Introduction

During the last couple of years, the hedge fund industry has experienced rapid growth. As a result of positive returns and strong inflows from both private and especially institutional investors, assets under management have reached an estimated USD 1.1 trillion (Tremont 2005). While this number is still relatively small compared to the overall size of financial markets, the presence of hedge funds is increasingly felt. The growth in assets as well as market influence has raised attention from journalists, regulators, and even politicians. However, due to the relatively intransparant nature of hedge funds and a few well known, often quoted hedge fund liquidations1 , the risk profile of hedge funds is generally poorly understood. Academic research on the subject is still in its infancy and a growing number of articles should be expected. Yet, as hedge funds are becoming a larger part of investors’ portfolios, a thorough understanding of hedge fund risk/return profiles is imperative. Even more as it impacts every part of the investment process: strategic asset allocation, portfolio construction, risk management and manager selection. Therefore this article will aim to provide an overview of and conceptual framework for the most frequently cited sources of hedge fund risk and return.

During the last couple of years, the hedge fund industry has experienced rapid growth. As a result of positive returns and strong inflows from both private and especially institutional investors, assets under management have reached an estimated USD 1.1 trillion (Tremont 2005). While this number is still relatively small compared to the overall size of financial markets, the presence of hedge funds is increasingly felt. The growth in assets as well as market influence has raised attention from journalists, regulators, and even politicians. However, due to the relatively intransparant nature of hedge funds and a few well known, often quoted hedge fund liquidations1 , the risk profile of hedge funds is generally poorly understood. Academic research on the subject is still in its infancy and a growing number of articles should be expected. Yet, as hedge funds are becoming a larger part of investors’ portfolios, a thorough understanding of hedge fund risk/return profiles is imperative. Even more as it impacts every part of the investment process: strategic asset allocation, portfolio construction, risk management and manager selection. Therefore this article will aim to provide an overview of and conceptual framework for the most frequently cited sources of hedge fund risk and return.

This article will start with briefly explaining hedge funds and the various investment processes employed. The next paragraph will introduce the major hedge fund risk categories, being investment, credit, liquidity and operational risk, after which the remainder of the article will be used to dig deeper into the investment risk factors that are most common to hedge funds. These risk factors will be illustrated for two strategies: long short equity as it is the largest strategy in terms of AUM and convertible arbitrage due to its diversity in risk exposures. The conclusion will discuss the main findings.

Hedge Funds

Hedge funds are lightly regulated investment funds that usually have limited investment constraints. They can short securities, use leverage and are very flexible with respect to the use of instruments, which might even include exotic derivatives. Another feature is the alignment of interest with investors due to the fee structure, as hedge funds usually charge a 20% performance fee. Hedge funds generally do not focus on a benchmark and aim to achieve absolute returns instead. However, while many market participants still claim that most hedge funds are market neutral and therefore uncorrelated to other asset classes2, research indicates that they, both individually and on aggregate, can have significant exposures to market factors such as equity, credit and interest rates, as well as somewhat more exotic factors. As hedge funds have very diverse investment processes and differing investment universes, risk factors and their impact can differ significantly from fund to fund, even within the same strategy group3.

Hedge funds are lightly regulated investment funds that usually have limited investment constraints. They can short securities, use leverage and are very flexible with respect to the use of instruments, which might even include exotic derivatives. Another feature is the alignment of interest with investors due to the fee structure, as hedge funds usually charge a 20% performance fee. Hedge funds generally do not focus on a benchmark and aim to achieve absolute returns instead. However, while many market participants still claim that most hedge funds are market neutral and therefore uncorrelated to other asset classes2, research indicates that they, both individually and on aggregate, can have significant exposures to market factors such as equity, credit and interest rates, as well as somewhat more exotic factors. As hedge funds have very diverse investment processes and differing investment universes, risk factors and their impact can differ significantly from fund to fund, even within the same strategy group3.

Hedge funds are very heterogeneous with respect to all of the following aspects:

- Investment philosophy, process and portfolio construction:

- Fundamental versus technical analysis

- Trading oriented versus investment oriented

- Quantitative versus qualitative decision making

- Highly diversified versus concentrated portfolios – Significant directional exposures versus tightly controlled and neutralized market exposures – The amount of leverage used (if any)

- Investment universe:

- Asset category and geography: some funds invest only in a few sectors in one country while other funds invest globally in a wide range of financial markets

- Instruments: some funds only use traditio nal instruments, while others combine these with (exotic) derivatives

- Risk management process and procedures

- Terms and conditions: there are wide ranges of fee and liquidity conditions

- Staffing: some funds are run by a limited number of individuals while others have hundreds of employees

This heterogeneity is further amplified by the growth in the number of funds, the increasing number of financial markets they operate in (e.g. chasing new opportunities such as direct lending, life insurance and private equity) and the growing number of different financial securities and derivatives available.

Major risk categories

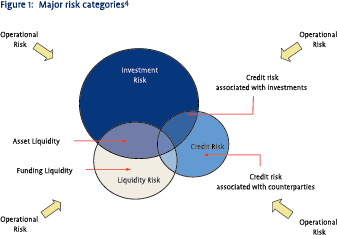

When investing in hedge funds an investor is not only exposed to investment risks, but to credit risk, liquidity risk and operational risk as well. For traditional long only funds it is current practice to analyze these risks in isolation as they are generally perceived not to be interrelated. For hedge funds however these risks are highly interrelated and should therefore be monitored in combination. This paragraph will describe these major risk categories and how they are interconnected (see also figure 1).

The major risk categories for hedge funds are:

- Investment risk relates to sensitivities towards changes in market factors such as equity markets, credit markets or the level of volatility. It relates to fluctuations in overall markets as well as individual securities. These are the primary risks most investors are focused on and generally carry a risk premium, i.e. a return can theoretically be expected in the long run. Investment risks will be covered more thoroughly in the next paragraph.

- Credit risk comes in two forms. It relates to potential losses due to changes in the credit quality of the investments of the fund (which in this article will be considered investment credit risk) and it relates to potential losses caused by the inability of trading counterparties to perform its obligations (counterparty credit risk). By identifying acceptable counterparties and using a set of appropriate exposure limits and collateral agreements, counterparty credit risk exposures5 can generally be controlled.

- Liquidity risk relates to losses due to declines in market liquidity (also known as asset liquidity, which in this article will be considered to be an investment risk) or to the ability of the fund to fund its investments (funding liquidity). Funding liquidity risk refers to the inability to meet payment obligations such as investor redemptions and margin calls, which may force early liquidation of positions. Asset and funding liquidity are highly interrelated. Liquidity management, in the form of asset liability management and specific provisions in the prospectus and prime brokerage agreements are therefore very important. Strategies that employ a large amount of leverage combined with a large short book generally have the largest exposure to funding liquidity risk.

- Operational risk relates to losses due to problems in the day to day operations of a fund. Operational risk is probably one of the most underestimated risks of hedge fund investing. Although risk analysis usually focuses on market risks, operational risk appears to be the largest risk factor within a hedge fund investment. Research of Capco (2003) indicated that approximately 50% of all hedge fund failures are solely due to operational issues, such as misrepresentation and misappropriation of investor’s funds, outright fraud, inability to manage a business or a combination of these. However, at the same time operational risk is probably the most difficult to quantify.

As mentioned earlier, in managing hedge funds it is important to realize that these four categories are highly interrelated and should thus be evaluated in combination. The reason for this is twofold: (1) the use of short selling and (2) the use of leverage. In shorting a security one first needs to borrow the underlying security from someone else, and the borrower needs to place a margin with the lender (usually the short selling proceeds). However, the lender often reserves the right to recall the security, or to increase the margin when he feels necessary (both usually during times when the position turns against the manager). Here, investment risk creates both counterparty and funding liquidity risk for the fund. When a fund is fully invested, a manager has to liquidate some of his positions to be able to perform his obligations. When his positions are illiquid, the forced liquidation can lead to substantial losses as the positions need to be sold at stressed prices (asset liquidity risk).

Again, it is the relation between these risk factors in which hedge funds differ from traditional long only funds. Additionally, operational risks are usually smaller for long only funds than for hedge funds as they are more regulated, invest mainly in traditional securities as opposed to complicated instruments, provide more transparency and do not use leverage or short selling. Equally important, most hedge funds tend to be smaller organizations supported by smaller operational infrastructures.

Operational, counterparty and funding liquidity risk are sources of risk that generally do not have an expected return, but can occasionally result in very large losses. Therefore practically speaking these risks should be minimized by well thought-out procedures and processes.

As operational, counterparty and funding liquidity risks are much less quantifiable than investment risks, the remainder of this article will focus on the specific investment risks of hedge funds. However, when constructing and managing a hedge fund portfolio the investment risks should be weighted appropriately and evaluated in tandem with operational, (counterparty) credit and (funding) liquidity risks.

Sources of investment risks and return

While hedge fund heterogeneity makes it very difficult to generalize with respect to risk profiles, investors need a conceptual framework for these risks at every stage of the investment process. An example of such a framework is provided below.

While hedge fund heterogeneity makes it very difficult to generalize with respect to risk profiles, investors need a conceptual framework for these risks at every stage of the investment process. An example of such a framework is provided below.

Research on the classification and segmentation of hedge fund returns is still developing and not much academic research is available on the topic. Up to now, research on hedge funds has predominantly focused on database bias properties and hedge fund return distributions while only recently academics have started analyzing hedge fund risk exposures6. However, only few articles explain in greater detail the realized and prospective hedge fund risk and return characteristics in a coherent and consistent (theoretical) framework. Such a framework would be much welcomed by (prospective) investors in hedge funds, regulators and other interested parties.

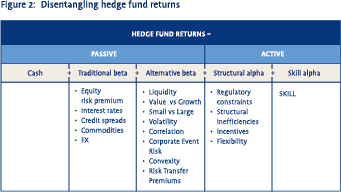

In classifying the diverse set of sources of hedge fund risks and returns this article is in some degree based upon Gehin and Vaissië (2005) and Harcourt (2004) (figure 2). It should be noted that the classification of sources of risk and return is somewhat arbitrary and should, in fact, be viewed as a continuum between traditional beta and alpha7. Investors can, and frequently do, have differing opinions on the classification of the different sources of risk. The main purpose for now is to give an overview of the major risk factors hedge funds are exposed to and to illustrate that hedge funds are not just skill based pure alpha generators as most aim to profit from multiple market risks premia as well.

As a starting point, risks can be divided into passive and active risk exposures. Passive exposures relate to the average exposures to certain risk factors, such as equity markets or volatility for instance, in contrast to active exposures which arise from ‘tactical asset allocation’ or timing and individual stock picking. The passive risks can be further divided into traditional and alternative beta. Active risk on the other hand can be divided into structural alpha and pure alpha, which will be explained in more detail below.

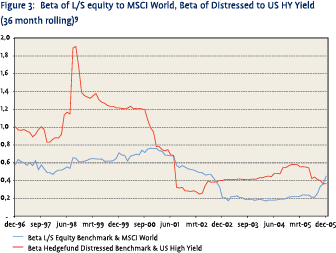

Traditional beta: These are average directional risk exposures towards equities, interest rates, credits, commodities and currencies and can be bought passively, both cheaply and easily. On average, equity long short hedge funds run a modest long equity bias towards the markets they invest in. Nevertheless, these equity betas can differ significantly between managers ranging from –0.8 (dedicated short bias) to larger than one. Distressed hedge funds generally run a long credit beta and therefore are exposed to the gyrations of the credit markets. Figure 3 represents the beta of indices for long short equity and distressed funds based on 36 months rolling regressions.8 The figure shows the overall net long exposure and illustrates its variability over time. The expected return on this part of the return equation can be based upon the long term expected return of the asset class times the exposure.

Traditional beta: These are average directional risk exposures towards equities, interest rates, credits, commodities and currencies and can be bought passively, both cheaply and easily. On average, equity long short hedge funds run a modest long equity bias towards the markets they invest in. Nevertheless, these equity betas can differ significantly between managers ranging from –0.8 (dedicated short bias) to larger than one. Distressed hedge funds generally run a long credit beta and therefore are exposed to the gyrations of the credit markets. Figure 3 represents the beta of indices for long short equity and distressed funds based on 36 months rolling regressions.8 The figure shows the overall net long exposure and illustrates its variability over time. The expected return on this part of the return equation can be based upon the long term expected return of the asset class times the exposure.

Alternative beta: Alternative betas consist of passive risk exposures to specific characteristics of financial markets or instruments. These risk premia can be derived from a static long short exposure (profiting from spread relations) or a directional long or short exposure (profiting from specific supply/demand characteristics). Examples of alternative betas are:10

- Liquidity: A distressed manager investing in very illiquid high yield bonds or defaulted securities will over time earn a liquidity spread. A traditional long only fund will also be able to capture this alternative beta but to a lesser extent as he cannot manage his funding risk by using gates and strict redemption terms.11

- Style factors such as the value / growth or smallcap / largecap spreads.

- Higher order risk factors such as volatility, convexity and correlation risks

- Event risks and direct or indirect insurance risks:

- Merger deal risk is an example of a directional static long short exposure. A merger arbitrage manager is usually long the stock of the acquired company and short the stock of the acquirer. As a result he is exposed to deal risk. When risk aversion increases merger spreads usually widen12 and hedge funds incur losses and vice versa. The merger deal spread is a premium for running this general market risk as well as the specific risk of the merger (alpha).

- Insurance risks: hedge funds are willing to take the opposite side of the transaction of a hedger, i.e. provide insurance. They will invest if they have an opposite outlook on the prices of the instruments and/or when they expect to earn a structural premium.

Alternative betas are static exposures towards these sources of risk. The expected returns (i.e. risk premia) on these could be captured using a more or less passive investment approach. However in contrast to traditional betas, investing in alternative beta exposures will generally be less easy and therefore more expensive.

Structural alpha: This part of hedge fund returns is facilitated by the specific hedge fund structure. Hedge funds have a superior set up compared to traditional long only funds as they have fewer investment constraints and a stronger alignment of interest. They have a bigger opportunity set and alpha will therefore be easier to capture (provided that the manager has skill). The fundamental law of active management and its extension with the transfer coefficient (Clarke 2002) serves as one of the theoretical foundations for this argument. Clarke showed that managers can increase their information ratio by reducing investment constraints as this enables one to include a larger number of independent bets. It is important to realize that skill is required to generate these returns.

The structural alpha comes from three related sources:

- Regulatory and investment constraints: Hedge funds can short securities and leverage the investment portfolio. As a result they can also profit from finding overvalued securities and can leverage relatively small mis-pricings. The investment universe of hedge funds is virtually unlimited and therefore they can invest in securities that long only investors are generally forced to sell, such as defaulted securities, for instance.

- Structural inefficiencies: Hedge funds have the flexibility to invest in securities which are not part of their normal investment universe and are therefore able to profit from structural inefficiencies between financial markets. An example is a long short equity investor that invests in a basket of oil companies which he thinks are undervalued because earnings estimates are still based on a low oil price. In contrast to traditional long only funds, he will be able to hedge the oil price risk by shorting a oil futures strip.

- Flexibility and incentives: Hedge funds usually have smaller teams and more flexible investment processes than traditional long only funds. As a result, they are able to respond much quicker to a changing opportunity set. In addition, the hedge fund incentive structure results in a strong alignment of interest, i.e. focus on performance as opposed to growth in AUM.

Pure alpha: The last source of risk and return for hedge funds is the alpha component derived from the investment skills of the manager. This is a sig nificant part of the overall portfolio risk, however at the same time it is the most difficult part of the return to generate and evaluate. Only a limited number of managers (long only and hedge fund managers) are able to consistently select the right securities at the right time. The alpha is generated because of superior skills in analyzing individual companies and securities, market savyness and/or superior portfolio and risk management skill and systems. One can argue that theoretically hedge funds offer better access to skill than traditional long only funds, as managers having skill are likely to set up a hedge fund. This will facilitate them in generating skill from both the long and the short side. More importantly, they will be able to earn far more money through the hedge fund incentive fee structure than they could at a traditional long only firm.

Analyzing hedge fund risk factors

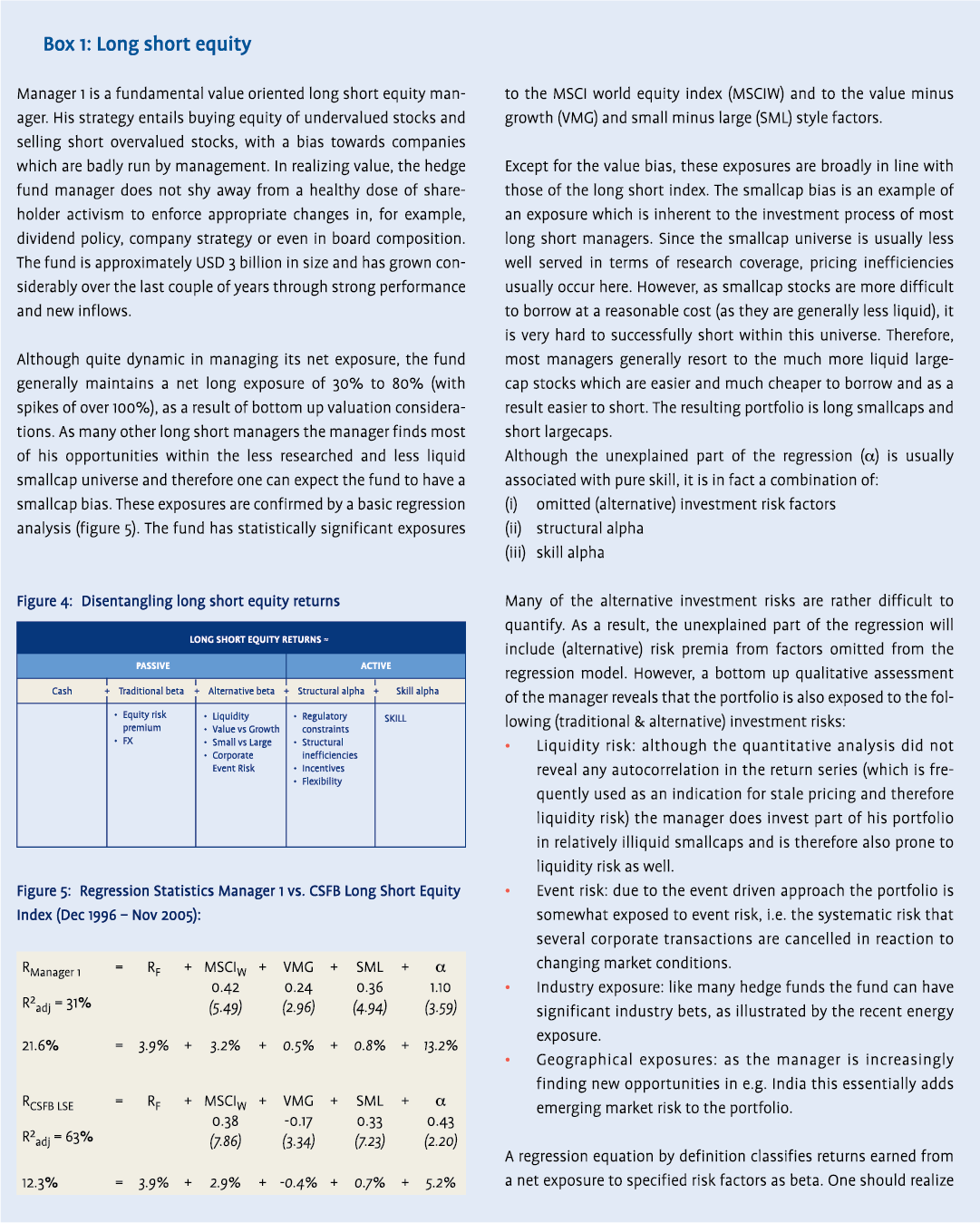

In order to properly evaluate any investment fund and construct a well balanced portfolio it is imperative that one gains a fundamental understanding of the various risks involved. A pure quantitative approach to analyzing hedge fund risks has significant pitfalls. Due to the frequent use of nonlinear financial instruments, the dynamic nature of trading strategies and the limited amount of (high quality) data, risk exposures and return distributions are difficult to estimate. Therefore a qualitative analysis with sound economic reasoning should always be leading.

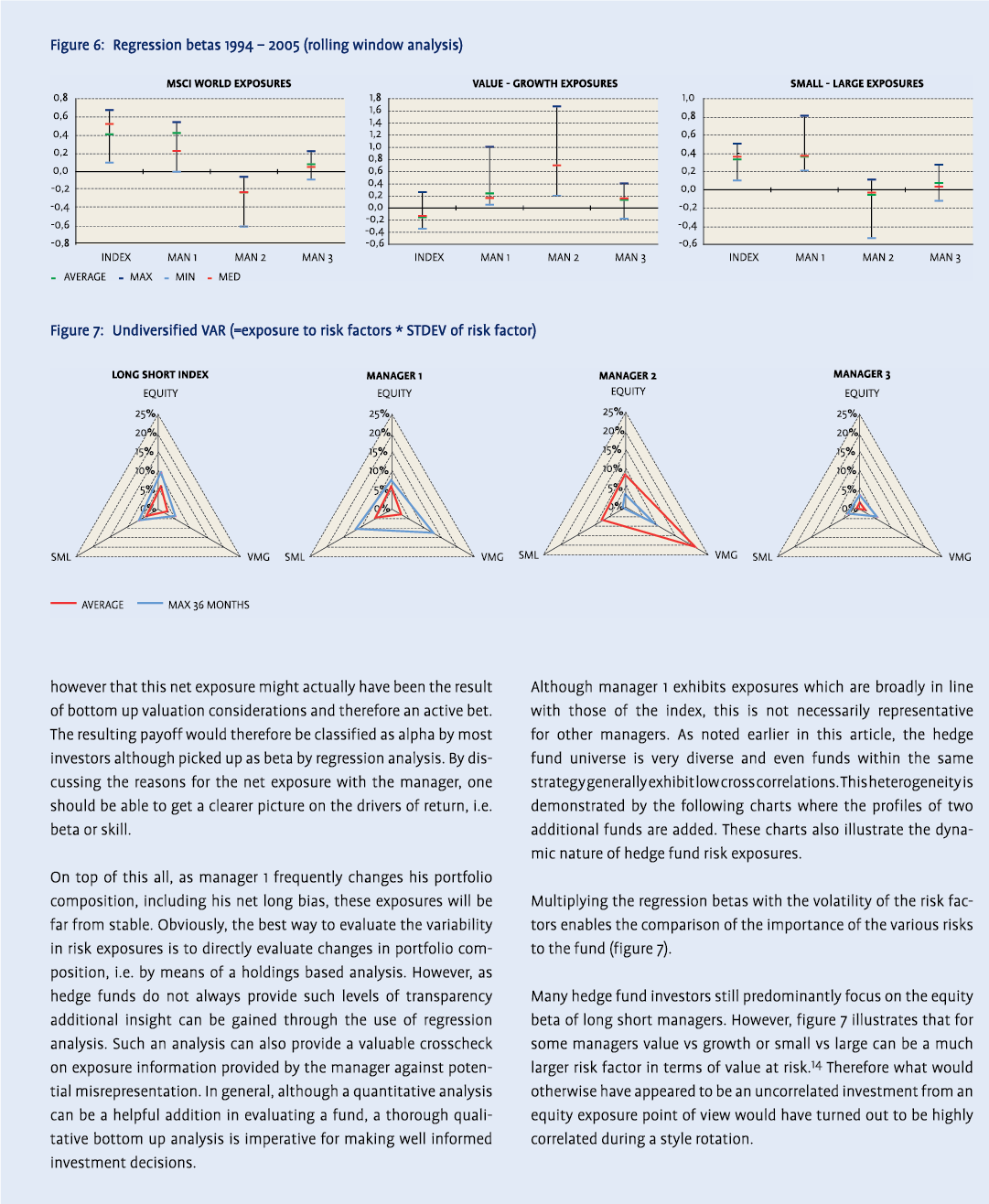

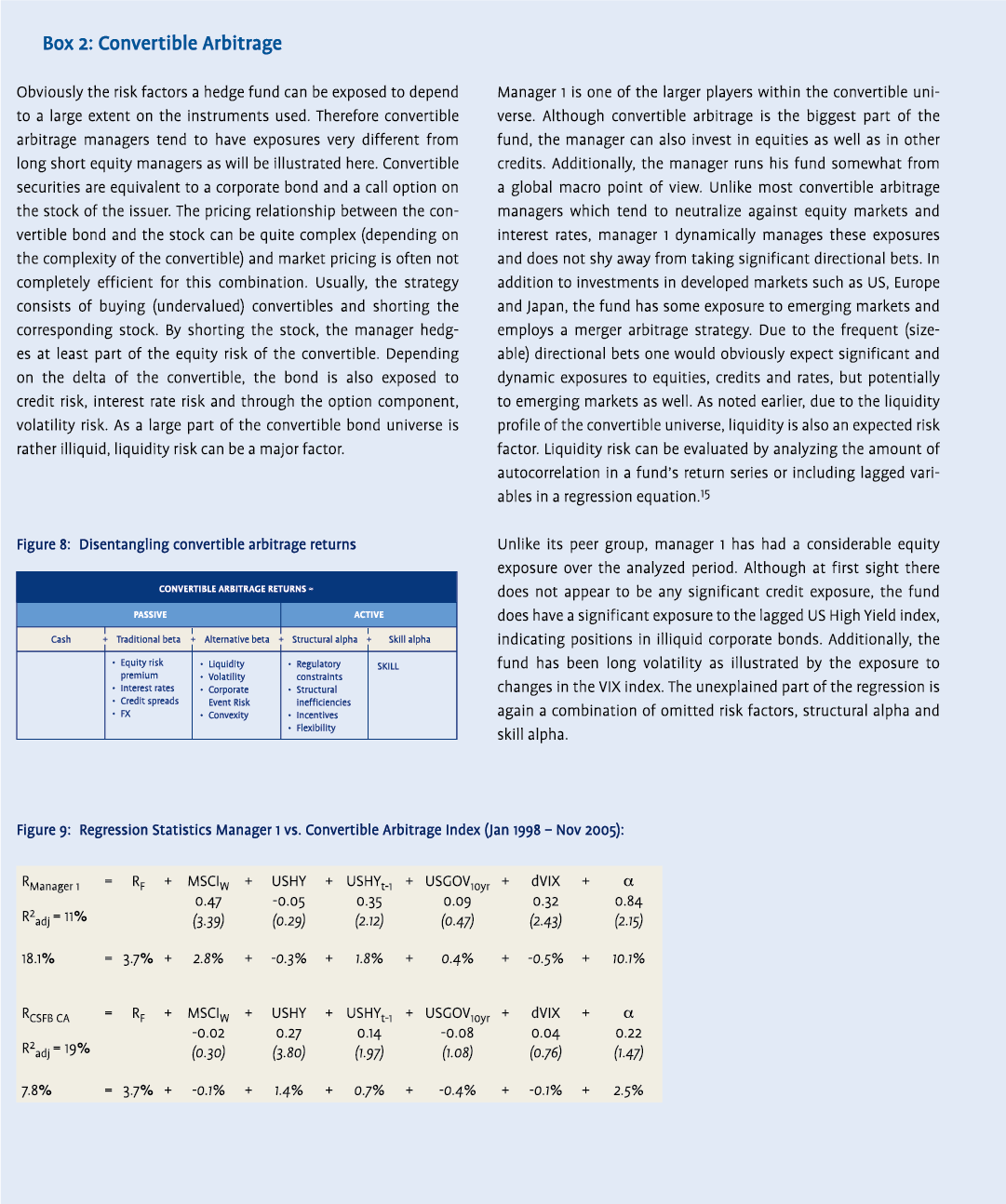

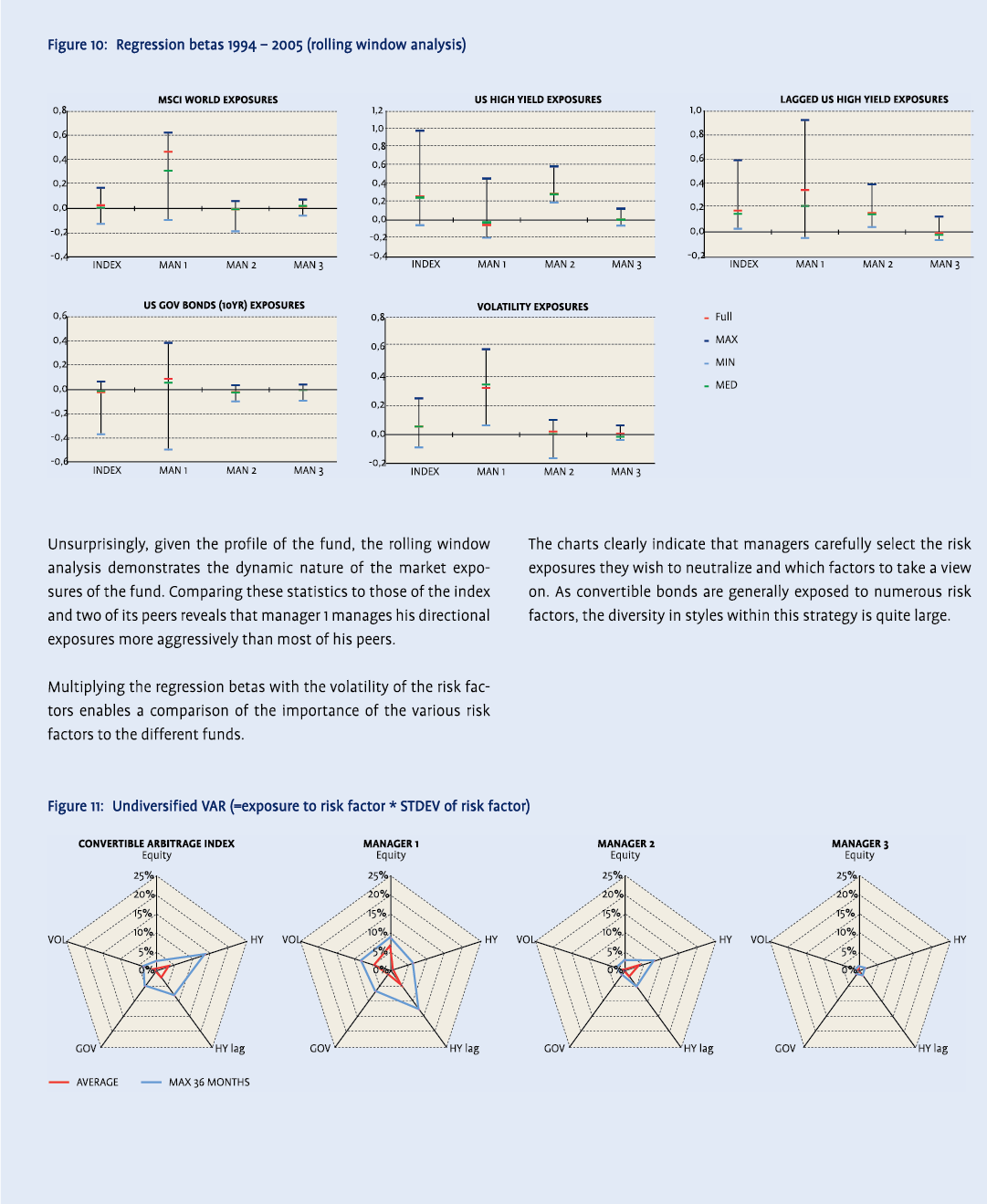

In the boxes the most important quantifiable risks involved and their dynamics through time will be illustrated for two strategies: long short equity and convertible arbitrage. For each of these strategies one fund will be profiled. The analysis is complemented with some basic regression analytics to illustrate the size and dynamics of the most common risk exposures. To display manager diversity, risk profiles of the strategy index and some additional funds13 are included.

Conclusion

The eight to ten thousand hedge funds estimated to be operational all have very distinctive risk return profiles. Although the objective is to achieve absolute returns regardless of the direction of financial markets and deriving alpha from pure skill, a hedge fund investor is usually exposed to a wide range of different risks. These risks can be categorized into investment, credit, liquidity and operational risk and should be analyzed in tandem. Investment risks can either be passive exposures to traditional markets such as equity and bond markets or alternative risk factors such as liquidity and insurance risks. The active part of hedge fund risk can conceptually be divided into the structural alpha resulting from the advantages of a hedge fund structure, and the pure alpha component resulting from the skill of the manager. While the classification is theoretically appealing, how to categorize certain risk factors is subject to debate. Further difficulties arise in quantifying the return on various risk factors and more importantly the manager’s exposure towards these, as for most risk sources widely accepted benchmarks are not available. The lack of transparency of most managers and the diversity in risk reporting further complicates mathematical representations of hedge fund risks and returns.

The first steps have been taken to explain and calculate hedge fund risk and returns. More effort is needed to further reduce the stubborn misperceptions about hedge fund investing. Quantitatively assessing risk and return is appealing. However, due to the flexible and dynamic nature of most hedge fund investment styles and the effect of less quantifiable risks such analysis should always be supplemented by a thorough qualitative assessment.

Literature

- Asness, C., Krail, R., Liew, J., ‘Do hedge funds hedge?’, Journal of Portfolio Management 28, 2001.

- Capco:’Operational risk in hedge funds investments’, white paper, 2003.

- Capocci, D, Corhay, A. Hubner, G.:’Hedge funds performance persistence in bull and bear markets’, working paper HEC University of Liege, 2005

- Clarke, R. de Silva, H. and Thorley, S.:’Portfolio constraints and the fundamental law of active management’, Financial Analysts Journal, 2002.

- Gehin, W. and Vaissië, M.:’The right place for alternative betas in hedge fund performance: an answer to the capacity effect fantasy’, Edhec working paper, 2005

- Geltner, D.M., ‘Smoothing in appraisal-based returns’, Estate Finance and Economics, 1991

- Geltner, D.M., ‘Estimating market values from appraisal values without assuming an efficient market.’, Journal of Real Estate Research, 1993.

- Harcourt: ‘Hedge funds explained’, 2004

- Ineichen, A.M.: ’Absolute returns: the risk and opportunities of hedge fund investing’, Wiley, 2002.

- Kat, H. and Lu, S: ’An excursion into the statistical properties of hedge fund returns’, working paper Cass Business School, 2002

- Litterman, B. ‘Beyond active alpha’, Goldman Sachs, 2005.

- President’s Working Group on Financial Markets, “Sound Practices for Hedge Fund Managers”, Working Paper, 2000 (http:// www.aima.org)

- Swinkels, L.A.P., van der Sluis, P.J., ‘Return based style analysis with time-varying exposures’, Working Paper, 2002.

- Tremont, ’Tremont asset flows report Q3 2005’, 2005

Notes

- The frequently used terms ‘blow ups’ or ‘failures’ are often not correct as only very occasionally a liquidation results in a total loss of equity capital.

- Whether hedge funds are a separate asset class or an investment management style is an issue of semantics. Hedge funds actively invest (both long and short) in multiple asset classes and could be considered a separate management style. As hedge funds are usually treated as a separate part of the strategic investment portfolio many consider them to be a separate asset class.

- For a good overview of hedge fund strategies see Ineichen (2002).

- Sound Practices for Hedge Fund Managers (2000).

- A recent example of counterparty credit risk were the difficulties faced by investors, including some hedge funds, due to the failure of Refco to meet its obligations.

- See e.g. Kat and Lu (2002) and Capocci et al. (2005)

- Litterman (2005) introduced a somewhat related categorization not specifically for hedge funds but for investments in general. He divides the risk of an investment in CAPM beta, exotic beta and pure alpha from active management. He describes exotic betas as passive and therefore cheap to implement risk exposures with (currently) a positive expected return. These exotic betas have zero correlation with the CAPM market portfolio. Examples are commodities, CAT-bonds, selling volatility and investment in M&A.

- Note that the numbers are generated using a return based approach and therefore always lags the actual exposures. Due to the lack of transparency of some funds a holdings based approach for the index is impossible.

- In choosing the length of the regression window there is a clear trade off between accuracy, which decrease as the number of data points decreases, and timeliness, which increases when the number of data points drops. Although the statistics for a 36 month window are presented, this can be supplemented with less accurate, but timelier statistics of a 24 month and even 12 month window. Alternatively, one can resort to somewhat more sophisticated estimation methods, e.g. using a Kalman filter, as illustrated in Swinkels & van der Sluis, (2002).

- Note that some of these risks are interrelated.

- This is also related to the structural alpha part which is explained later on.

- And deals might even break. When interest rates suddenly rise and/or equity markets fall, many announced transactions will get cancelled. What once appeared to be uncorrelated idiosyncratic deal risks have suddenly appeared to be highly correlated systematic risks.

- All funds are selected randomly from an internal database and although their names are not disclosed these are real life examples.

- While the value versus growth and the small versus large factors are usually much less volatile than overall equity markets these factors have been highly volatile during the analyzed period, most likely as a result of the ICT bubble during the late 90’s.

- See e.g. Geltner (1991, 1993) and Asness et al (2001) on stale and managed pricing.

in VBA Journaal door Drs. A.J. van Stijn RBA (l), Drs. M.J. Geene RBA (r)