Investing in non-listed real estate funds has increased substantially over the last decade. Although indirect investing in real estate has existed for a long time little is known about the costs associated with investing in these funds. This article provides an overview of typical fee structures related to non-listed real estate funds for institutional investors. The topic is important for a number of reasons. First, as a fundamental requirement, investors need to be able to understand the costs of investing into non-listed real estate funds and to compare these costs between different fund types or between different asset classes. Second, fees are the key determinant of fund managers’ compensation and investors will therefore need to ensure that managers are compensated for their performance in a way which is aligned with the strategic goals of the fund. As an example, aggressive performance fee structures might be unsuitable for a low-risk fund, as this would encourage the fund manager to assume excessive risk.1

Inleiding

Inleiding

In April 2006 INREV2 conducted the Management Fees and Terms Study. The objective of this annual study is to create a systematic approach to gathering and reporting information on fee structures to enhance investors’ ability to analyse and compare unlisted real estate funds in the markets. Although investing in non-listed real estate has existed for a long time hardly any research has been done on this topic. This article presents a framework for the analysis of fees and costs in non-listed real estate funds. The framework establishes three key fee categories: basic management fees, performance fees and other fees and costs. The final part of this article discusses two separate fee groups, basic management fees and performance fees in more detail.

All results presented below are based on the abovementioned INREV Management Fees and Terms Study 2006. Before presenting the framework for management fees, it is necessary as a basis for the discussion to give a brief overview of funds’ investment strategies, as the investment strategy is a major determinant of the fee structure.

Investment strategies for non-listed real estate funds

INREV has identified three investment styles, core, value added and opportunity, for non-listed real estate funds.3 The three different styles are differentiated by their targeted level of return, as measured by the internal rate of return, and the permitted level of gearing, as percentage of gross asset value. Core funds are the lowest risk investment alternative, whereas opportunistic funds have aggressive return targets and employ a high level of gearing. There is a border region between the target returns for core and value added funds and again for value added and opportunistic funds, where the target returns for two different styles can be identical. In these instances, the permitted level of gearing decides which style category the fund should be assigned to.

In order to achieve their aggressive return targets, the opportunistic funds typically source assets with significant value appreciation potential. This potential can be in the form of a development project, vacant building or an entry to new markets. As these funds use several strategies for achieving higher returns, it can be challenging to identify and isolate the precise source of additional risk and to isolate its impact on target returns. At the other end of the spectrum, core funds focus on established assets with the main emphasis being on stable income return rather than on capital growth.

Three main fee categories

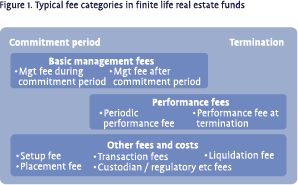

Essentially, non-listed real estate funds are private arrangements between the manager of the fund and its investors. For this reason, there is a lot of variability in fee structures between different investment funds, which in itself makes comparisons between different products a difficult task. The INREV Management Fees and Terms Study 2006 identifies three main fee groups: basic management fees, performance fees and other fees and costs, as presented in figure 1 below. This framework is especially tailored for finite life funds, with varying fee arrangements at different stages of a fund’s life.

Essentially, non-listed real estate funds are private arrangements between the manager of the fund and its investors. For this reason, there is a lot of variability in fee structures between different investment funds, which in itself makes comparisons between different products a difficult task. The INREV Management Fees and Terms Study 2006 identifies three main fee groups: basic management fees, performance fees and other fees and costs, as presented in figure 1 below. This framework is especially tailored for finite life funds, with varying fee arrangements at different stages of a fund’s life.

Most of the fee items presented in figure 1 also apply to infinite life funds. The main difference has to do with fees and costs associated with the fund’s termination, which are not applicable to infinite life funds.

Annual management fees: basis and level

Annual management fees: basis and level

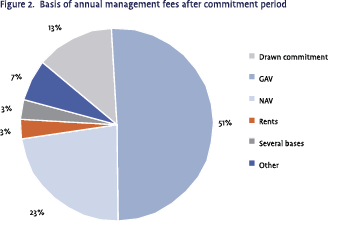

Annual or basic management fees cover the day to day fund management. In analysing these fees, there are two issues to be looked at: the basis of the fee and the actual level of the fee in relation to this basis. The breakdown in figure 2 is based on an analysis of 184 non-listed real estate funds investing in Europe and it clearly shows that gross asset value (GAV)4 is the most typically used basis for the annual management fee, with net asset value (NAV)5 and drawn commitments as two other popular metrics. However, figure 2 also illustrates the wide variety of other fee bases used in the industry.

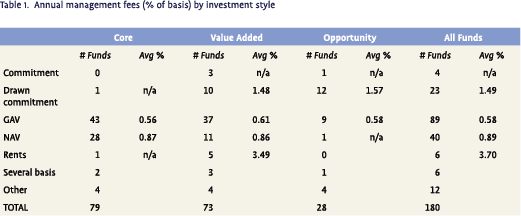

The actual fee levels for each investment style are depicted in table 1. The table clearly illustrates the difficult task of comparing the fee levels of funds which apply different bases to their management fees. However, when focusing on the most common fee basis, GAV, table 1 indicates that there are no major differences in fee levels across the different investment styles. However, this conclusion is premature for two important reasons. Firstly, annual management fees represent only one part of total costs and therefore investors will need to analyse all fees related to the fund. Secondly, measuring annual management fees  as a percentage of gross assets ignores the use of leverage, whereas in reality there are notable differences in funds’ approach to gearing.

as a percentage of gross assets ignores the use of leverage, whereas in reality there are notable differences in funds’ approach to gearing.

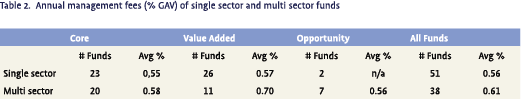

An important issue which can influence the level of management fees is the region and sector focus of a fund. The current results show that funds with either a single country or a single property sector focus have a lower management fee than funds which operate on a more diversified strategy, either by investing into several countries or into several property sectors. The key explanation for this is that a more diversified strategy also requires a more diverse skill set and additional management resources. The case of single sector funds compared with multi  sector funds is illustrated in table 2 below. On average, the annual management fee of single sector funds is 0.56%, whereas funds investing in several sectors charge 0.61% on average.

sector funds is illustrated in table 2 below. On average, the annual management fee of single sector funds is 0.56%, whereas funds investing in several sectors charge 0.61% on average.

Performance fees reward fund management for good returns

The second main fee category, performance fees, is vital in setting incentives for the fund management to run the fund according to the investment targets of the fund. Performance fees can be split into two categories: periodic performance fees, paid during the life of the fund and performance fees paid at the end of the fund’s life.

The second main fee category, performance fees, is vital in setting incentives for the fund management to run the fund according to the investment targets of the fund. Performance fees can be split into two categories: periodic performance fees, paid during the life of the fund and performance fees paid at the end of the fund’s life.

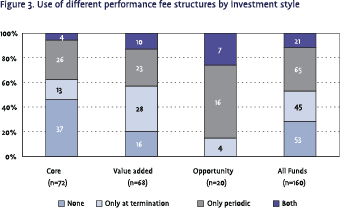

As illustrated in figure 3, there are notable differences in funds’ use of performance fee structures. Generally, the use of performance fees is less common within core funds, whereas it is very typical for opportunistic funds.

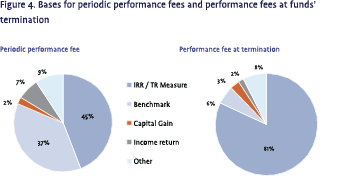

In most cases, both periodic performance fees and performance fees paid at the end of the fund’s life are based on IRR or another total return measure. The use of benchmarks is also fairly common for periodic performance fees, where the fund manager is rewarded for outperforming the agreed real estate benchmark by a predefined margin. The differences in these bases highlight the different operating logics of different styles: core funds are typically driven by benchmark performance, whereas opportunistic funds focus on delivering absolute returns.

As the right-hand pane of figure 4 depicts, performance fees at the fund’s termination are based on the fund’s internal rate of return or another total return measure most of the time.

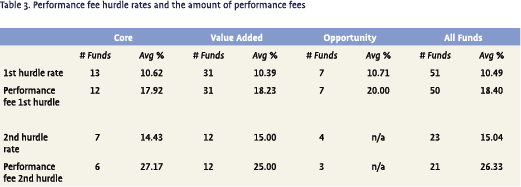

The actual level of the performance fee is typically tied to a hurdle rate. As the fund’s returns exceed the hurdle rate, the fund manager is entitled to a share of the fund’s profit. It is most common to set one hurdle rate for the fund, but as shown below, some funds also use a second hurdle rate.

The actual level of the performance fee is typically tied to a hurdle rate. As the fund’s returns exceed the hurdle rate, the fund manager is entitled to a share of the fund’s profit. It is most common to set one hurdle rate for the fund, but as shown below, some funds also use a second hurdle rate.

The results presented in table 3 should be analysed carefully, as they are based on small samples. However, the most striking observation from the table is that hurdle rates and performance fees are very similar across all fund types. As an example, the first hurdle rate varies only slightly from an average of 10.39% for value added funds to 10.71% for opportunistic funds. The result is surprising as it essentially encourages core fund managers to assume similar risks as value added and opportunistic fund managers and thus to contradict the investment targets for a core fund. Fortunately the problem is a limited one, as only 12 core funds have reported a performance fee after surpassing the first hurdle rate; this represents only a small minority among the 80 core funds included in the survey.

Other fees and expenses

Besides management and performance fees a varying amount of other fees and expenses are charged by funds. The existence, frequency and basis of these fees vary between funds making it difficult to analyse their effect on total expenses.

The most common fees are set up costs, property management fees, asset acquisition fees, administration fees and asset disposal fees.

In theory funds with several other cost items should have a lower management fee assuming the management fee includes all the fees charged by the manager. However, a direct relationship could not be detected in this survey.

Summary

This article has established the typical fee structures and fee levels in non-listed real estate funds operating in Europe. Furthermore, the discussion shows that there are notable differences in fee structures, depending on the investment strategy of the fund; typically the use of performance fee structures is more common in the riskier value added and opportunistic funds than in core funds. This highlights the importance of analysing the proposed fee structure in connection with the investment strategy of the fund.

Even though the research on fees and costs is helpful in understanding the typical fee structures, comparing the fee structures of individual funds remains difficult. To address this issue, INREV is currently formulating a total expense ratio (TER) for non-listed real estate funds. The aim is to develop a set of metrics, which will allow market participants to compare the fee structures between different non-listed real estate funds, but which also allows comparisons between non-listed real estate funds and other asset classes. The initiative is crucial in further improving the level of transparency in the industry and improving its accessibility.

Notes

- The author would like to thank Raymond Satumalaij of Blue Sky Group for his contribution to the article.

- INREV is the European Association for Investors in Nonlisted Real Estate Vehicles and it was launched in May 2003 to act for investors and other participants in the growing non-listed real estate vehicles sector. The nonprofit association is based in Amsterdam. INREV aims to create a forum for the sector and to increase the transparency and accessibility of non-listed vehicles; to promote professionalism and clarify best practice; and to share and spread knowledge. INREV currently has over 200 members, drawn from leading institutional investors, fund managers and promoters and advisors across Europe and beyond. Investor members of INREV have over ¤100 billion of real estate assets under management. The results quoted in this article are based on the INREV Management Fees and Terms study, published in April 2006. The study covers 184 European non-listed real estate funds and provides detailed information on the fee structures and levels of these funds.

- Manager Styles in Real Estate, A Model Approach on NonListed European Real Estate Vehicles, INREV Research Committee, Arjan Planting, Lisette F.E. van Doorn and Maarten R. van der Spek.

- The gross asset value of a fund is the gross property value plus the value of any further assets at market value.

- The net asset value of a fund is its GAV less all liabilities.

in VBA Journaal door Ville Raitio