In this article we will reflect on the developments in the field of quant investing and argue that the future looks bright. With decades worth of experience at actively navigating multiple investment cycles we have learned that a long-term winning formula can sometimes feel like riding a rollercoaster in the short run. Due to this cyclical nature quant investing is often more a test of character than a test of intelligence and ‘strong hands’ are a necessary condition for success.

The swift analysis of vast amounts of data is an obvious characteristic of quant investing that sets it apart from its fundamental sibling. But its key strength is its rules-based and systematic nature that results in objective outputs that strip out human emotions. Quant investing has become more relevant since more investors can get access to quant based mutual funds, ETFs, or direct indexing solutions. In this piece we primarily focus on the developments going on in research as well as what is needed to translate high quality research into excellent investment results. The main scope is equity market strategies, but we also discuss our view on quant fixed income, multi asset quant and other possible market applications.

The swift analysis of vast amounts of data is an obvious characteristic of quant investing that sets it apart from its fundamental sibling. But its key strength is its rules-based and systematic nature that results in objective outputs that strip out human emotions. Quant investing has become more relevant since more investors can get access to quant based mutual funds, ETFs, or direct indexing solutions. In this piece we primarily focus on the developments going on in research as well as what is needed to translate high quality research into excellent investment results. The main scope is equity market strategies, but we also discuss our view on quant fixed income, multi asset quant and other possible market applications.

As we have dedicated our careers to quant investing, we have had front-row seats to witness how effective it has been for investors over the long term. We discuss the move beyond traditional ‘Fama-French’ type factors to more innovative signals. We explore the opportunities next-gen quant techniques like machine learning and alternative data sources offer to predict not only risk and return, but also characteristics such as the sustainability of a firm. Quant investing has become increasingly a team play, which means culture will also be more important in the future.

DIGGING INTO THE ARCHIVES

First we will take a few steps back to provide a bit more context. The empirical foundations for equity factor investing were laid over 40 years ago. Sanjoy Basu outlined the value effect in 1977,1 followed by the size anomaly discovered by Rolf Banz in 1981.2 The three-factor model developed by Nobel prize laureate Eugene Fama and fellow researcher Kenneth French in 1992 provided the catalyst for increased attention and research on factors.3 Hot on the heels of the seminal Fama and French paper, Narasimhan Jegadeesh and Sheridan Titman documented the momentum factor in 1993.4

This bevy of academic research helped to form the basis of our own personal education and inspired us to become early proponents of factor-based investing. We thought to ourselves, “could it be so easy to beat the market?”, while reading the academic literature in the 1990s. And as young and ambitious practitioners, we made our own contribution by helping to establish the low volatility effect within equities in the mid-2000s.5 Interestingly, this defensive factor has been largely ignored by academics, despite the abundant empirical evidence and research in support of it. However, the low-volatility effect has remained strong post-publication, and its popularity among investors has grown steadily. From the outset we have also embraced the momentum factor, notwithstanding the skepticism from academics who questioned its profitability after transaction costs.

In 2015, Fama and French built on their earlier work as they included the investment and profitability factors in their new five-factor model.6 The, by then empirically proven, low volatility and momentum factors remained conspicuously absent though. Industry practitioners typically bundle the two new factors into a single theme called quality, which also consists of other financial statement health metrics, such as earnings quality.

QUANT CYCLES REQUIRE STRONG HANDS

Through our experience as practitioners and researchers, we have observed that factors have offered a premium in the long term (pre and post publication), but tend to experience major bull and bear phases in the short run. The difficult quant bear phases come in different shapes, typically last 2-4 years and are driven by deeply entrenched cognitive biases that afflict investors.

That said, we have learnt that behavioral finance is not only a lens through which to view the world, but also a mirror to look at ourselves. Therefore in addition to employing a disciplined and systematic approach to keep emotions at bay and take advantage of market inefficiencies driven by human behavior, quant investors need to be stoic and tenacious to weather the bumps and bruises along the way, as we too are human.

Moreover, timing quant cycles has proven to be extremely hard. For instance, if we had changed our quant models by lowering our exposure to the value factor in various strategies due to its publicized struggles in the late 2010s, then we would have partially missed the recent rebound in performance. Similarly, investors typically make withdrawals after a prolonged period of underperformance, thereby locking in the losses and missing out on the subsequent reversals.7

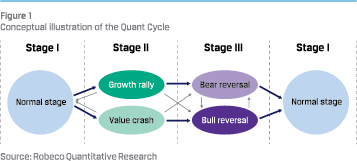

To contextualize the cyclicality in factor returns, we mapped out a quant cycle by qualitatively identifying peaks and troughs that correspond to bull and bear markets in factor returns.8 Traditional business cycle indicators do not capture much of the large cyclical variation in factor returns. Instead, major turning points of factors seem to be caused by abrupt changes in investor sentiment. Thus a quant cycle can be inferred directly from factor returns, which consists of a normal stage that is interrupted by occasional severe drawdowns of the value factor and subsequent reversals as shown in Figure 1.

To contextualize the cyclicality in factor returns, we mapped out a quant cycle by qualitatively identifying peaks and troughs that correspond to bull and bear markets in factor returns.8 Traditional business cycle indicators do not capture much of the large cyclical variation in factor returns. Instead, major turning points of factors seem to be caused by abrupt changes in investor sentiment. Thus a quant cycle can be inferred directly from factor returns, which consists of a normal stage that is interrupted by occasional severe drawdowns of the value factor and subsequent reversals as shown in Figure 1.

The normal stage prevails around two-thirds of the time and factors typically perform well during this phase. Value drawdowns, which usually occur once every decade and last around two years, are caused either by growth rallies or value crashes. The model also identifies two types of reversals: bear and bull. Bear reversals are distinguished by large positive returns for value due to a growth crash. By contrast, bull reversals are characterized by large negative returns for momentum.

Overall, we believe a better understanding of the quant cycle can help investors contextualize the behavioral dynamics of factors. This provides a basis to formulate a multi-year outlook by providing insight into how the cycle could potentially unfold based on the prevalent market environment. Moreover, our research highlights the benefits of perseverance during periods of weak factor performance.

More philosophically, the quant cycle plays a role in the persistence of factor premiums. As history shows, it is possible for factors to underperform for an interval as long as 10 years (a la value in the 1930s and 2010s). This leads some investors to give up in such instances as the waiting period is too long. Indeed, the occasional drawdowns that we witness often engender disillusion in the quant approach among investors.

This makes factor premiums difficult to arbitrage, because in the short run they are anything but risk free. As such, quant investing is ultimately more a test of character than a test of intelligence. In light of all this, we are confident that factor investing will remain alive and healthy for the foreseeable future.

FACTOR PREMIUMS ARE PERVASIVE

Our strong conviction is also supported by our finding that the low volatility, value and momentum factors have been effective since the mid-19th century, based on a proprietary US stock database that dates back to 1866.9 This underlines that these factor premiums do not depend on specific historical market structures. The deep 155-year sample also allows us to study infrequent macro events, from which we can infer that low-risk stocks generally exhibit resilience in times of recession, expansion, peace, war, deflation or inflation.

Most of the studies on quant investing revolve around the US, but the opportunity set is much broader. For example, factors also turn out to be highly effective in emerging markets.10 It even seems that the grass is greener in emerging markets, perhaps because of the presence of many private, non-professional investors. The recent opening up of the Chinese A market to international investors offered a rare opportunity for true out-ofsample testing. It turns out that factors also thrive in this market which is known to attract many speculative investors.11

Beyond equities, quant investing can be applied to fixed income. In government bond markets, various signals can be used for duration timing.12 In corporate bond markets, similar factors as in the stock market turn out to be rewarded.13 As a result, the concept of multi-factor investing seems equally appealing for credits as for stocks.14 Quant fixed income investing has the potential for enormous growth, but, in all fairness, we would probably have said the same thing ten years ago. Progress has been slow, similar to how Brazil has for a long time been recognized as the land of the future, but having a hard time living up to the high expectations.

In fact, some asset managers who had ventured into the quant fixed income space have since pulled out due to a lack of traction. This serves as yet another illustration that quant investing really requires the long view. In addition to stocks and bonds factors can also be harvested in other asset classes such as commodity markets and currencies, where they are commonly referred to as alternative risk premia.15 The next step could be the application of quant strategies to cryptocurrencies and tokens on illiquid assets.

THE VERSATILE NATURE OF QUANT INVESTING IS ONE OF ITS KEY FEATURES

As mentioned earlier, one of the unique elements of quant investing is that it can be used to systematically analyze vast amounts of data. But what investors plan to achieve with the use of data is an important consideration. Anecdotally, we have noticed that people instinctually focus on returns when they think about the use of data in the context of quant investing. For example, academic papers on the use of machine learning in quant investing virtually all examine alpha generation. We believe it is important to consider not only on return, but also risk, sustainability and other important characteristics.

Risk can have an impact on how clients experience their investment journey, especially in volatile environments. Moreover, risk also plays a vital role in performance. For instance, avoiding investments in companies that subsequently experience financial distress can be helpful for investors.

While sustainability integration is by no means limited to any particular investment approach, quant strategies are especially suitable for this. Their rules-based nature makes it easy to integrate additional quantifiable variables in the security selection and portfolio construction processes. This enables quant investors to create a portfolio that strikes the right balance between sustainability preferences and risk-return expectations.

A quant approach also offers the flexibility to adapt to everevolving views. A decade ago, sustainability was all about exclusions and integrating ESG. Nowadays, the market focuses on SDGs, carbon footprints, calculating Scope 3 trajectories, measuring real-world impact in portfolios, etc. And for certain, we have not seen the last of these changes. Examples of upcoming topics are biodiversity and human rights.

Good quality data is required to address these issues. On the one hand, there is an increasing standardization of sustainability data for reporting purposes and to manage portfolio restrictions. While this data is being commoditized, it is not cheap. However, commercial data vendors could be disrupted if asset owners/ managers make this data publicly available and free of charge.

Aside from the issue of data access, top-class technical skills are crucial for the development of proprietary sustainability data that is more effective than generic data and can also help generate alpha. This data ‘arms race’ will be an increasing hurdle for smaller quant houses with limited resources, whereas their larger peers could effectively harness their quant platforms to adequately satisfy evolving sustainability preferences.

Meanwhile, clients have differing beliefs and values, which can also evolve over time due to social developments. As such, we foresee increased demand for customized and flexible solutions that cater to client-specific financial and sustainability goals. The execution of such portfolios will likely require state-of-theart infrastructure to facilitate the construction of customized strategies. This uniquely positions quant investing to benefit from these trends.

NEXT-GENERATION QUANT

Quant investing has traditionally relied primarily on price data and financial statement information. However, exciting new opportunities are opening up due to the big data revolution and advanced in computing power. This forms the basis for nextgeneration quant strategies, that use alternative data and machine learning techniques.

In our research, we outline how machine learning can help to predict the risk that a firm becomes financially distressed.16 Risk is often non-linear. For instance, leverage levels might be fine up to a certain threshold, but risk could rise disproportionally beyond this level. Next-generation models can identify such patterns to better forecast stock crashes. As return databases grow in breadth and depth, the likelihood of successfully exploiting non-standard patterns should increase. Moreover, machine learning techniques can help us to better understand how factors work and interact with each other. This can reveal some of the shortcomings of quant investing and risks associated with factors.

Next-generation models may also better cluster similar securities beyond traditional industry classifications. This could allow for more effective tracking error control, thereby improving the accuracy of relative risk forecasts which could lead to more stable outperformance. As mentioned, advanced methods can also be used to create new sustainability data. For example, this can be achieved by analyzing audio transcripts, decomposing capital expenditure and R&D data, or web scraping.

Next-generation models may also better cluster similar securities beyond traditional industry classifications. This could allow for more effective tracking error control, thereby improving the accuracy of relative risk forecasts which could lead to more stable outperformance. As mentioned, advanced methods can also be used to create new sustainability data. For example, this can be achieved by analyzing audio transcripts, decomposing capital expenditure and R&D data, or web scraping.

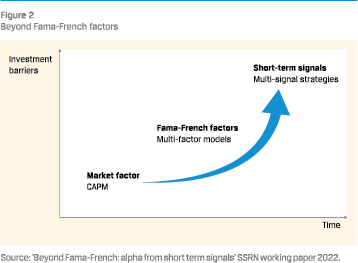

In addition, next-generation quant strategies can be designed to target sources of alpha that are orthogonal to existing factors. For instance, short-term signals are uncorrelated with traditional Fama-French factors because they change frequently. In a recent paper we show that these alpha signals can be captured and exploited when multiple signals are integrated and an efficient trading approach is used.17 In Figure 2 we show conceptually how short-term signals may enable investors to go beyond the standard Fama-French framework. It shows the move from passive to factors and on to signals over time, but also increasing investment barriers which need to be overcome to translate these new signals into positive net alpha.

CULTURE EATS QUANT STRATEGIES FOR BREAKFAST

Peter Drucker supposedly said “culture eats strategy for breakfast”.18 Relatedly, quant investing has increasingly become a ‘team sport’ over time. Staying ahead of the curve with cuttingedge research calls for investing in state-of-the-art infrastructure and employing smart people. As the saying goes, the bamboo that bends is stronger than the oak that resists. In other words, failure to take into account the future needs of investors and evolve will likely result in asset managers being left behind.

However, it is more important than ever to carefully look for genuine signals in this era of burgeoning data sources and modeling techniques. With more data, there is increased risk of data mining or uncovering spurious results. The issue here is that some patterns may come out as statistically significant, when in fact there is no real underlying phenomenon. Within academia the problem of ‘p-hacking’ is now much more acknowledged than say 10 years ago.19

Thus, we believe in a cautious approach to innovation. Our investment philosophy of evidence-based research, economic rationale and prudent investing also applies to new variables or methods. Although some new signals might not have long histories, the coverage should at least be sufficient and preferably span across multiple markets worldwide. The quality of the data should also be sufficiently high, while variables have to pass our stringent falsification tests. We often find that many new promising variables fail at this stage of testing.

This should be underpinned by a strong culture that rewards high-quality research. Meritocracy is central to this, as the best ideas should always win, regardless of who proposes them. For this to happen, a flat structure and direct communication that offers everyone an opportunity to engage and speak up is key. In other words, a culture where junior members can safely challenge their seniors and contribute to discussions. This competition of ideas helps to shape an innovative research agenda.

A team-based approach is important as the problems that need to be solved in quant investing have become increasingly complex, and often call for cooperation across disciplines. In this sense, quant investing is very much a ‘team sport’. In terms of actual research, a strong research protocol is required to separate sheep from goat factors in an ever-expanding zoo of factors.

Remaining ahead of the curve requires awareness of the innovator’s dilemma, meaning the willingness to disrupt or falsify one’s established approach, beliefs or solutions. This is a tough concept to follow since many biases need to be overcome. That said, it is a great method to stay honest and to future-proof the investment process.

Innovation is not a goal in itself and must be conducted with a long-term horizon. This means prioritizing sustainable innovation that will endure the test of time, which in turn requires strategic investments in infrastructure and people over time. A collaborative approach is also crucial to this. For example, encouraging all researchers to improve the shared code base which helps to guard against complexities that can stifle innovation down the line.

QUANT INVESTING IS MORE A VOCATION THAN AN OCCUPATION

Ten years ago we might have said that most research questions would be answered by 2022. Instead, we probably have more questions today than we had a decade ago. We have experienced that quant investing is easy and difficult at the same time. We have also learnt to maintain ‘strong hands’ when we encounter challenging phases of the quant cycle. Now, we are facing a fastdeveloping world in which data and computing power is swiftly increasing, giving rise to next-generation quant.

Asset managers have been entrusted by their clients with their savings. Asset managers who are responsible stewards of capital can help clients to achieve their financial and sustainability goals. This means exercising prudence in the decision-making and alignment of objectives by also investing one’s own capital in the same strategies. We derive great pleasure and purpose from our jobs as we continuously undertake sustainable innovation to deliver quality results for our clients.

From an asset owner perspective we believe that quant investing will become an even more important part of the investment toolbox. More specifically not only helping them to deliver high returns over the full investment horizon, but also in an increasingly sustainable manner. Quant premia are often uncorrelated or even negatively correlated with the classical equity and bond market premiums. After a 10+ years long bull market in which equities and bonds were strongly supported by very loose monetary policy we are now probably entering a new macro regime. A world with lower growth, higher macro uncertainty and lower real returns. Since most asset owners have horizons of more than 5 or even 10 years quant investing is ideally suited to help them grow and preserve capital.

Therefore in our humble and admittedly biased opinion, we firmly believe the signals are green for quant investing!

Notes

- Basu, S., June 1977, “Investment performance of common stocks in relation to their price-earnings ratio: a test of the market hypothesis”, Journal of Finance.

- Banz, R. W., March 1981, “The relationship between return and market value of common stocks”, Journal of Financial Economics.

- Fama, E., and French, F., 1992, “The cross-section of expected stock returns”, Journal of Finance.

- Jegadeesh, N., and Titman, S., March 1993, “Returns to buying winners and selling losers: implications for stock market efficiency”, Journal of Finance.

- Blitz, D., and van Vliet, P., October 2007, “The volatility effect: lower risk without lower return”, Journal of Portfolio Management.

- Fama, E., and French, K., April 2015, “A five-factor asset pricing model”, Journal of Financial Economics.

- Dichev, I., March 2007, “What are stock investors’ actual historical returns? evidence from dollar-weighted returns”, American Economic Review.

- Blitz, D., January 2022, “The quant cycle”, Journal of Portfolio Management.

- Baltussen, G., van Vliet, B. P., and van Vliet, P., November 2021, “The cross-section of stock returns before 1926 (and beyond)”, SSRN working paper; Baltussen, G., van Vliet, B. P., and van Vliet, P., May 2022, “150+ years of conservative investing”, Robeco article.

- Van der Hart, J., Slagter, E., van Dijk, D., 2003, “Stock selection strategies in emerging markets”, Journal of Empirical Finance.

- Blitz, D., Hanauer, M., and van Vliet, P., 2021, “The volatility effect in China A”, Journal of Asset Management.

- Baltussen, G., Martens, M., and Penninga, O., 2021, “Predicting bond returns: 70 years of international evidence”, Financial Analysts Journal.

- Hottinga, J., van Leeuwen, E., and van Ijserloo, J., October 2001, “Successful factors to select outperforming corporate bonds”, Journal of Portfolio Management.

- Houweling, P., and van Zundert, J., February 2017, “Factor Investing in the corporate bond market”, Financial Analysts Journal.

- Baltussen G., Swinkels, L., and van Vliet, P., December 2021, “Global factor premiums”, Journal of Financial Economics.

- Swinkels, L., and Hoogteijling, T., June 2022, “Forecasting stock crash risk with machine learning”, Robeco white paper.

- Blitz, D., Hanauer, M. X., Honarvar, I., Huisman, R., and van Vliet, P., May 2022, “Beyond Fama-French: alpha from short-term signals”, SSRN working paper.

- Interestingly the phrase is not that old and was contributed to Peter Drucker only recently (post 2005). Source Quote Investigator (2017/05/23/culture-eats).

- Harvey, C. R., Liu, Y., & Zhu, H. (2016) “… and the cross-section of expected returns”. The Review of Financial Studies, 29(1), 5-68.

in VBA Journaal door David Blitz and Pim van Vliet