We spoke to Pete Chiappinelli, based at the headquarters of GMO in Boston, about his outlook for markets. GMO is a value investor that does not use the traditional benchmark approach. Instead, GMO looks for asset classes that are undervalued. They do not try to forecast economies or predict the timing of major market shocks.

We spoke to Pete Chiappinelli, based at the headquarters of GMO in Boston, about his outlook for markets. GMO is a value investor that does not use the traditional benchmark approach. Instead, GMO looks for asset classes that are undervalued. They do not try to forecast economies or predict the timing of major market shocks.

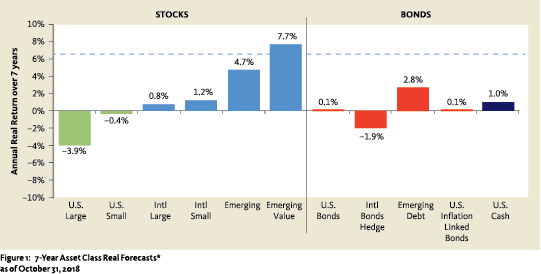

Jeremy Grantham, managing director of GMO, is known for his contrarian view on financial markets. He does, as stated, not believe in the traditional index-based approach to investing. His company allocates its investments to a wide range of asset classes. The question of whether an asset class has an attractive outlook for future returns guides the allocation process. GMO makes choices that are quite different from the traditional decisions made by other asset allocators. As the company foresees low returns from traditional assets, it has constructed a different portfolio for the next few years. The chart below illustrates their current negative view on traditional assets.

What is your current view on markets given the current prolonged period of rising stock prices and profits, and a decline in interest rates?

Grantham was not particularly optimistic: “We believe that traditional asset classes will offer little value for the next 7 years. With current high valuations around the world, the forecasts here at GMO are very bleak. Especially for US equities the prospect is not pretty. For this asset class we forecast a real return of minus 4 percent, annualized for the next 7 years. We come up with this number by comparing the current valuation with what we believe is the intrinsic value. The current valuation of US equities is the second most expensive market ever seen. The debate in our team is mostly about the speed of the expected reversion, and the level to which we revert, which depends on whether the high profit margins are here to stay to some extent. But even if we plug in more gentle assumptions for our intrinsic value, such as higher profit margins, prospective returns are still low.

We don’t pretend to know the timing of a decline in these assets or what will be the trigger that starts this process. We are more historians than economists. When we are in the expensive zone, as we currently are, it is our job to keep our clients’ money safe. That is why we are dramatically underweighting these types of assets, at least compared to other investors.”

More specifically, what about the outlook for profits? Do you believe they have peaked already or is there still room for improvement or consolidation?

“You often hear that ‘this time is different’. That there is less competition, that the position of technology companies in a globalized world results in structurally higher profit margins. It is of course true that these platforms make it harder and costlier to switch.

But is that new? We would argue that it is not. There have always existed good quality companies that have a strong economic moat and deserve a higher multiple for that reason. However, that is only a selection of stocks. Wall Street now believes that all companies deserve this high multiple. That is where we disagree with the market. Maybe to add, especially in technology, moats can disappear very quickly. When I joined GMO 10 years ago, Blackberry had very high profit margins and switching costs were high. Three years later, they were on the verge of bankruptcy. Disruption of these companies tends to be sudden, quick and unpredictable.” What is your view on the relation between economic growth and developments on financial markets? “Well, this is one of the hardest concepts to grab: understanding that this relation is actually very limited, while conventional wisdom tells us that it matters. There is even evidence that the relationship is inverted. At the same time, the financial press and market commentators are discussing the economy continuously. Economic data matters in the short run, but the impact is very limited over the long haul. We believe managing a portfolio based on economic forecasts is a difficult job to do successfully, as you need to do three things right. First you need to have the economic forecast right. Second, you need to identify the impact on markets and third, you have to be smarter than others doing the same thing. We believe that this is too hard to do successfully. We don’t need a crystal ball for that because there is something better: valuation.”

But is that new? We would argue that it is not. There have always existed good quality companies that have a strong economic moat and deserve a higher multiple for that reason. However, that is only a selection of stocks. Wall Street now believes that all companies deserve this high multiple. That is where we disagree with the market. Maybe to add, especially in technology, moats can disappear very quickly. When I joined GMO 10 years ago, Blackberry had very high profit margins and switching costs were high. Three years later, they were on the verge of bankruptcy. Disruption of these companies tends to be sudden, quick and unpredictable.” What is your view on the relation between economic growth and developments on financial markets? “Well, this is one of the hardest concepts to grab: understanding that this relation is actually very limited, while conventional wisdom tells us that it matters. There is even evidence that the relationship is inverted. At the same time, the financial press and market commentators are discussing the economy continuously. Economic data matters in the short run, but the impact is very limited over the long haul. We believe managing a portfolio based on economic forecasts is a difficult job to do successfully, as you need to do three things right. First you need to have the economic forecast right. Second, you need to identify the impact on markets and third, you have to be smarter than others doing the same thing. We believe that this is too hard to do successfully. We don’t need a crystal ball for that because there is something better: valuation.”

What do you make of the current setback in markets, with worries about economic developments often mentioned as reason for this drop?

“Obviously there is a relationship between GDP and companies’ earnings, and without doubt, markets will be bad in recessions. But at GMO we don’t believe we can anticipate this. Put differently, we don’t anticipate but react to price movements. Our main effort is in estimating the fair value of a company. We look at the fundamentals and estimate the value that companies can create, which is often a sum of decades of future cashflows.

Wars and deep recession aside, most stories and commentaries that we see in economic news coverage are about things that do not affect the fundamental value of the economy and businesses. The nuclear disaster in Fukushima back in 2011 is a classic example of an event to which the market overreacted. In just three days, Japanese equity markets lost 20% of its value. This impairment was only temporary and it was a bargain for investors.”

What active decisions do you take as a fund manager?

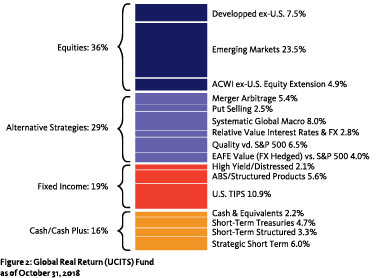

“Our Global Real Return Fund demonstrates that we are investing with conviction following our forecasts. In this fund, we are not bound by a policy benchmark. This often results in portfolios with rather unconventional asset allocations. We can take bets in a way that other companies are not designed to.

Currently, you don’t want to own a traditional portfolio. Less than 3 years ago, the yield on 10-year US treasuries was just 1.4% and a 50-year Swiss bond’s yield was even negative; we were at a 500- year high in bond pricing. This was an unbelievable European bond bubble and shows that weird things can happen. In a benchmark environment you just buy into these products.

Currently, you don’t want to own a traditional portfolio. Less than 3 years ago, the yield on 10-year US treasuries was just 1.4% and a 50-year Swiss bond’s yield was even negative; we were at a 500- year high in bond pricing. This was an unbelievable European bond bubble and shows that weird things can happen. In a benchmark environment you just buy into these products.

The alternative is to step away from risks at certain points. We hold a significant number of alternatives today, as most other asset classes have risks that are expensive. We own very little bond duration, equity beta and credit risk. As these traditional 3 risks are overpriced, we swapped market risk to alpha risk. Spread trades are definitely not free of risk, but here these are risks worth taking as valuation spreads are extremely high and attractive.”

More specific: do you expect supervisory actions with regard to platforms like Google, Apple and Facebook to limit their power?

“There are historical precedents for regulators or other governmental agencies stepping when companies have become similarly dominant in their market. We don’t pretend to have any new or unique insights at the moment. In the technological sector, there might be no need for such intervention as the market does these things on its own. There are so many unknowns that it’s hard to see where this is going.”

We would very much appreciate some elaboration on your view on sustainability and climate change. What is GMO doing in relation to these issues with regards to its allocation?

“We believe these are very real risks. For example, the elimination of fossil fuels from our economic system may result in stranded assets from traditional energy companies. On the other hand, new opportunities will present themselves. Climate change is a secular growth sector. Many companies active in developing batteries, smart grids and green energy will grow fast and generate large profits. We allocate funds to these sectors.”

Do you have any final message for us Europeans?

“Traditional assets have done extremely well, but their outlook is meagre. Against a backdrop of a decade with mediocre to poor economic growth, we have seen surprisingly strong returns, especially in the US. This will come to an end at some point.

Consider owning the unconventional assets, even though it might feel uncomfortable. You should be buying the stuff nobody wants, and selling the stuff that everyone owns. That is the core of value investing.”

in VBA Journaal door Jaap Koelewijn