A 2020 CASE STUDY

2020 is a year that will be forever etched into the history books. Many lost a beloved relative, or friend, to the pandemic and all of us had to change our personal and professional lives in ways that would have been considered impossible prior to the pandemic. Despite the disruptive impact 2020 had on our lives, most long-term investors ended the year in positive territory. Yet, from an investment perspective, this was also a year in which decades happened.

This article discusses an investment approach that is more robust in case of a crisis and helps navigate the uncertainty in the following period. The first part of the article describe the ‘Scenario-ready’ approach, followed by a real-life case study in the second part. By definition a case study is a sample of one, a real life stress test of the strategy. The purpose of this paper is therefore not to provide a statistically significant proof, but to illustrate how a ‘Scenario-ready’ investment strategy could be implemented in practice during a very difficult period.

This article discusses an investment approach that is more robust in case of a crisis and helps navigate the uncertainty in the following period. The first part of the article describe the ‘Scenario-ready’ approach, followed by a real-life case study in the second part. By definition a case study is a sample of one, a real life stress test of the strategy. The purpose of this paper is therefore not to provide a statistically significant proof, but to illustrate how a ‘Scenario-ready’ investment strategy could be implemented in practice during a very difficult period.

The case study illustrates that it is possible to pursue a satisficing investment strategy, without giving up investment returns. The somewhat contradictory conclusion is that giving a global multiasset strategy team more degrees of freedom, resulted in less risk in the investment outcomes.

PART I: PREPARED FOR UNCERTAIN TIMES

Entering 2020, the global economy was not in a great shape, with high levels of debt and low economic growth, despite artificially low interest rates. At the beginning of the pandemic, it was not known how contagious the virus was, nor how to prevent it from spreading. With lockdowns in place, it was not clear whether the pandemic would be the catalyst for a recession or not. Governmental interventions supporting the economy were developed and rolled out in real-time and it was unclear how consumers and businesses would adapt to this new reality.

There were no textbook manuals for a 21st century pandemic and communities across the globe had to adapt and respond – fast! Navigating this developing crisis required an understanding of how the dynamics would change. But as governments, individuals and companies adapted to the new situation, feedback loops were created, which in turn changed the dynamics further, a phenomenon that Soros (1986) referred to as reflexivity. As a society, we learnt to think in scenarios and to update our plans as new information became available.

SATISFICING VS. OPTIMISING

The pandemic illustrates that it is impossible to predict when a crisis will happen. One way to prepare for the unknown is to construct a robust portfolio that will reach satisfying results under a broad range of possible outcomes and, as a crisis unfolds, be prepared to change the portfolio as the conditions change.

In that context, the investment team should focus on constructing a robust portfolio that delivers ‘satisficing’ needs, rather than ‘optimising’ the portfolio based on a single theory (Lo, 2017), see also Ben-Haim (2018). The future is path dependent which means that events in the past influence what may happen in the future. The pandemic thus illustrated that the longer term is a series of several shorter-term periods. This makes scenario thinking a useful tool for constructing satisficing portfolios.

In practice, this means that the investment outcome is the result of multiple small decisions, each targeting the portfolio’s risk characteristics so that it can remain resilient to an everchanging combination of future possibilities. This results in a scenario ready portfolio that is diversified across different potential economic futures, instead of ‘optimising’ the portfolio based on specific theoretical models expressing one specific future.

GOVERNANCE OF THE ‘SCENARIO READY’ INVESTING APPROACH

For aging Defined Benefit pension schemes, a satisficing approach to managing the balance sheet mitigates the sequencing risk and reduces the likelihood for the sponsor to pay additional deficit repair contributions. Scenario investing is one component of such an integrated approach. The inflation and interest rate sensitivity of the liabilities of the pension schemes are hedged using derivatives and a portion of the cash is invested in the ‘Scenario ready’ strategy. This approach allows the scheme to select an appropriate overall risk level in an easy way, without having to customise the composition of the ‘Scenario ready’ portfolio.

Constructing and managing a satisficing portfolio requires a governance structure holding the investment team accountable for the overall outcome. In this case study, the global multi-asset strategy team has been given a return target of CPI + 4.5%, over a business cycle, which makes it possible to cover the needs of most DB schemes. A return target does not mean giving the team a ‘carte blanche’, there is a clear separation of duties between the scenario construction team and the portfolio construction team.

The main difference with a traditional capital weighted reference portfolio approach is that it increases the overall transparency of who is accountable for each of the investment decisions, since nothing can be ‘stowed away’ in a reference portfolio. In addition, working with a return target removes the mental gravity that a capital weighted reference portfolio has on the wider investment organisation. In those cases when the investment organisation has large in-house asset class teams, a carefully designed governance structure is required to avoid that the tail may end up wagging the dog.

WORKING WITH A RETURN TARGET REMOVES THE MENTAL GRAVITY THAT THE REFERENCE PORTFOLIO HAS

Major decisions are taken by a portfolio construction committee, which also delegates responsibilities. To make the decisions more robust and to avoid ‘group think’, debiasing tools such as the devil’s advocate and pre-mortem are a natural part of the decision process. All decisions are documented for future evaluation and learnings. The committee meets on a regular weekly basis but ad-hoc committee meetings can be summoned on short notice.

Needless to say, the remuneration of the global multi-asset strategy team needs to be aligned with the long-term objective.

THE SCENARIO CONSTRUCTION PROCESS

The scenario construction team is tasked with developing and maintaining a suite of plausible 12 to 18 months ahead economic scenarios for the global economy. Each scenario describe a possible future ‘state of the world’, based on the current starting point. To reduce the potential number of scenarios a set on underlying economic drivers, such as inflation and economic growth, are at the core of the scenario construction. This leads to a suite of scenarios that will, as a minimum, comprise of a base case and two outlier cases although further scenarios are analysed and developed as appropriate.

The suite of scenarios broadly outlines potential ‘states of the world’ and how the major assets will be affected in each of them. To do that, the scenario construction team continually asks itself two questions; “What may happen next?” and “How will we be wrong?”. The answers to these questions are subject to debate and challenge.

First, the scenario team seeks challenge from outside the organisation, from the network of peers, providers and academics. The second step is an internal debate between the scenario team and the portfolio construction team. As a result the scenarios are neither imposed upon, nor directed by, the portfolio constructors. It is a collaborative process that ensures that rigorous scrutiny is applied to the portfolio construction process’s upstream activities.

DIVERSIFYING ACROSS DIFFERENT POTENTIAL ECONOMIC FUTURES, INSTEAD OF OPTIMISING THE PORTFOLIO BASED ON A SPECIFIC THEORETICAL MODEL

Once the suite of economic scenarios is determined, the impact on the wider financial markets is estimated. This will entail the forecasting of changes in risk premia using a blend of macroeconomic analysis, market data and anticipated policy responses. The output from this forecasting process will be a series of scenario-specific projected returns for instruments within the investment universe. These scenario-specific returns are used by the portfolio constructors in the next stage of the investment process.

THE PORTFOLIO CONSTRUCTION PROCESS

The portfolio construction team is tasked with building a portfolio that can deliver satisficing outcomes across the suite of scenarios. In order to achieve this requirement, it is likely that the portfolio’s asset allocation is tilted towards outcomes that are; reasonable likely and furthest from the present market valuations. The team is also likely to allocate away from outcomes that are already priced in by the market, i.e. where the expected risk / return pay-off would be weakest. This implicitly creates an contrarian approach.

To control for risk, the team must adhere to a range of portfolio construction rules that provides boundaries around their freedom to construct the portfolio as they might wish. These rules provide a robust ex-ante risk management framework which includes a minimum and maximum contribution to the portfolio risk contribution of each major asset class building block; for example equities, credit and government bonds. Whilst it is intuitive as to why maxima are applied, minima are important too. Minimum risk contributions act as the first rung on the ladder of ensuring that the portfolio has adequate diversification. Limitations on individual positions manage concentration risks and total net portfolio risk (after diversification) also has a minimum and maximum permitted range. The limits for the portfolio in the case study are 5% and 9%, measured as expected tracking error with respect to cash returns.

To gauge the portfolio’s resilience in the face of tail risks, the portfolio is also subject to a set of stress scenarios. These stress scenarios are based on:

- Historic episodes of market stress, e.g. Lehman crisis, taper tantrums, 9/11, etcetera;

- Risk premia expansions and contractions (and break downs in the historical correlations of risk premia changes between asset classes) irrespective of their cause;

- Pre-determined macro-economic outcomes, e.g. stagflation, deflationary busts, etcetera, even if these outcomes are not contained within the suite of scenarios.

Whilst it would not be possible to construct a portfolio that generates its target return across all the stress tests, the portfolio construction team can still gain valuable insight into the portfolio’s risk characteristics from an analysis of stress results. For instance: is there an asymmetry in the magnitude of the largest drawdowns and the largest gains? If so, does this asymmetry properly reflect the directionality of the portfolio’s positioning as guided by the scenarios?

INVESTMENT UNIVERSE AND INSTRUMENTS

To achieve this, a multi-asset strategy team requires a broad toolkit with three main levers:

- Changes to the total portfolio risk level;

- The allocation of risk across different asset classes;

- The use of different instruments for implementing the risk allocation within an asset class.

The first two levers include a broad opportunity set across equities, interest rates, credit, commodities, currencies and inflation protection. This is combined with the ability to use leverage to appropriately risk-balance assets that have inherently different risk characteristics. Also added is the flexibility to manage risk dynamically in response to change and to capture opportunities. The third lever covers the efficiency in the implementation of this ‘Scenario-ready’ strategy. This means proactively searching for the ‘cheapest’ exposure and being agnostic when it comes to different instruments while, when possible, striving for convexity.

PART II: CASE STUDY – IMPLEMENTING A SCENARIOREADY STRATEGY

To illustrate the implementation of a ‘Scenario-ready’ strategy, a case study is presented covering the decisions of one global multi-asset strategy team1 in 2020. This should primarily be seen as a stress test of the approach. In this case study, the ‘Scenarioready’ strategy was implemented by a seasoned team2 with years of experience implementing this strategy.

All investment decisions were made by humans, using modern tools and techniques to support the decision process. There were no proprietary black box models or advanced quant algorithms driving the decisions. Many long-term investors have investment teams of similar quality and access to the same market information.

In terms of trading activity, the ‘Scenario-ready’ strategy is a relatively low-intensity strategy compared to hedge funds with a similar return-target, but with an annual evaluation horizon. That being said, the strategy is managed dynamically and thus during periods when risk premia are changing rapidly, the strategy retains all the required flexibility to be responsive to evolving market conditions as will be illustrated below.

FIVE VERY DIFFERENT QUARTERS

From an investment perspective, 2020 was a year with several distinct periods. For simplicity, the year is segmented into calendar quarters and the changes to the risks presented by the global multi-asset opportunity set are detailed accordingly. This demonstrates how an economically-balanced, risk-allocated portfolio was able to take advantage of opportunities and respond to challenges. But first, let’s cast our minds back to late2019. How was the global financial system positioned and what was the market opportunity?

Q4 2019 – Heading for a late-cycle peak

Market

Equity markets performed well through the latter half of 2019 and, coupled with credit spreads that were relatively low, pro-growth risk assets looked close to cyclical peaks. Markets were unconcerned with potentially disruptive developments, volatility was low. Monetary policy, liquidity, economic and geopolitical conditions were favourable and thus risk was negatively skewed.

Positioning

Equity positions were supplemented with put protections to improve portfolio convexity, guarding against a reversal should positive drivers falter. Government bonds were leveraged to add portfolio risk, balancing the net equity exposure. No credit was held, and little inflation protection. Commodities exposure was limited. As a result, total net portfolio risk was close to the lower limit of the management range.

Rationale

With markets discounting a continuation of late-cycle conditions, risk / reward expectations around the scenario team’s base case favoured assets that would perform well in a reversal of conditions and the onset of a slowdown.

Q1 2020 – The two-step path into the crisis

Market

Volatility increased on geopolitical developments; positively, news flow centred on the US-China trade deal and negatively, upon Qasem Soleimani’s assassination. Equity markets were rattled but the emerging coronavirus situation was downplayed. Investors hoped that this virus would be locally contained or limited in global impact. Those hopes were reversed as the quarter wore on. The coronavirus spread globally. Initial hotspots in Europe and the US were seeing different public health responses and pro-growth risk markets crashed. The full extent of the inevitable fiscal and monetary policy response was yet to come.

Positioning

Whilst the portfolio didn’t anticipate the coronavirus as the catalyst for market turmoil, late-cycle positioning benefitted results. Government bond holdings protected returns during January’s “step one” deterioration and then, augmented by the put protection held against equity drops, supported during March’s “step two”. Equity exposure was then increased, and protection removed.

Rationale

Equity markets discounted a depression but the team’s forward looking expectations assigned only a low probability to this outcome. Evaluated against the full range of outcomes in the scenario suite, the probability of conditions arising that were more favourable than market expectations discounted was high. Asian markets were added first; crisis containment and the early prospect of recovery flowed from China’s aggressive coronavirus initiatives.

Q2 2020 – Unprecedented ‘policy bazooka’

Market

Clearly, global activity was heading lower for a prolonged period, due to lockdowns and travel restrictions. Large fiscal and monetary policy responses allowed pro-growth risk markets to rally. Disinflationary trends were heightened; energy markets, in particular, responded negatively to the collapse in activity and consequential supply/demand imbalance.

Positioning

Economic activity was set to be exceptionally weak, but progrowth markets were underpinned by policy support. Global equity risk and credit were added (diversifying away from Asia as political unrest in Hong Kong intensified). Government bond exposure was maintained. Risk was balanced with oil (capitalising on market dislocation), inflation break-even swaps and precious metals. The latter being an inflation hedge and protection against market stress.

Rationale

Fiscal expansion was incorporated within the scenario team’s base case – and thus support for equity markets was expected. However, a plethora of downside risks peppered the scenario suite; a reversal of sentiment, fiscal missteps and negative policy rates could not be ruled out, even in the US. Hence, a gradual approach to adding portfolio risk was warranted. An ex post analysis now shows that reducing diversification (and exposing the portfolio to a reversal of market trends) would have led to higher returns.

Q3 2020 – Consolidation

Market

Lockdowns eased and activity responded. Helped by supportive fiscal and monetary policy conditions, and with little prospect of accommodation being withdrawn, equity and credit risk markets moved higher. Government bond yields rose as the prospect of negative rates outside of the Eurozone eased.

Positioning

Government bond risk was reduced. A broad range of strategies was adopted to capture risk premia in more stable markets and further improve convexity; the portfolio sold equity puts and high yield puts, bought swaption protection to dilute the effects of further rises in Treasury yields and added Yen currency exposures as a cheap protection against market stress re-emerging. Inflation protection was increased using break-even inflation swaps.

Rationale

The summer period saw a consolidation of earlier trends. As the scenario team’s expectations were now pointing to a lower risk of market reversal reducing government bond risks and increasing inflation sensitivity in the portfolio was favoured. With respect to inflation protection, commodities were disfavoured, having already recovered from their earlier lows, because risk / reward expectations were not as strong as for break-even inflation swap markets.

Q4 2020 – The US presidential election

Market

The quarter’s biggest risks centred around the US presidential elections. However, in Europe, increasing coronavirus case counts halted the recovery and rattled markets. Contemporaneous news of successful vaccine trials, Biden’s presidential win and Democrat gains in the Senate all settled nerves. Further gains for pro-growth risk assets were made into the year-end.

Positioning

Initially, the portfolio took a cautious approach during this period, reducing equity exposure and increasing portfolio stress protection. Positions were quickly reversed mid-November; US equity exposure was increased (Russell 2000 rather than S&P500 to broaden exposure to a domestic US recovery and dilute FAANGS exposure); stress protection was reduced and inflation protection was increased.

Rationale

Caution was warranted as, with European recovery threatened by heightened coronavirus risks, any disruption from a contested presidential election would undermine market confidence. Whilst the scenario team did outline a possible favourable outcome for markets from an uncontested Democrat sweep this was not the base case and the portfolio was tilted away from it. Ultimately, the election outcome, closely followed by vaccine news, overshadowed other concerns. Markets rallied and the portfolio’s sub-optimal positioning was realigned as more positive economic expectations were promoted into the base case.

WERE THE CHECKS AND BALANCES EFFECTIVE?

WERE THE CHECKS AND BALANCES EFFECTIVE?

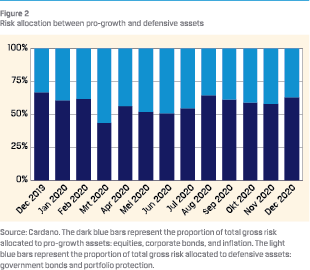

One concern with the ‘Scenario-ready’ strategy is that giving the multi-asset strategy team freedom could result in binary risk taking. Even in an extreme year as 2020, with a lot of investment activity, there were no extreme shifts in risk allocations on an aggregated level, as illustrated in Figure 1 and 2. This can be attributed to satisficing, not optimising, as the portfolio construction is using a scenario-based framework.

The investment decisions are based upon proprietary calculations, by the scenario team, of risk and return in a range of future possible ‘states of the world’. As referenced earlier, the portfolio construction team is likely to allocate towards ‘states of the world’ that are furthest from the present market view and credibly possible. The team is likely to allocate away from ‘states of the world’ that are discounted already by the market. It is a bit of a contrarian approach, but no ‘state of the world’ will be completely ignored. This leads to minimum risk allocations per asset class as well as a minimum total net risk allocation. In other words, satisficing acts as a natural counterbalance without curtailing investment opportunities.

In Figure 1 the realised risk is shown for each month. The ex-ante maximum limit of total risk was 9% and the minimum limit was 5%. The average risk allocation in Figure 2 hovers around 60%, this demonstrates the degree to which the multiasset team was able to change risk allocation within the guideline parameters for the ‘Scenario-ready’ portfolio.

In Figure 1 the realised risk is shown for each month. The ex-ante maximum limit of total risk was 9% and the minimum limit was 5%. The average risk allocation in Figure 2 hovers around 60%, this demonstrates the degree to which the multiasset team was able to change risk allocation within the guideline parameters for the ‘Scenario-ready’ portfolio.

WAS THE ROBUST PORTFOLIO TOO DEFENSIVE?

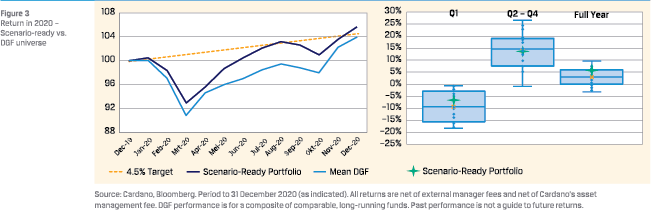

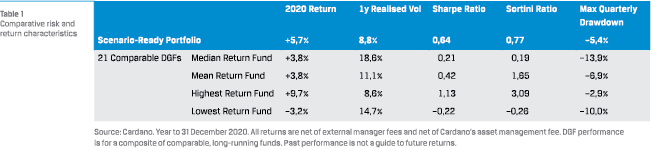

For a one-year case study, a comparison with the return target of CPI + 4.5% is not applicable since it should be measured over a business cycle,. A more relevant comparison is the performance of diversified growth funds (DGF) in 2020. The underlying investment approach differs across DGFs, where some hold a diversified, but relatively static, allocation to pro-growth assets while others have a more dynamic approach. In Figure 3, the ‘Scenario-ready’ strategy is compared with the average return of 213 popular DGFs with a similar return target.

In terms of realised return, the ‘Scenario-ready’ strategy performed well in comparison with the DGF, which illustrates that it was possible to hold a resilient portfolio without sacrificing investment returns during a very turbulent 2020. From the box plot it is clear that the scenario portfolio was able to withstand the fall in Q1 a good way and participate in the upside in the other quarters, reaching the upper quartile over the full year.

A strategy that satisfices – instead of optimises – will, by definition, not be the best nor worst in terms of outcomes since it is more robust. In turbulent periods, the ‘Scenario-ready’ approach is expected to deliver a more resilient return, reaching a higher risk adjusted return, see Table 1. The Sharpe ratio for the ‘Scenario-ready’ approach was 0.64 while it was 0.42 for the average DGF and 1.13 for the best performing DGF.

A strategy that satisfices – instead of optimises – will, by definition, not be the best nor worst in terms of outcomes since it is more robust. In turbulent periods, the ‘Scenario-ready’ approach is expected to deliver a more resilient return, reaching a higher risk adjusted return, see Table 1. The Sharpe ratio for the ‘Scenario-ready’ approach was 0.64 while it was 0.42 for the average DGF and 1.13 for the best performing DGF.

LUCK OR SKILL?

One could argue that in Q1, the investment team was “right for the wrong reasons”, since the portfolio had positioned for a down turn when the coronavirus crisis started. That is correct, since the investment team could not predict the impact of the coronavirus crisis and how markets would react in advance. But markets were expensive, the portfolio was positioned for potential bad news when the coronavirus crisis happened. It is worth to note that if the market would have been attractively priced, the market’s reaction to the crisis would probably have been less dramatic. Following the crisis, the investment team bought at low prices, which is a contrarian approach. The main difference with a more traditional approach is that the investment team did not have to consider the relative deviation to a benchmark portfolio. This made it psychologically easier for the team to adjust the positioning of the portfolio as the conditions changed during 2020.

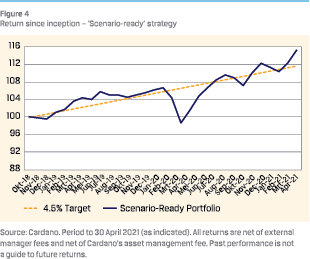

Although the case study is intended to illustrate a stress test of the ‘Scenario-ready’ approach it is worth to point out that it has performed as intended as well during less volatile periods. Since the inception in Q4 2018 of this particularly strategy it has delivered CPI+4.5% in a robust way, see Figure 4, although it is a bit too early to judge the strategy based on its track record since the sample size does not yet cover a full business cycle.

Although the case study is intended to illustrate a stress test of the ‘Scenario-ready’ approach it is worth to point out that it has performed as intended as well during less volatile periods. Since the inception in Q4 2018 of this particularly strategy it has delivered CPI+4.5% in a robust way, see Figure 4, although it is a bit too early to judge the strategy based on its track record since the sample size does not yet cover a full business cycle.

CONCLUSIONS

CONCLUSIONS

In this paper we outline a framework for constructing a satisficing portfolio and contrast this framework with a more traditional optimising approach. Moving away from a reference portfolio effectively removes an artificial barrier and makes it possible for multi-asset strategy teams to build more robust portfolios by adopting a ‘Scenario-ready’ approach. This requires autonomy, a broader investment universe and toolkit. To mitigate the increased freedom, a set of checks and balances need to be in place.

The case study is a stress test illustrating how the investment team was able to better adjust to changing conditions during a very stressful period. An important observation is that the natural checks and balances in the case study seemed to mitigate the potential risks by giving the investment team more autonomy and access to a broader toolkit. Another observation from the case study was that holding a portfolio that is resilient to market turmoil does not mean that investors must accept lower investment returns.

SATISFICING ACTS AS A NATURAL COUNTERBALANCE WITHOUT CURTAILING INVESTMENT OPPORTUNITIES

Note that this case study is a sample of one, which is not enough for making broad generalisations. But it shows that a ‘Scenarioready’ approach with a good investment team can deliver more resilient outcomes in a year ‘in which decades happened’. This also without missing the target in less exciting periods, as illustrated by the outcomes since the inception of this particular ‘Scenario ready strategy’.

References

- Ben-Haim, Y., 2018, The Dilemmas of Wonderland – Decisions in the Age of Innovation, Oxford University Press, Oxford.

- Lo, A.W., 2017, Adaptive Markets: Financial Evolution at the Speed of Thought, Princeton University Press, Princeton.

- Soros, G., 1986, The Alchemy of Finance, Hoboken, John Wiley & Sons, New Jersey

Notes

- Cardano Risk Management Ltd, UK-based Investment Team. The case-study reflects the management of the team’s global multi-asset strategy “Prime” portfolio. AuM within this strategy was GBP3.8bn at the end of the case study period.

- The authors are not part of the investment team.

- Based on monthly returns. DGF universe for this analysis: Aberdeen Standard GARS, Aviva AIMS, Baillie Gifford DGF, Barings DAA, Blackrock Dynamic DGF, Fidelity Diversified Markets, Fulcrum Diversified Absolute Return, GMO Global Real Return, Insight Broad Opportunities, Invesco GTR, M&G Dynamic Allocation, Newton Real Return, Ninety One DGF, Nordea Stable Return, Pictet Dynamic Allocation, Pyrford Global Total Return, Ruffer Absolute Return, Schroder DGF, Seven 7IM AAP Funds, Threadneedle Dynamic Real Return, Troy Multi-Asset Strategy.

in VBA Journaal door Stefan Lundbergh and Nigel Sillis