Sub-Saharan Africa has traditionally been negatively associated with widespread poverty, war, drought and severe political and economic instability, despite its valuable mineral and land resources. International portfolio investment in these markets has lagged the large flows into the Asian and Latin American emerging markets. However, positive developments in recent years are increasingly attracting the attention of large hedge funds and real money funds. These investors have concluded that they can no longer afford to ignore Africa’s improving political stability, prudent macroeconomic policies, successful debt relief programs, vast reserves of valuable commodities and low correlation with other emerging markets.

Economic Background

Economic Background

Sub-Saharan Africa (SSA) has recorded strong growth rates in recent years due to internal and external factors. Increasingly sound economic policies and some improvement in political transparency and accountability have improved conditions for economic growth. These have been reinforced by the substantial increase in revenues for the SSA countries derived from the high international commodity prices.

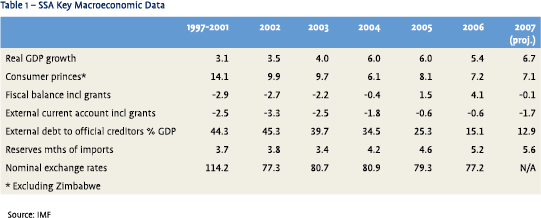

As Table 1 shows, there have been significant improvements in the macroeconomic environment in SSA. The region recorded an average real GDP growth rate of 5.4% in 2006 compared to an average of 3.1% in 1997-2001. It is worth noting that more than 50% of the non-oil producing countries registered GDP growth above 5% in 2006, and more than two-thirds are expected to do so in 2007.

Despite the jump in international oil prices and the transmission of these price rises to consumers in several SSA countries, annual inflation has been on a steady decline in recent years. This is a significant improvement on the peak inflation rate of 47% recorded in 1994 when many of the SSA countries embarked on economic reforms that included rapid liberalization of their economies under the guidance of the International Monetary Fund and the World Bank.

The strong role played by international creditor nations and institutions cannot be ignored. External debt that was rapidly accumulated and wasted in the 1970s and 1980s has been a significant burden for SSA countries. Heavy debt service commitments accounted for a significant proportion of government expenditure and foreign exchange outflows. Debt relief under several programs, including the IMF and World Bank-backed Heavily Indebted Poor Countries (HIPC) Initiative, has resulted in a drastic reduction of external debt to official creditors. This has freed up valuable resources for use in other key development areas, especially health and education. The picture is not entirely rosy and significant challenges persist. While democratic space has inc reased, the processes and institutions  remain weak. A clear separation between the executive and judiciary remains a source of concern in some countries while ethnic affiliations inhibit the development of policy-based political debate. Corruption remains a big problem that hinders the achievement of SSA’s full potential. SSA countries consistently dominate the weaker half of the corruption perception rankings in global surveys. Poor infrastructure, bureaucratic bottlenecks (lengthy licensing procedures), and poor intra-regional trade are in need of rapid solutions. While SSA’s population is rising, many countries markets lack critical mass, especially when compared to China and India. SSA’s population of fewer than 700 million is divided among over 40 countries, each with its own significant physical and administrative barriers to internal and external trade.

remain weak. A clear separation between the executive and judiciary remains a source of concern in some countries while ethnic affiliations inhibit the development of policy-based political debate. Corruption remains a big problem that hinders the achievement of SSA’s full potential. SSA countries consistently dominate the weaker half of the corruption perception rankings in global surveys. Poor infrastructure, bureaucratic bottlenecks (lengthy licensing procedures), and poor intra-regional trade are in need of rapid solutions. While SSA’s population is rising, many countries markets lack critical mass, especially when compared to China and India. SSA’s population of fewer than 700 million is divided among over 40 countries, each with its own significant physical and administrative barriers to internal and external trade.

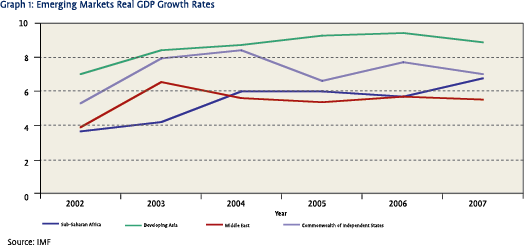

While GDP growth has been strong in recent years, it is some distance from the 10% level needed to significantly reduce widespread poverty and poor social indicators such as in health and education. As Graph 1 below shows, there is significant room for improvement in GDP growth rates as seen in the performance of other emerging markets.

The Foreign Exchange Markets

The Foreign Exchange Markets

Foreign exchange markets in SSA prior to the 1990s were generally heavily regulated and marked by periods of foreign currency scarcity. Significant growth in export revenues, broad-based economic liberalization and large-scale inflows of diaspora remittances have been supportive of SSA currencies in recent years. As many local currencies’ interest rates in the region are above their USD counterparts, the SSA currencies are generally supported by a favorable interest rate differential. The SSA diaspora in Europe and North America have emerged as key investors in their countries of origin. For example, Kenyan diaspora remittances are now larger than FX revenues of either of the two largest exports– tea and horticultural produce. Strong economic growth in North America and Europe and renewed confidence in the business climate in Kenya resulted in a rise in diaspora remittances to Kenya Shillings 70 billion (about USD 1 billion) from 2006 from Kenya Shillings 32.8 billion in 2005.

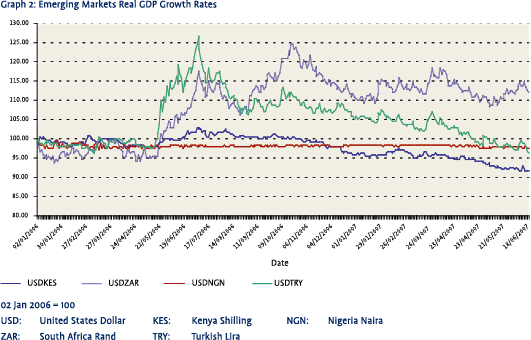

The SSA FX markets (excluding South Africa’s) exhibit very low correlation with other emerging markets, as can be seen in Graph 2 below. For example, during the recent bout of weakness in the emerging market currencies in May/June 2006, the Kenyan Shilling, Nigerian Naira and Zambian Kwacha remained fairly stable, unlike the losses experienced by the heavily traded Turkish Lira and South African Rand.

The SSA FX markets (excluding South Africa’s) exhibit very low correlation with other emerging markets, as can be seen in Graph 2 below. For example, during the recent bout of weakness in the emerging market currencies in May/June 2006, the Kenyan Shilling, Nigerian Naira and Zambian Kwacha remained fairly stable, unlike the losses experienced by the heavily traded Turkish Lira and South African Rand.

However, the SSA FX markets do suffer certain fundamental weaknesses. While two-way spot quotes are available in many markets, the bid-offer spreads remain relatively large while the markets remain relatively unsophisticated by international standards. Derivatives are mainly limited to FX swaps and forwards and liquidity is rather low. Some offshore players do quote FX options but trading volumes are insignificant. The foreign exchange markets retain a high correlation with the export sectors. For example, the Tanzanian Shilling traditionally depreciates rapidly in the first quarter of the year when agricultural exports are at their lowest. Availability of foreign currencies also comes at a heavier price during the low cocoa export season in Ivory Coast. Thanks to the lack of export diversification, a few SSA foreign currencies are vulnerable to external shocks such as falling international commodity prices and unfavorable weather conditions that often necessitate the import of large volumes of food. Finally, the current advantages of lack of correlation with other emerging markets could disappear as more international investors move into the SSA markets.

Interest Rate Markets

In the past decades, concessional debt from foreign lenders accounted for a significant of total government debt. Domestic debt levels were low and were predominantly held by commercial banks, often resulting in the crowding out of the private sector. The securitized debt was usually short-dated (under 1 year) and characterized by high yields and lack of investor confidence in the longer end of the curve. In the few cases where there existed longer-dated paper, these were usually floaters based on 3-month Treasury bill yields.

The domestic debt markets are still in their infancy, even when compared to other emerging markets. They have relatively low levels of liquidity as most investors are from the buy-and-hold school of investment.

Significant developments have occurred in recent years. Prudent economic policies have created a favorable environment for the lengthening of the yield curve. For example, in March this year, Kenya issued its first 15-year fixed rate treasury bond in an auction that was heavily oversubscribed.

Significant developments have occurred in recent years. Prudent economic policies have created a favorable environment for the lengthening of the yield curve. For example, in March this year, Kenya issued its first 15-year fixed rate treasury bond in an auction that was heavily oversubscribed.

Yield-hungry international investors are now increasingly setting their sights on the opportunities presented by the SSA local currency debt. The increasing liquidity and stability in the FX markets, attractive yields and low correlation with other emerging markets have provided significant incentives for the foreign investors. According to the IMF, foreign investor interest in Nigeria and Zambia stood at 18% and 16% respectively of total marketable debt. The Fund estimates that Nigeria received portfolio inflows of about USD 1 billion in the first half of 2006, more than five times the total capital inflows in 2005.

The number of SSA countries rated by international credit rating agencies has grown rapidly in recent years. In 2006, Standard and Poor’s rated 14 SSA countries while Fitch had rated 12. The SSA’s average rating (excluding South Africa) is B, significantly below investment grade but nonetheless useful in providing international investors with reference points for international comparisons. The ratings have a prestige value and act as an anchor to favorable economic reform.

The lack of efficient communication tools could be a source of frustration in some markets. While major information and dealing platform providers have made some inroads in the region, price transparency issues could complicate mark-to-market needs for markets that have yet to upgrade their infrastructure. Market regulators do in many instances lag their developed market peers in setting market regulations.

The Role of the Multilateral Lending Agencies

The various multilateral finance organizations have played a key role in the development of the SSA capital markets through the encouragement of prudent economic policies and/or the issuance of highly rated bonds.

The International Monetary Fund (IMF) has helped provide some legitimacy (much like an auditor) to the positive economic developments in SSA. By monitoring the economic and financial developments in its client countries, the Fund has been able to provide investors with updated information on the economic situation in these countries. The fund also provides the countries with budgetary and balance of payments support that assist in correcting the underlying problems while providing an anchor to prudent economic policies.

The African Development Bank (AfDB) is an AAArated multilateral institution whose shareholders include 53 African countries and 24 non-African countries from the Americas, Asia and Europe. The bank mobilizes resources from various international sources (traditionally the major markets capital markets) that are then used to promote economic and social development through loans, equity investments and technical assistance. The AfDB has taken an active interest in the development of the African capital markets and has issued bonds in Botswana Pula, Tanzania Shillings, Ghanaian Cedi and Nigerian Naira. The Nigeria Naira bond issued in January this year attracted investors from the United States (52%), the United Kingdom (31%), Continental Europe (15%) and the Middle East (2%). 22% of the issue was taken up by banks 77.9% by asset managers.

The World Bank focuses on providing loans, guarantees, risk management products and advisory services mainly for specific projects that promote sustainable development. The International Finance Corporation (IFC), the private sector arm of the World Bank, in December 2006 became the first foreign institution to issue a bond denominated in West African CFA francs (the currency of eight Frenchspeaking countries in West Africa).

The China Effect

China’s fast growth has been matched by a voracious appetite for resources. Despite being a major oil producer in its own right, China’s domestic crude oil consumption is rising rapidly and outstrips its production. Not surprisingly, SSA, with its rich reserves of oil, is proving to be an attractive destination for Chinese companies looking to secure crude oil supply. SSA’s huge reserves of metals and minerals are also of great interest to a rapidly industrializing China. This has had a major positive impact, both indirectly (higher international market prices) and directly (foreign direct investment).

China now offers substantial financial aid and soft loans to African governments and it has promised to double development assistance to Africa by 2009. China’s leaders, including President Hu Jintao, have made extensive visits to SSA. In an effort to deepen trade and political ties, Beijing hosted 48 African leaders in November 2006. The African Development Bank’s Annual General Meeting was held in Shanghai in May 2007, only the second time in its history that it has been held outside Africa.

SSA governments have long complained of having to endure public lectures and tough demands on political and economic affairs from the multilateral lending agencies and OECD bilateral lenders, and they have warmed up to the new low-key approach offered by China. On the other hand, the traditional Western lenders have criticized China for providing easy access to funding with no regard to environmental and governance concerns. There are concerns that China’s loans to SSA countries could result in another massive buildup in foreign debt and slippages in human rights.

Conclusion

The scramble for Africa’s resources has put China in direct political and economic competition with Europe and the United States (SSA’s traditional trading partners). SSA has huge infrastructure funding needs and therefore the renewed interest in its markets is bound to have a positive economic impact. However, there are concerns that the renewed interest by competing economic powers could result in another rapid buildup in SSA foreign debt. The SSA markets are by no means uniform, and there are some thorns among the roses. However, the economic foundations that are being put in place in many SSA countries provide reason to believe that the financial market developments should remain positive. Interesting returns exist for the discerning investor.

References

- The African Development Bank, The African Development Bank Website www.afdb.org, May 2007

- The International Finance Corporation, The International Finance Corporation Website www.ifc.org, May 2007

- The International Monetary Fund, Regional Economic Outlook: Sub-Saharan Africa, World Economic and Financial Surveys, April 2007

- The International Monetary Fund, Sub-Saharan Africa Economic Policy and Outlook for Growth, Finance & Development Magazine – (IMF Quarterly Magazine) March 1999, Volume 36, Number 1

- The International Monetary Fund, The International Monetary Fund Website www.imf.org, May 2007

- Warman, J, Profits, I presume? Why there’s money to be made out of Africa, Money Week, July 7, 2006

in VBA Journaal door Michael Wachira