A first step in building a robust portfolio would be to hedge these unintended risks, and consequently free up the risk budget for intended risks. In addition, this condenses the funding ratio problem into a more traditional investment problem. At each point in time, a preferred investment portfolio utilising the risk budget should:

- have sufficient expected return within the midterm horizon,

- be robust across economic scenarios and

- be resilient against tail events.

The basic idea of investing is to only take risk when the expected gains are sufficiently high to compensate for the potential downside. This relationship between risk and reward does vary over time and across potential economic scenarios. In each scenario, factor models can be used to determine the expected return and risk for a particular investment (or strategy). The overall expected return of an investment is then the probability weighted return across all economic scenarios.

Once a set of attractive investments (or “investment strategies”) has been identified, the following step is to combine them into a portfolio that is robust across economic scenarios. To achieve this, we need a diverse portfolio which is not driven by sensitive estimations of correlations between different investments based on historical data. It is reasonable to group investments together that behave in a similar way across economic scenarios and use these as a building blocks in portfolio optimization. For example all investments that are expected to perform well across economic scenarios are grouped together and labelled market neutral. Most of these strategies are driven by manager skill, for example long-short strategies and other types of absolute return strategies. Investments that will do well in growth surprise, neutral in new normal and bad in both inflation surprise and recession will be grouped together and labelled accordingly. All investments are grouped across other combinations of economic scenarios and outcomes. This approach helps investors to search for diversity instead of statistical diversification which often breaks down in case of crisis.

In addition to investments based on economic scenarios, it is useful to have a separate group of investment strategies that perform well when there are substantial economic changes. At time of large changes caused by a transition between two economic regimes, there is often a persistent behaviour (momentum) among investors which is partly driven by anchoring and herding. Trend following investment strategies like CTAs, tend to perform well in these transitions and typically add to the overall robustness of the portfolio.

With these different groupings as building blocks it is relatively straight forward to construct a robust portfolio. This should, however, not be considered a mechanical exercise. By using several different risk measures you can avoid relying too much on one single methodology. The uncertainties due to both model and measurement errors are substantial so there is no point over-engineer the portfolio optimisation. A crucial step in the portfolio construction is to adaptively adjust the risk level in the portfolio based on the risk appetite. At a neutral risk appetite, the risk level is at the base line. If risk is not expected to be rewarded in the near future we should take risk off the table and when risk is expected to be rewarded we should add risk to the table.

The last step is to make sure that the chosen portfolio is resilient against tail risks, i.e. that the consequences in tail scenarios are acceptable. If this is not the case, we need to either change the weightings of the different groupings or add some insurance strategies in order to reduce tail risks. The latter could be done by reducing the riskiest allocations or through buying put options. In practice, insurance strategies are only used in periods when the risk appetite is high and the portfolio is more aggressive. The intention is not to eliminate tail risks, but to keep losses at an acceptable level.

This is not rocket science, since rocket science is based on the stable laws of physics and not driven by human interactions. Implementing this framework in a successful way requires a multi-disciplinary mind-set and decision process that helps us mitigate our own behavioural biases. Mixing disciplines such as complexity theory, cognitive psychology, macroeconomics, sociology, history and finance are crucial for the outcome. In other words, allowing for a diversity of theories expands the toolbox, and it is crucial for investors to be aware of the strengths and weakness of the different tools.

Final thoughts

As investors, we need to make the “unthinkable” thinkable and integrate this into our investment processes. We should not overly rely on one single theory, method or model. Instead we should opt for a multi-disciplinary approach where diversity (instead of “statistical” diversification) helps us create a robust portfolio which is resilient in case of extreme outcomes. The multidisciplinary mind-set is crucial in outlining economic scenarios and for the decisions taken at each step of the process. An adaptive approach where we react not just to economic drivers such as growth and inflation, but also to psychological phenomena like euphoria-driven bubbles, helps avoid exposure to extreme risks. Robustness is not at the expense of returns since, if carefully implemented, this approach results in a better risk-return profile. Acknowledging the conventional wisdom that “past performance is no guarantee of future results”, we should therefore not allocate capital based on historical returns. Instead we should consciously allocate risk based on what we expect to happen in the underlying economy and the financial markets in the future. Constructing and implementing an investment portfolio along these lines does not provide a guarantee for a stable funding ratio, but it certainly beats the alternatives in this uncertain and often unpredictable world.

Sources

- Ambachtsheer, K. (2016), “The Future of Pension Management: Integrating Design, Governance, and Investing”, The Wiley Finance Series.

- Ang, A. (2014), “Asset Management: A Systematic Approach to Factor Investing.” Oxford University Press.

- Fama, E.; and French, K. (1992), “The Cross-Section of Expected Stock Returns.” The Journal of Finance 47 (2).

- Ilmanen, A. (2011), “Expected Returns: An Investor’s Guide to Harvesting Market Rewards.” The Wiley Finance Series.

- Koijen, R. S., T. E. Nijman, and B. J. Werker, (2010), “When can life cycle investors benefit from time varying bond risk premia?” Review of Financial Studies, 23(2):741–780.

- Litterman, R., and J. A. Scheinkman, (1991), “Common Factors Affecting Bond Returns.” Journal of Fixed Income 1.

- Shiller, R.J. (1981), “Do stock prices move too much to be justified by subsequent changes in dividends?” American Economic Review 71, 421-436.

- Soros, G. (2013), “Fallibility, reflexivity, and the human uncertainty principle.” Journal of Economic Methodology, 20(4), 309-329.

Notes

- De auteurs zijn werkzaam bij Cardano. Stefan Lundbergh, PhD is Director Cardano Insights en drs. Mark Petit CAIA is Head of Clients.

- http://www. pensioenthermometer.nl/ index.php?option=com_ content&view= article&id=6&Itemid=16

- https://www.rijksoverheid. nl/documenten/ rapporten/2014/03/21/ advies-commissieparameters

- Statistical models can result in a false sense of security. The CFO at Goldman Sachs, David Viniar, said in an interview in 2007 “We were seeing things that were 25-standard deviation moves, several days in a row.” referring to their stochastic analysis.

in VBA Journaal door Stefan Lundbergh (l) Mark Petit (r)