Larry Summers of Harvard University once said “In the history of the world, no one ever washed a rented car”. Apparently people behave differently depending on whether they are the owner or the fiduciary. This notion is the foundation of the agency theory and goes back to the writings of Adam Smith. Assuming that people in the first place serve their own interests, there is no reason to believe that the management of a company will act in the best interests of its capital providers. Therefore a set of mechanisms is needed that aligns the interests of the management with those of the capital providers, and that prevents management from destroying the value of the company. Corporate governance is all about that. In this article we will provide both an historical overview of the corporate governance debate, with a focus on the Dutch situation, followed by an overview of the empirical literature on the relationship between corporate governance, stock prices, firm value and accounting measures of financial performance.

1. An historical overview of the debate

1. An historical overview of the debate

Corporate governance has in recent years been a much-debated subject in all major industrialized countries, but especially in The Netherlands. The draft form of the Dutch Corporate Governance Code of 2003 elicited more than 250 written comments; more than the Higgs review in the UK, the Cromme Code in Germany or the Lippens Code in Belgium in 2003 and 2004.

This well-spring of reaction indicates that the public debate over corporate governance in The Netherlands was more heated than in other countries. This is supported by the correspondingly larger number of Dutch news articles that appeared on the subject than appeared in other markets that also had their accounting scandals.

In the US the most recent corporate governance reforms were a regulatory answer to the Enron, Tyco and Worldcom scandals. The impetus to create a new code in the Netherlands was directly linked to the Ahold accounting scandal of February 2003. Up to then corporate Holland preferred to wait for new European initiatives. But less than 30 days after the scandal erupted the Tabaksblat committee was formed to draw a corporate governance code.1

The sense of urgency was further heightened by the debate over executive remuneration that began in 2002. This debate would reach its zenith in 2003 with a call for a consumer boycott of the Dutch supermarket chain of Ahold, following the disclosure of the remuneration package of Ahold’s new CEO.

Compelling as they are, these factors alone, however, can not explain the broader public attention to corporate governance in The Netherlands compared to other continental European countries. Germany for example also had its share of corporate scandals, as did France and Italy. And executive remuneration has been a topic of fervent debate in both the US and in the UK and continental European countries for the past ten years.

In the US these factors combined produced the Sarbanes Oxley act. The European Union’s reaction was slower and less far-reaching. In this article we will not elaborate on the regulatory aspects of corporate governance in different markets. But to define the subject of corporate governance and to explain why Dutch interest in the subject exceeds that of its neighbors, we will first describe two unique features of Dutch listed companies and the legal framework within which they operate.

The first unique feature is the large company section of Dutch corporate law, the so-called structure regime. Since the 1970’s this law has placed enormous corporate power in the hands of a supervisory board (“Raad van Commissarissen”), which, in the two-tier corporate structure of Dutch companies, is separate from the executive board. These supervisory directors are not charged with acting in the interest of shareholders or employees, but instead are expected to act in the interest of the corporation. And because the law does not define what ‘the interest of the corporation’ might be, for all practical purposes, that interest is defined by the supervisory board itself.

Dutch law regards these supervisory directors as ‘wise men’ who ‘know best’ how to run a company: a governance model reminiscent of Plato’s trust in philosopher kings. And, until 2002, it was the official government policy that shareholder demands should only supersede supervisory board’s decisions in the ‘unlikely’ event that the supervisory board failed in its supervisory duties. This attitude went largely unchallenged until 2002, when several well publicized corporate strategic disasters end court cases sowed that blind trust in wise men is sometimes misplaced. Especially failed takeovers based on grandiose strategies showed that supervisory directors might have a ready ear for employee interests – workers councils, after all, have some say in their appointment – but were unable to restrain dominant chief executive officers.

The second unique feature comprises the anti-takeover measures built into Dutch company by-laws. Although companies in other countries also have their defenses, the Dutch arsenal contains some measures that interfere with the day tot day balance of power within a corporation, also when there is no hostile situation. These include:

- non voting share certificates

- priority shares

- binding nominations for board appointments

- preference shares with multiple voting rights that created board friendly blocks in the shareholders meeting

These and other sophisticated legal defenses were at the core of the first wave of discussions on corporate governance that started in the Netherlands in 1986. In that year the Amsterdam Stock Exchange raised the question whether anti-takeover measures had distorted the balance of power in listed companies and whether shareholders should not be given back some of their traditional rights in the interest of a well functioning capital market. It was pointed out that P/E ratio’s in Amsterdam were lower than in other markets.

Heated emotions, however, soon made a rational discussion about corporate governance impossible. The stock exchange had formed a committee to advise on changes, but the take over fight between publishers Elsevier and Kluwer in 1987 not only drew fault lines within this committee, where most of the members were in one way or the other linked to the contestants. It also pitted the Amsterdam Stock Exchange against a powerful and well-funded lobbying group organized by corporate Holland. Major companies such as Royal Dutch/Shell feared any denting of their corporate armor. With no securities and exchange watchdog to support it and lacking legal powers necessary to affect change, the Amsterdam Stock Exchange was no match for this powerful opponent. The issue of corporate governance remained buried in endless and fruitless rounds that lasted almost a decade to 1996.

The compromise was finally reached by splitting the subject in two. Regarding hostile takeovers a new law was drafted.2 It proposed that twelve months following the acquisition of 70 percent or more of the shares in a company, the acquirer be given the right to ask the court to abolish all anti-takeover measures in the acquired company. This less-thanshocking proposal was debated in parliament, but never ratified, as political parties did not dare to form their final opinion. It was subsequently buried in the drawers of legislature, never to be seen or heard of again. Dutch parliament waited for European legislation and when the 13th EU directive was finally accepted in 2004 the Dutch government had to make proposals to implement this directive in Dutch law. These proposals are now expected next year. That was the way The Netherlands dealt with antitakeover questions.

For all non-hostile, “peacetime” corporate governance issues, self-regulation was deemed to be the answer in 1996. A committee, named for its Chairman, Jaap Peters, was jointly established by the stock exchange and the listed companies, and published in 1997 forty recommendations for good governance.3 Both parties agreed that corporate compliance would be monitored on a one-time-only basis., which took place in 1998.4

Looking back, this decision may appear casual. But one should not forget that discussions in the 1990’s took place against a background of skyrocketing share prices and self-fulfilling prophesies of further rises to come. Dutch institutional and private investors alike were drawn into the stock market, a market institutional investors had shunned for years in favor of high real interest government bonds. In this “make hay while the sun shines” atmosphere, corporate governance was not a hot issue.

On the contrary, fuelled by the high national savings rate Dutch listed companies went on a international buying spree. Corporate managers set out to prove, especially with acquisitions in the US, that they could outdo their international competitors.

This rosy picture was abruptly shredded to pieces in early 2000 when Internet and Telecom stocks proved to be nothing more than emperors without clothes. By 2002, other highflying companies also faced rough landings on multiple fronts with the resulting financial restructurings, damaging shareholder value. Some of these were taken to court by investors seeking to prove mismanagement.

In the mean time, the Peters Committee, now officially disbanded, had transformed itself into a private foundation dedicated to fostering research and debate on corporate governance and at the end of 2002 it published a study which concluded that self regulation had failed and called for a new corporate governance code, enshrined in the law.5 Had it not been for the Ahold scandal however, even this call for action might have gone unheeded, as corporate Holland preferred to wait for proposals from the EU commission in Brussels. There, responding directly to Sarbanes Oxley, a group of legal experts asked for recommendations to modernize corporate law throughout the European Union, had its mandate broadened to provide also recommendations on corporate governance. Ultimately, the group decided that each country should formulate its own corporate governance code, but that these individual country efforts would be coordinated by the European Committee and be based on a European blueprint. As this blueprint was not unacceptable to corporate Holland, the new Dutch Corporate Governance Committee formed in 2003 and chaired by Morris Tabaksblat, had most of its work done even before deliberations began. In fact, writing the Dutch Corporate Governance Code, took less time than forming the committee that would have to write it. The major differences between the Dutch code and the European blueprint had to do with executive remuneration, golden parachutes and the number of board seats any one person could hold. The remuneration clauses were added at the request of the ministry of Finance and were intended for use as a bargaining chip in wage negotiations with labour unions. The issue of board seats was an attempt to open the old boys network, which in the Netherlands was particularly dense, because of the unique Dutch governance feature of the ‘structuurregime’, mentioned before.

Although the code is no force of law, it is, in an ingenious way, connected to the law, that will require listed companies to both explain to shareholders where they deviate from the code and seek shareholder approval for these discrepancies.

So, after a debate started in 1986 to improve the quality of the Amsterdam financial market, the Dutch regulated corporate governance issues. Looking back, it must be noted that the competitive position of the Amsterdam Stock Exchange, the casus belli of the whole debate, did not improve during the many years it took to reach consensus. The number of companies listed in Amsterdam shrank dramatically and the exchange witnessed the transfer of much of its power to Euronext in Paris. It is therefore, with mixed feelings, that after this review of the corporate governance debate in the Netherlands, we will now review what corporate governance really is all about. Whereby it should be noted that the 2003 Dutch corporate governance code, the outcome of the whole debate, in its 71 pages does not define what corporate governance is.

In the next sections we will leave the political arena and put the focus on the investor. From an investor perspective it is of interest to know how corporate governance impacts the risk-return profile of the firm. A large body of literature has emerged over the past years that analyses the relationship between corporate governance (and its components) on the one hand, and stock returns, firm value and accounting measures of performance on the other hand. In the next section we will present an overview of this literature.

2. Corporate governance, stock returns, firm value and financial performance

Since the publication of the Jensen and Mecking (1976) paper on the theory of the firm, largely inspired by Adam Smith’s Wealth of Nations, Berle and Means’ (1932) study of the modern corporation and the nature of the firm as described by Coase (1937), the number of theoretical papers devoted to the issue of corporate governance increased heavily6. Although we can also list numerous empirical studies, we will conclude that this research area is not in a mature stage yet. There are three major problems regarding empirical studies of corporate governance. Corporate governance characteristics used in these studies are often limited to one specific governance item (for example anti-takeover amendments, board structure or ownership structure) and the results are strongly dependent on the methodologies used. Moreover, the bulk of research effort is dedicated to the U.S. Especially outside the US, underlying databases lack quality and quantity in order to conduct sound empirical analysis. Nevertheless, a positive development is that a growing number of independent research firms (e.g. GMI and Deminor) and brokers (e.g. Deutsche Bank) are putting a great effort in collecting data on various aspects of corporate governance. No doubt, this will stimulate both the quantity and quality of research on corporate governance.

Before starting with a discussion on the empirical literature on corporate governance we will present a definition: “corporate governance deals with the ways in which suppliers of finance to corporations assure themselves of getting a return on their investments” (Shleifer & Vishny, 1997). Central in this definition is the agency relationship between the management of the firm on the one hand and the providers of capital on the other hand. Unlike many other definitions the focus here is on all capital providers, not just the shareholders. From an institutional investor perspective that is the right approach, since often times they are not only shareholder in a firm but also bondholder. In spite of the fact that corporate governance impacts both shareholders and bondholders, the focus in our discussion of the empirical literature will be on the shareholder. This is because most of the empirical literature is dedicated to the impact of corporate governance on the shareholders. We will nevertheless provide some flavor on the position of the bondholder from a corporate governance perspective at the end.

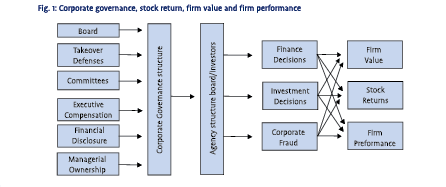

We have chosen to structure our discussion of the empirical corporate governance literature along four strands of research: the effect of individual or composite corporate governance indicators on: 1) stocks returns in the short (event studies) and long run, 2) firm value, in most cases measured by Tobin’s q7, 3) several performance or profitability measures of companies, mostly of an accounting origin, and on 4) financial statement fraud. To establish a relationship between corporate governance, stocks returns, firm value, profitability and financial statement fraud, we need to describe and classify corporate governance in a way that enables us to measure it. As figure 1 illustrates, we distinguish between six building blocks: Board, Takeover Defenses, Committees, Executive Compensation, Financial Disclosure and Managerial Ownership. Board measures both the size of the board and the proportion of independent outside directors. Furthermore, it measures whether the CEO and Chairman are separate persons. Takeover Defenses measures, which provisions a company has in place to limit the impact of shareholders and potential bidders. These provisions include poison pills, dual class of stock or unequal voting rights and supermajority voting requirements. Committees measures whether certain committees are in place (nomination committee, audit committee, compensation committee), and the proportion of independent directors on these committees. Executive Compensation measures not only the total value of the annual compensation of the board members, but also the structure of the compensation (what part of the compensation is coming from a fixed base salary and what part is coming from granted stocks or stock options). Financial Disclosure measures whether a company discloses its corporate governance guidelines, executive compensation guidelines and the percent of shares held by directors. It also measures whether there is a qualified audit opinion on the financial statements and whether a company expenses the options it has granted to its directors. Managerial Ownership measures the percentage of stock held by the board members.

The six building blocks just described make up the firm’s corporate governance structure. The specific nature of a firm’s corporate governance structure, which can be rather complex, determines the agency relationship between management and investors. The description of the agency structure translates into a set of incentives, risks and rewards, which all have an impact on a firm’s finance decisions, investment decisions and the probability of fraud (broadly defined, including earnings management). Finally, these decisions ultimately – in conjunction with the perceived agency risks by investors – determine the value of the firm, its stock return and firm performance.

In the following sections we will briefly discuss the empirical literature that puts the spot light on the relationship between the different components of corporate governance and stock return, firm value, firm performance and the probability of financial statement fraud. The reason for implicitly discussing the relationship between the components of a firm’s governance structure and the probability of fraud is twofold. First, a lot of recent accounting scandals were rooted in weak governance structures, which were unable to prevent managers from cooking the books. Secondly, for an investor the implications of corporate fraud, once revealed are normally disastrous. For example, Dechow, Sloan and Sweeney (1996) find that firms subject to a SEC investigation because of earnings management, experience an average return of –9% when it is first announced. Furthermore, Richardson, Tuna and Wu (2002) find, using a sample of 225 restating firms over the period 1971 – 2000, that firms that have to restate their earnings experience an average return of –11% over a three-day window around the first announcement and an average return of –25% over a [–120 days, +120 days] interval. These are just averages, and examples like Enron, MicroStrategy,and K-Mart, Ahold and Parmalat show that things can turn out much worse than that.

In the following sections we will briefly discuss the empirical literature that puts the spot light on the relationship between the different components of corporate governance and stock return, firm value, firm performance and the probability of financial statement fraud. The reason for implicitly discussing the relationship between the components of a firm’s governance structure and the probability of fraud is twofold. First, a lot of recent accounting scandals were rooted in weak governance structures, which were unable to prevent managers from cooking the books. Secondly, for an investor the implications of corporate fraud, once revealed are normally disastrous. For example, Dechow, Sloan and Sweeney (1996) find that firms subject to a SEC investigation because of earnings management, experience an average return of –9% when it is first announced. Furthermore, Richardson, Tuna and Wu (2002) find, using a sample of 225 restating firms over the period 1971 – 2000, that firms that have to restate their earnings experience an average return of –11% over a three-day window around the first announcement and an average return of –25% over a [–120 days, +120 days] interval. These are just averages, and examples like Enron, MicroStrategy,and K-Mart, Ahold and Parmalat show that things can turn out much worse than that.

3. Corporate Governance and stock returns

If investors put their money where their mouth is, we would expect to find a positive relationship between corporate governance and stock returns. According to an investor opinion survey by McKinsey (2002), almost 80% of the investors are willing to pay a premium for stocks of well-governed companies. For the US and the UK the average premium was between 12% and 14%, for Europe between 20% and 25% and for Asia close to 30%. Since it is imminent in human nature to claim more than we practice, it is up to empirical studies on the subject to verify the validity of this claim.

The vast majority of empirical research related to the effect of corporate governance measures on (short term) stock returns is based on event studies with a clear focus on anti-takeover amendments in the U.S. Karpoff and Malatesta (1989) conduct the most extensive study analyzing the wealth effect of all second-generation takeover defenses introduced in the U.S. between 1982 and 1987. Their sample covers about 88% of all firms listed on the NYSE and AMEX. They find a statistically significant, though rather small, negative announcement return. Bhagat and Jefferis (1991) study the effect of self-enacted takeover defenses by companies on stock returns8. Their results indicate that the adoption of anti-takeover amendments leads to significantly negative returns during the event period, after accounting for the fact that market participants might anticipate the adoption of the amendments. Bhagat and Jefferis argue that the enactment of anti-takeover amendments might depend on other firm specific variables such as board composition and size, leadership structure etc. Market participants adjust their expectations about the likelihood of adoption according to these firm characteristics. In a situation in which market participants do expect a firm to adopt these amendments there will be no reaction to the actual event. If a firm, however, unexpectedly adopts these amendments, Bhagat and Jefferis find a negative return. Neglecting this notion might produce misleading results.

Brickley, Coles and Terry (1994) investigate the shortterm stock price reaction to the adoption of poison pills depending on the proportion of outside directors on the board. They show that market participants perceive the adoption of these defenses differently, mainly depending on the composition of the board. In the absence of outside directors the predicted return is negative and in the presence of outside directors (at least two-third) positive. McWilliams and Sen (1997) find that firms in which the chairman and the CEO is one and the same person, the stock price reaction is negative when inside and affiliated directors dominate the board. Moreover, Klein (1998) shows that the market’s reaction to changes in board composition is strongly dependent on which committees these changes are taking place. Increasing the percentage of inside directors in investment and finance committees generally results in positive returns during the event period, whereas increasing the percentage of outsiders on these committees results in negative abnormal returns. The intuition behind this finding is that inside directors possibly have more firm-specific expertise than outside directors, which is needed especially for financing and long-term investment decisions. For compensation committees, however, market participants regard an increasing percentage of outsiders as favorable. Klein’s study shows that we have to carefully differentiate between the effects of inside versus outside directors depending on the specific committee.

Combining the evidence presented by the event studies discussed above, we have to conclude that there seems to be some evidence that corporate governance characteristics have an impact on short-term stock returns. The choice of event horizon, sample as well as research methodology, however, can have a considerable impact on the results. Although several studies qualitatively agree on the direction of these wealth effects, quantitative estimates diverge. Furthermore, event studies are by definition shortterm oriented and cannot make any inferences about long-term effects of corporate governance on stock returns. The long-term impact is especially interesting for institutional investors like pension funds and insurance companies. The main issue is therefore whether the market fully incorporates the effect on corporate governance immediately or whether there are indications that only part of this effect is directly accounted for in stock prices.

Klein (1998), Bauer, Guenster and Otten (20032004), Bøhren and Ødegaard (2001), Bhagat and Black (1999, 2002), Bhagat, Black and Blair (2002), Gompers, Ishii and Metrick (2003) and Drobetz, Schillhofer and Zimmermann (2003) are examples of the few studies conducted on the effect of corporate governance on long-term stock returns. Klein does not provide evidence that board committee structure significantly influences long-term stock returns, but this could partly be caused by a lack of sufficient time-series data. The results of Bhagat and Black indicate that firms with a bad history of stock market performance tend to increase the fraction of independent directors. They additionally examine the effect of board independence on future performance, using marketadjusted returns form 1991 until 1993 as the dependent variable. Although the coefficient of board independence is positive, it is statistically insignificant. Bhagat and Black therefore conclude that increasing the fraction of independent directors does not improve future performance. Bhagat, Black and Blair investigate the association between relational investors and market-adjusted stock returns for about 1500 U.S. firms. While their results indicate that large block holders might have improved performance during certain time-periods, their results are not robust to different time-periods as well as to specifications of relational investors. One main difficulty Bhagat, Black and Blair face is that there is not a formal model or definition of a ‘relational investor’. Consequently, one should interpret their results more as a first indication than as an absolute proof.

Klein (1998), Bauer, Guenster and Otten (20032004), Bøhren and Ødegaard (2001), Bhagat and Black (1999, 2002), Bhagat, Black and Blair (2002), Gompers, Ishii and Metrick (2003) and Drobetz, Schillhofer and Zimmermann (2003) are examples of the few studies conducted on the effect of corporate governance on long-term stock returns. Klein does not provide evidence that board committee structure significantly influences long-term stock returns, but this could partly be caused by a lack of sufficient time-series data. The results of Bhagat and Black indicate that firms with a bad history of stock market performance tend to increase the fraction of independent directors. They additionally examine the effect of board independence on future performance, using marketadjusted returns form 1991 until 1993 as the dependent variable. Although the coefficient of board independence is positive, it is statistically insignificant. Bhagat and Black therefore conclude that increasing the fraction of independent directors does not improve future performance. Bhagat, Black and Blair investigate the association between relational investors and market-adjusted stock returns for about 1500 U.S. firms. While their results indicate that large block holders might have improved performance during certain time-periods, their results are not robust to different time-periods as well as to specifications of relational investors. One main difficulty Bhagat, Black and Blair face is that there is not a formal model or definition of a ‘relational investor’. Consequently, one should interpret their results more as a first indication than as an absolute proof.

Gompers, Ishii and Metrick (2003) explore the effect of corporate governance on long-term returns, using a different approach than the other two studies. Their approach can be considered as the most comprehensive one, because of the use of a sample of approximately 1500 firms from 1990 till the end of 1999. They analyze the impact of 24 different governance provisions, which are all closely related to takeover defenses. Using these 24 different corporate governance provisions they construct a corporate governance index, using the following procedure. For every provision a company receives a score of one if it is part of its governance structure and a score of zero if it is not. The corporate governance index is simply a summation of the 24 scores. Using this very large database they construct portfolios consisting of firms with numerous anti-takeover amendments and high scores (‘Dictatorship Portfolio’) and portfolios including firms with very few amendments and low scores (‘Democracy Portfolio’). They subsequently examine the returns to holding a long position in the Democracy Portfolio and a short position in the Dictatorship Portfolio. After adjusting for risk factors, this simple strategy earns an average annual return of about 8.5%. To validate these results several robustness check are performed, which generally confirm the observation of positive returns to a corporate governance long-short strategy. However, recently several studies were conducted which show that the findings of Gompers et al. are highly sensitive to the specific methodology and time-horizon. Core, Guay and Rusticus (2004) provide evidence of a reversal effect taking place in the four years following the analysis of Gompers et al. Further, their results provide some indication that the findings of Gompers et al. might be closely related to the internet bubble. Removing technology firms substantially decreases the abnormal returns reported by Gompers et al. In addition, Cremers and Nair (2004) document that the performance differential diminishes substantially and becomes statistically insignificant when the cut-off points are slightly changed and the time-horizon is extended by two years. Moorman (2004) suggests that the abnormal returns are due to a misspecification of the asset pricing model. After using control firm portfolios to correct for the model misspecification, there is no evidence of abnormal returns to a corporate governance longshort strategy.

Bauer, Guenster and Otten (2004) study the relationship between corporate governance and longterm stock returns using a sample consisting of the 250 largest firms in the FTSE Eurotop 350 index, covering the period 1997 – 2002. Like in the Gompers, Ishii and Metrick study, they use a corporate governance rating (obtained from Deminor) to measure a firm’s level of corporate governance. Their results corroborate the findings of Gompers, Ishii and Metrick, although the performance of their long-short strategies is lower. Adjusting for the Fama-French risk factors and sector effects, they find an average annual return of 4.6% for the U.K. portfolio, whereas the EMU portfolio yields a return of 3% (if we would take out the sector neutrality constraint the annual returns would be respectively 6.8% and 1.6%).

Bøhren and Ødegaard (2001) study the long-term stock return effects of corporate governance for all non-financial Norwegian stocks for the period 1989 – 1997. To this end they construct a comprehensive database containing information on ownership structures, board characteristics, ownership concentration and security design as of 1989. On average they find only a weak positive, statistically insignificant relationship between corporate governance and long-term stock returns.

Drobetz, Schillhofer and Zimmermann (2003) also construct corporate governance factor portfolios similar to Gompers et al. After risk adjusting they find an extremely large excess return of 16.4% per annum, which is almost twice as much as the excess return reported by Gompers et al. for the U.S. market. In interpreting their results one should keep in mind that there are possible areas for improvement. Drobetz et al. sent out questionnaires to 253 German firms in different market segments. They only received answers from about 36% of these firms. Therefore, their sample is not necessarily reflecting the ‘average’ German firm. Furthermore, Drobetz et al. have no time-varying corporate governance ratings. Instead, they assume that the corporate governance rating was constant throughout their research horizon, January 1998 to March 2002. Despite these shortcomings, one should definitely acknowledge that Drobetz et al. are the first ones to examine the German market and attempt to overcome the obstacles in obtaining corporate governance information about non-U.S. firms.

4. Corporate Governance and firm value

While the empirical literature about the effect of corporate governance on stock returns was primarily considering anti-takeover amendments, studies about the effect on firm value have the tendency to focus on the firm’s board structure and equity ownership, and differences in legal frameworks between countries and states. There are generally few studies which use an approach based on a composite measure of corporate governance. In the majority of studies Tobin’s q is used to approximate firm value. Tobin’s q is defined as the ratio of the market value of assets to the replacement costs of assets.

4.1 Board structure and firm value

The literature analyzing the impact of the board on firm value generally focuses either on board size and/or board composition. While evidence about the effect of board size on firm value is rather conclusive, research on board composition finds more ambiguous results. Yermack (1996), for instance, analyses the relationship between board size and firm value for 452 U.S. firms. He performs extensive robustness checks, which all confirm his results. The evidence presented clearly indicates that board size is negatively correlated with firm value9. The relationship described for the U.S. market has been documented in other countries as well. Mak and Kusnadi (2002) present evidence that board size and firm value are negatively related in Singapore and Malaysian companies. Eisenberg, Sundgren and Wells (1998) report similar findings for the Finnish stock market. All studies discussed above find evidence of a statistically significant inverse realationship between board size and firm value. As Hermalin and Weisbach (2001) observe in their literature overview: “The data… appear fairly clear: board size and firm value are negatively correlated.”10 Although this observation is generally correct, a recent study conducted by Adams and Mehran (2002) shows that we have to differentiate across sectors. Most studies in the empirical literature focus on industrial firms and exclude financial companies11.

Evidence about the relationship between board composition and firm value is not nearly as conclusive. Despite the fact that numerous studies have investigated the relationship between board independence and firm value, ‘…there does not appear to be an empirical relation between board composition and firm performance.’ (Hermalin and Weisbach, 2001)12. Becht, Bolton and Röell (2002) confirmed this observation recently in their literature survey “…this work has investigated whether board composition and/or independence are related to corporate performance and typically rejects the existence of such a relationship.” A possible explanation for not finding a positive relationship with board independence is that we fail to define independence such that it accords with the perception of investors. Carter, Simkins and Simpson (2002) control for board independence and they find, like other studies, no significant effect. Their research actually focuses on board composition from a different point of view by analyzing the impact of board diversity on firm value. Diversity is defined as the fraction of women or minorities, such as African-Americans, Asians and Hispanics, on the board. Examining about 640 U.S. firms, they find a significant relationship between the percentage of women on the board and firm value. Their evidence furthermore shows that minority representation enhances firm value.

4.2 Managerial ownership and firm value

Like the relationship between board composition and firm value, the relationship between managerial ownership and firm value is far from conclusive. Important early contributions on this matter include Morck, Shleifer and Vishny (1988) and McConnell and Servaes (1990). Both studies find a non-monotonic relationship between managerial ownership and firm value. In their study, which contained 371 of the largest U.S. firms o f the Fortune 500 in 1980, Morck et al. find a positive relation between firm value and managerial ownership over 0 percent to 5 percent of outstanding shares, a negative relation over the 5 to 25 percent range, and a positive relation once again for managerial holdings exceeding 25 percent. Similar results were obtained by McConnell and Servaes. Their sample contained 1173 firms for the year 1976 and 1093 firms for the year 1986, which were all listed on the NYSE or AMEX. According to Morck et al. the non-monotonic relationship can be explained by combining the incentive alignment argument (Jensen and Meckling, 1976) with the entrenchment argument offered by Morck et al. According to the incentive alignment argument more managerial equity ownership implies less agency costs and risks and therefore a higher firm value. This would translate into a positive monotonic relationship between managerial ownership and firm value. The entrenchment argument holds that between ‘normal’ levels more managerial ownership may decrease the value of the firm because more power to the manager enables him to care less about the interests of the other stakeholders and instead focus primarily on his own wealth creation, partly at the expense of the other stakeholders. For low levels of managerial ownership it seems reasonable to expect that managers will not be entrenched at all, whereas for very high levels of managerial ownership there is hardly any difference between manager and owner and as a result the manager bears most of the costs of any sub-optimal decision making. The combination of both the incentive alignment argument and the entrenchment argument is able to explain the empirical findings of Morck et al. and McConnell and Servaes13.

One of the limitations of the studies mentioned above, and more generally with a lot of studies, which examine the relationship between corporate governance measures and firm value, is that the corporate governance variables are treated as exogenous variables. There are, however, many reasons to believe that managerial ownership and firm value are jointly determined. To account for that one should endogenize the ownership structure by using a simultaneous equations modelling approach. Agrawal and Knoeber (1996), Cho (1998) and Coles, Lemmon and Meschke (2003) are among the few studies that explicitly accounted for the joint determination of firm value and managerial ownership in their test methodology. Their results, however, are still inconclusive. Cho finds that, using a sample of 326 large U.S. firms from the Fortune 500 in the year 1991, manager ownership is determined by expected performance but not the other way around, which is consistent with the insider-reward argument. Agrawal and Knoeber find a positive relationship between managerial ownership and firm value; their sample contains 383 large U.S. firms from the Forbes 800 list for the year 1987. Finally, the study of Coles et al., which uses data from the Execucomp database covering the years 1993 through 2000, corroborate the findings of Morck et al. and McConnell and Servaes.

4.3 Investor protection and firm value

In this section we will start with a discussion on the studies of LaPorta, Lopez-de-Silanes, Shleifer and Vishny (2001) and Daines (2001), who examine the differences in corporate governance characteristics among countries and states. LaPorta et al. investigate differences in investor protection and their effect on firm value in 27 countries. Daines estimates the effect of Delaware law on firm value compared to other U.S. states.

Besides investigating the impact of corporate governance for a large sample of firms in different countries, one of the main benefits of the study conducted by LaPorta et al. is that their research is one of the very few empirical studies, which also develops a formal theoretical framework. This framework includes several aspects of the agency theory of Jensen and Meckling (1976). LaPorta et al. derive four main hypotheses, which subsequently are tested empirically14.

- firms in more protective legal regimes should have a higher Tobin’s q;

- firms with higher cash flow ownership by the controlling entrepreneur should have a higher Tobin’s q;

- firms with better investment opportunities should have a higher Tobin’s q;

- the effect of the entrepreneur’s cash flow ownership on valuation is lower in countries with good investor protection.

The empirical evidence presented strongly confirms these hypotheses. Firms incorporated in countries with superior investor protection laws, usually common law countries, have a higher valuation than firms in civil law countries, which tend to have less rigorous investor protection standards. Moreover, they find that higher cash flow ownership by the controlling shareholder has a positive impact on firm value. This effect is larger in a less protective legal environment. These results are corroborated by the study of Leutz, Nanda and Wysocki (2003). Based on the agency theory they argue that insiders have an incentive to conceal their private control benefits from outsiders. This can be effected by managing reported earnings. Their hypothesis is that firms in countries with strong investor rights and legal enforcement engage in less earnings management. Using a sample of non-financial companies from 31 countries for the period 1990 – 1999 they find a negative relationship between earnings management – proxied by various measures – and investor protection.

Whereas LaPorta et al. examine the effect of country law on firm value, Daines (2001) explicitly analyses the effect of state law. Since U.S. corporate law is determined by state law and not meaningfully affected by federal law, the approach is generally similar. Delaware has a unique law, significantly different from all other U.S. states. More than 50% of publicly traded U.S. firms are incorporated in Delaware15. Therefore, the question arises whether Delaware is chosen as state of incorporation because its unique laws benefit shareholders or management. If they benefit shareholders, incorporation in Delaware should be positively associated with firm value, after controlling for other factors. Daines examines a very large sample of about 4500 U.S. corporations over the time period 1981-1996. His results indicate that Delaware law increases firm value. According to Daines, one main argument why Delaware law increases firm value is that it facilitates takeovers by decreasing the associated costs compared to other states. We can conclude from the evidence presented so far that state and country laws remarkably affect firm value.

Another issue is how different governance standards among firms within one country affect firm valuation. We will describe three studies analyzing the effect of corporate governance standards within one country. De Jong, de Jong, Mertens and Wasley (2002) examine the impact of corporate governance on firm value for Dutch corporations using a sample of 205 Dutch firms between 1992 and 1999. While their main objective is to examine the effectiveness of the Netherlands’ Peters Committee16, a self-regulation initiative, their research also gives significant insight into the impact of governance standards on firm value in the Netherlands. Dutch firm above a certain size and having more than 50% of their employees in the Netherlands are required to operate under a socalled ‘structured regime’. Under this system, a supervisory board is established which takes rights from shareholders and should exercise them on behalf of all stakeholders. Obviously, this system causes a greater separation of ownership and control, since the owners cannot directly exercise their rights. Besides the structured regime, they analyze the impact of ownership structure and takeover defenses. Their results show that the structured regime prevailing in the Netherlands has a negative impact on firm value. They confirm the results of La Porta et al. and find a positive correlation between insider holding and firm value. De Jong et al. find that anti-takeover amendments decrease firm value, supporting the research of Gompers et al., discussed below, and the interpretation of Daines. Gompers, Ishii and Metrick (2003) study the effect of corporate governance on firm value in the U.S. They find that anti-takeover amendments are negatively correlated with Tobin’s q after controlling for other factors. Further, their results show that the impact of corporate governance on firm value is significantly larger in 1999 than in 1990. This finding suggests that U.S. stock prices have adjusted over this time-period to account for the impact of corporate governance standards. Drobetz, Schillhofer and Zimmermann (2003) analyze the effect of corporate governance on firm value in Germany. In accordance with other authors, they find that superior governance standards increase firm value.

Both Gompers et al., De Jong et al. and Drobetz et al. present evidence that good corporate governance and firm value are positively related in developed countries. Nevertheless, the magnitude of the effect seems to be even larger in developing countries. Black (2001) analyses the relationship between corporate governance and firm value in Russia. Although he uses a very small sample, his study gives significant insight about the value of corporate governance in a country in which governance standards are very diverse. Compared to Western Europe and the US, governance standards as well as their enforcement are less effective in Russia. Therefore, Russian companies show a wide divergence within their standards, as they can choose their governance rules without external constraints. Black examines a sample of 16 Russian firms in 1999. Despite the small sample size, the results are statistically significant. Corporate governance seems to have a substantial impact on firm value in Russia. An improvement in the governance ranking by one standard deviation is associated with a more than 8-fold increase in firm value. This relationship is much stronger than the evidence usually presented for developed countries.

5. Corporate governance and performance measures

Research about the effect of corporate governance on firm performance can be generally divided into two types of studies. The first line of research examines the effect indirectly by looking at variables, which are no direct measures of firm performance, but give an indication of agency costs arising from different corporate governance rules. Betrand and Mullainathan (1999), for instance, investigate the impact of anti-takeover amendments on CEO pay. They find that the adoption of takeover defenses is generally followed by an increase in CEO pay, compared to firms not adopting the amendments. Core, Holthausen and Larcker (1998) also analyze CEO compensation related to the governance structure. Unlike Bertrand and Mullainathan, they do not focus on anti-takeover amendments, but instead consider the impact of board and ownership structure. Their results show that CEO compensation is higher, the less effective the governance structure. Meulbroek, Mitchell, Mulherin, Netter and Poulsen (1990) present evidence that managers decrease R&D spending upon the introduction of anti-takeover amendments. Garvey and Hanka (1999) find that managers substantially reduce the use of debt financing subsequent to the adoption of takeover defenses. All studies presented conclude that less efficient governance structures increase corporate slack and thus agency costs.

A second line of research uses performance and profitability ratios to examine the effect of governance standards on firm performance directly. Most of these studies examine the impact of corporate governance on firm value or long-term stock returns besides analyzing the effect on firm performance. Gompers, Ishii and Metrick (2003) examined the relationship between their corporate governance index (introduced in the section on corporate governance and stock returns), and various accounting measures of performance, net profit margin, ROE and sales growth (all industry-adjusted). On average their results indicate that firms with good governance have better operating performance than firms with poor governance. Bauer, Guenster and Otten did a similar study for EMU countries and the UK. Unlike Gompers et al. they did find that ROE and net profit margin are negatively related to the level of corporate governance. For the U.K. the results were not statistically significant, however the coefficients for the EMU countries were statistically significant. Taking into account country effects did not have a major impact on the results; the coefficients were still negative, though no longer statistically significant. A possible explanation is that the perceived quality of earnings numbers in the late nineties did have a detrimental impact on the relationship between accounting based profitability ratios and stock returns.

6. Corporate governance and corporate fraud

Corporate fraud can be defined and classified in many ways. We follow the classification by Karpoff and Lott (1993) who distinguish between fraud of stakeholders (this occurs when a company lies about contracts with customers, suppliers and employees), fraud of the government (this occurs when a company lies about contracts it has with the government), fraud of financial reporting (this occurs when a company misrepresents its financial conditions in the financial reports) and regulatory violations (this occurs when a company violates regulations that can be enforced by federal agencies; this may be regulations related to environmental issues, antitrust law issues etcetera). In this section our focus is on financial reporting fraud.

Corporate fraud can be defined and classified in many ways. We follow the classification by Karpoff and Lott (1993) who distinguish between fraud of stakeholders (this occurs when a company lies about contracts with customers, suppliers and employees), fraud of the government (this occurs when a company lies about contracts it has with the government), fraud of financial reporting (this occurs when a company misrepresents its financial conditions in the financial reports) and regulatory violations (this occurs when a company violates regulations that can be enforced by federal agencies; this may be regulations related to environmental issues, antitrust law issues etcetera). In this section our focus is on financial reporting fraud.

Beasley (1996) examined the relationship between the proportion of outside directors on the board and the probability of financial statement fraud. He used a sample of 75 fraud and 75 matched non-fraud companies in the US over the period 1980 – 1991, and he applied a logit regression approach. He found that outside board members reduce the likelihood of financial statement fraud. This finding is corroborated by the study of Uzun, Szewczyk and Varma (2004), using a similar approach over the period 1978 – 2001. For the U.K. Peasnell, Pope and Youn (2000) provide evidence that supports the conclusion of Beasley

Bryan, Liu and Tiras (2004) study whether the quality of earnings would improve if a company employs an audit committee, comprised of members that are independent and skilled in finance and accounting, and which meets regularly17. Earnings quality is measured by the size of accruals. Their sample consists of all firms listed on the 1996 Fortune 500, and their tests include the years 1996 – 2000. They find a significant positive relationship between the quality of earnings and the proportion of independent and financially literate members.

Using a sample consisting of all firm-year observations with information on CEO stock-based compensation included in the ExecuComp database for the years 1993 – 2000, Cheng and Warfield (2003) find that managers with high stock-based compensation are a) more likely to sell shares in subsequent periods, b) more likely to report earnings numbers that meet or just beat analysts’ forecasts, and c) more likely to report high accruals. Erickson, Hanlon and Maydew (2004) conduct a similar study. Their sample includes 50 firms that are accused of accounting fraud by the SEC over the period from 1996 through 2003. Controlling for other governance characteristics, financial performance, financial distress, market capitalization and the probability that a company will obtain additional financing, they find a positive relationship between stock-based executive compensation and accounting fraud. Similar results have been found by Johnson, Ryan and Tian (2003), and Gao and Shrieves (2002). All these studies report results that are in accordance with Jensen’s (2004) concept of Agency Costs of Overvalued Equity, which argues that stock-based compensation motivates management to manage the earnings numbers.

7. Digesting the empirical evidence and venues for further research

Several important conclusions can be drawn based on the analysis of the previous paragraphs. First, several empirical studies indicate that corporate governance has a positive effect on stock returns, especially in the long term. Studies on the short term provide inconclusive evidence. Unfortunately, most studies focus on one or a limited number of governance measures, are based predominantly in a US context and use databases with too short histories to draw any conclusions for the long term. Second, firm value is negatively related to board size and, against widespread beliefs in the institutional investment world, board independence does not seem to have a significant impact. Furthermore, the research shows that the impact of corporate governance on firm value is larger, the wider the divergence in standards. This result can have two implications, which are related. Investors in countries with weaker standards might assign a higher importance to governance mechanisms. Instead of being protected by laws and their enforcement, they have to ensure themselves that they are not being betrayed. Therefore they investigate the governance standards of the companies they chose to invest in more carefully. The problem might also be inherent in the data. The variation in standards in developed countries might be so small, that their effect may be less observable. A third important conclusion is that less efficient governance structures increase the probability of corporate slack and hence low scores on internal efficiency ratios. Finally, a relatively new strand of the literature shows a direct connection between the governance of a company and the probability of financial statement fraud. Although most of these studies face limitations of various kinds we feel that there is a clear indication that corporate governance information is positively linked with the financial performance of companies.

What can we learn from these insights? Well, first of all companies should realize that the empirical evidence will encourage shareholders to act more proactively on annual shareholder meetings. The emergence of corporate governance networks across and within countries facilitates that shareholders increasingly pressure the boards of companies. The recent change in the board structure of Royal Dutch/Shell maybe is a good example. Furthermore, some of these shareholders might, fuelled by the empirical evidence, explicitly integrate corporate governance information into their investment process. This again might induce third parties, like index providers and brokers, to incorporate governance information directly into their analysis. Eventually, this could possibly lead to a lower cost of capital for well-governed companies. On the other hand we should be cautious: the cost of capital is a combination of both equity and debt capital. Recent theoretical and empirical evidence shows that a positive effect of corporate governance on shareholders does not necessarily have a positive impact on bondholders. A good example is the abolishment of anti-takeover amendments, which can be harmful for providers of debt capital. Removing these amendments raises the probability that the current management of the firm will be replaced. Bondholders then have to negotiate with a new management. This might lead to a higher ex ante risk premium required by providers of debt capital. The important question is now whether the gain of shareholders is offset by the loss of bondholders?

So what is a possible research agenda for the future? In our opinion, the construction of sound databases, with a large history, across countries and incorporating a variety of governance information, is a necessary condition for future empirical research. Conclusions will only be taken seriously and acted upon when institutional investors are comfortable with the setup of studies. Linking the recent “codification” and changes in legislation with corporate governance information will give new insights in the behavior of the boards of companies. Subsequently, investigating the impact of these changes on financial performance measures then can provide valuable insights to shareholders. Moreover, for reasons mentioned above, future research should not just focus on the impact of corporate governance on shareholders, but on all providers of risk capital.

The evidence in this overview article may suggest the contrary, but we are at the start of this research area, which can be tackled both from a theoretical and an empirical side. Investments in data bases and openminds of all parties involved are required. The management of companies, providers of capital and regulatory bodies can then reap the fruits of new research insights and use them in a practical context.

References

- Adams, R.B., H. Mehran, Board Structure and Banking Firm Performance, 2002, available from http://papers.ssrn. com

- Agrawal, A., C.R. Knoeber, Firm Performance and Mechanisms to Control Agency Problems Between Managers and Shareholders, Journal of Financial and Quantitative Analysis, 1996, Vol. 31, p. 377-397

- Bauer, R., N. Guenster, R. Otten, Empirical Evidence on Corporate Governance in Europe: The Effect on Stock Returns, Firm Value and Performance, Journal of Asset Management, 2004, Vol. 5, p. 77-90

- Beasley, M.S., An Empirical Analysis of the Relation between the Board of Director Composition and Financial Statement Fraud, The Accounting Review, 1996, Vol. 71, p. 443-465

- Becht, M., P. Bolton, A. Röell, Corporate Governance and Control, 2002, available from http://papers.ssrn.com

- Berle, A. A., G.C. Means, The Modern Corporation and Private Property, Macmillan Publsihing Co., 1932, New York

- Bertrand, M., S. mullainathan, Corporate Governance and Executive Pay: Evidence from Taeover Legislation, 1999, available from http://papers.ssrn.com

- Bhagat, S., R.H. Jefferis, Voting Power in the Proxy Process: the Case of Anti-takeover Charter Amendments, Journal of Financial Economics, 1991, Vol. 30, p. 193-225

- Bhagat, S., B. Black, The Uncertain relationship Between Board Composition and Firm Performance, Business Lawyer, 1999, Vol. 54, p. 921-963

- Bhagat, S., B. Black, The Non-Correlation Between Board Independence and Long-Term Firm Performance, The Journal of Corporation law, Winter 2002, p. 231-273

- Bhagat, S., B. Black, M. Blair, Relational Investing and Firm Performance, 2002, available from http://paper.ssrn.com

- Black, B., Does Corporate Governance Matter? A Crude Test Using Russian Data, University of Pennsylvania Law Review, 2001, Vol. 149, p. 2131-2150

- Bøhren, ø, B. ødegaard, Corporate Governance and Economic Performance in Norwegian Listed Firms, Working Paper, 2001, The Norwegian School of Management

- Brickley, J.A., J.L. Coles, R.L. Terry, Outside Directors and the Adoption of Poison Pills, Journal of Financial Economics, 1994, Vol. 35, p. 371-390

- Bryan, D.M., C. Liu, S.L. Tiras, The Influence of Independent and Effective Audit Committees on Earnings Quality, 2004, paper available at http://papers.ssrn.com

- Carter, D.A., B.J. Simkins, W.G. Simpson, Corporate Governance Board Diversity and Firm Value, 2002, available from http://papers.ssrn.com

- Cheng, Q., T. Warfield, Equity Incentives and Earnings Management, 2004, paper available at http://papers.ssrn.com

- Cho, M., Ownership structure, Investment, and the Corporate Value: an Empirical Analysis, Journal of Financial Economics, 1998, Vol. 47, p. 103-121

- Coase, R.H., The Nature of the Firm, Economica 4, No. 13-16, 1937, p. 386-405

- Coles, J.L., J.F. Meschke, M. L. Lemon, Structural Models and Endogeneity in Corporate Finance: The Link Between Managerial Ownership and Corporate Performance, available from http://papers.ssrn.com

- Core, J., W. Guay, and T. Rusticus, ‘Does weak governance cause weak stock returns?

- An examination of firm operating performance and analysts’ expectations’, 2004, Working Paper, The Wharton School.

- Core, J.E., R.W. Hothausen, D.F. Larcker, Corporate Governance, Chief Executive Officer compensation, and Firm Performance, Journal of Financial Economics, 1999, Vol. 51, p. 371-406

- Cremers, K., and V. Nair, ‘Governance Mechanisms and Equity Prices’, 2004, Journal of Finance, forthcoming.

- Daines, R., Does Delaware Law Improve Firm Value?, Working Paper 159, Columbia Law School, 2001

- Dechow, P.M., R.G. Sloan, A. Sweeney, Causes and Consequences of Earnings Manipulation: An Analysis of Firms Subject to Enforcement Actions by the SEC, Contemporary Accounting Research, 1996, Vol.13, p. 1-36

- Drobetz, W., A. Schillhofer, H. Zimmermann, Corporate Governance and Expected Stock Returns: Evidence from Germany, Working Paper No. 02/03, 2003, WWZ, Department of Finance, University of Basel, Basel Switzerland

- Eisenberg, T., S. Sundgren, M. Wells, Larger Board Size and Decreasing Firm Value in Small Firms, Journal of Financial Economics, 1998, Vol. 48, p. 35-54

- Erickson, M., M. Hanlon, E. Maydew, Is There a Link Between Executive Compensation and Accounting Fraud?, 2004, paper available at Gao, P., R.E. Shrieves, Earnings Management and Executive Compensation: a Case of Overdose of Option and Underdose of Salary, 2002, paper available from http://papers.ssrn.com

- Garvey, G.T., G. Hanka, Capital Structure and Corporate Control: The Effect of Anti-takeover Statutes on Firm Leverage, Journal of Finance, 1999, Vol. 54, p. 519-546

- Gompers, P.A., J.L. Ishii, A. Metrick, Corporate Governance and Equity Prices, The Quarterly Journal of Economics, 2003, Vol. 118, p. 107-155

- Hermalin, B.E., M.S. Weisbach, Board of Directors as an Endogenously Determined Institution: A Survey of the Economic Literature, 2001, available at www.nber.org

- Jensen, M., J. Meckling, Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure, Journal of Financial Economics, 1976, Vol. 45, p. 305-329

- Jensen, M., Agency Costs of Overvalued Equity, Finance Working Paper, 39/2004, European Corporate Governance Institute

- Johnson, S.A., H.E. Ryan, Y.S. Tian, Executive Compensation and Corporate Fraud, Working Paper, Louisiana State University, 2003

- Jong, A. de, D.V. de Jong, G. Mertens, C. Wasley, The Role of Self-regulation in Corporate Governance: Evidence from the Netherlands, 2002, available from http://papers.ssrn.com

- Karpoff, J.M., P.H. Malatesta, The Wealth Effects of SecondGeneration State Takeover Legislation, Journal of Financial Economics, 1989, Vol. 25, p. 291-322

- Karpoff, J.M., J.R. Lott, The Reputational Penalty Firms bear from Committing Criminal Fraud, Journal of Law and Economics, 1993, Vol. 36, p. 757-802

- Klein, A., Firm Performance and Board Committee Structure, The Journal of Law and Economics, 1998, Vol. XLI, p. 275-303

- LaPorta, R., F. Lopez-de-Silanes, A. Shleifer, R. Vishny, Investor Protection and Corporate Valuation, 2001, available from www.nber.org

- Leutz, C., D. Nanda, P.D. Wysocki, Earnings Management and Investor Protection: an International Comparison, Journal of Financial Economics, 2003, Vol. 69, p. 505-527

- Mak, Y.T., Y. Kusnadi, Size Really Matters: Further Evidence on the Negative Relationship Between Board Size and Firm Value, 2002, available from http://papers.ssrn.com

- McConnell, J., H. Servaes, Additional Evidence on Equity Ownership and Corporate Value, Journal of Financial Economics, 1990, Vol. 27, p. 595-612

- McKinsey Company, Global Investor Opinion Survey: Key Findings, July 2002

- McWilliams, V.B., N. Sen, Board Monitoring and Anti-Takeover Amendments, Journal of Financial and Quantitative Analysis, 1997, Vol. 32, p. 491-505

- Meulbroek, L.K., M.L. Mitchell, J.H. Mulherin, J.M. Netter, A.B. Poulsen, Shark Repellents and Managerial Myopia: An Empirical Test, Journal of Political Economy, 1990, Vol. 98, p. 1109-1117

- Moorman, T., ‘Governance and Stock Returns’, Working Paper, 2004, available from http://ssrn.com/abstract=578221

- Morck, R., A. Shleifer, R. Vishny, Management Ownership and Market Valuation: An Empirical Analysis, Journal of Financial Economics, 1988, Vol. 20, p. 293-316

- Peasnell, K.V., P.F. Pope, S. Young, Board Monitoring and Earnings Management: Do Outside Directors Influence Abnormal Accruals?, 2001, paper available from http://papers.ssrn.com

- Richardson, S., I. Tuna, M. Wu, Predicting Earnings Management: The Case of Earnings Restatements, 2002, paper available from http://papers.ssrn.com

- Shleifer, A., R. Vishny, A Survey of Corporate Governance, Journal of Finance, 1997, Vol. 52, p. 737-783

- Uzun, H., S.H. Szewczyk, R. Varma, Board Composition and Corporate Fraud, Financial Analysts Journal, May/June, 2004, p. 33-42

- Yermack, D., Higher Market Valuation of Companies with a Small Board of Directors, Journal of Financial Economics, 1996, Vol. 40, p. 185-211

- Zingales, L., Corporate Governance, CEPR, 1998

Notes

- The Dutch corporate governance code. Principles of good corporate governance and best practice provisions. Corporate Governance Committee 9 December 2003.

- Invoering van de mogelijkheid tot het treffen van bijzondere maatregelen door de ondernemingskamer over de zeggenschap in de naamloze vennootschap. Tweede Kamer, vergaderjaar 1997-1998, 25 732, nrs 1-2. Ingediend op 7 november 1997.

- Corporate Governance in the Netherlands, Forty Recommendations, June 25, 1997.

- Monitoring Corporate Governance in Nederland (1998), published by Amsterdam Exchanges NV and the Association of Securities Issuing Companies.

- Corporate Governance in Nederland 2002, De stand van zaken. Een uitgave onder auspiciën van de Nederlandse Corporate Governance Stichting. (2002).

- According to Zingales (1998) the words ‘corporate’ and ‘governance’ were never used in combination until 1977.

- Measured as the ratio of market value of assets to replacement cost of assets. Most studies use rather simple approximations of Tobin’s q and do not attempt to estimate actual replacement costs.

- They analyze defense mechanisms that make it difficult for an outsider to gain control of the board such as classified board amendments. Additionally, they examine fair price provisions, anti-greenmail amendments and the possibility to issue blank-check preferred stock.

- Yermack’s results furthermore show that the relationship is convex. After controlling for other factors, the estimated loss in firm value is the same for a board growing from 12 to 24 members when compared to a board growing from 6 to 12 members. Thus, an increase in board size has a larger impact on firm value when the board is smaller.

- Hermalin and Weisbach, 2001, p.14.

- The financial sector is often excluded since the governance structure of banks and insurance companies is greatly impacted by the regulatory framework regarding financial institutions.

- Hermalin and Weisbach, 2001, p.12.

- Note that there are more combinations possible that are consistent with these empirical findings. For example, combing the incentive alignment argument with the takeover premium argument of Stulz (1988), also results in the non-monotonic relationship found in many studies.

- LaPorta, Lopez-de-Silanes, Shleifer and Vishny (2001), p.9.

- Daines (2001), p.1.

- Comparable with the Hampel report in the U.K. and the Vienot report in France.

- The Blue Ribbon Committee on Improving the Effectiveness of Corporate Audit Committees argued that audit committees would enhance the financial reporting process, when they include independent board members, which have skills in finance and accounting, and which meets regularly.

in VBA Journaal door Rob Bauer, Paul Frentrop, Nadja Guenster, Hans de Ruiter