Introduction

Fixed income markets have seen enormous developments in the last decade. Whereas before interest rates and currency were the driving forces behind fixed income portfolios, nowadays credit investments get at least the same level of attention. Not only because credit risk1 offers an additional source of investment returns, but also because of the many different shapes and risk-return characteristics in which it is available to investors.

Fixed income markets have seen enormous developments in the last decade. Whereas before interest rates and currency were the driving forces behind fixed income portfolios, nowadays credit investments get at least the same level of attention. Not only because credit risk1 offers an additional source of investment returns, but also because of the many different shapes and risk-return characteristics in which it is available to investors.

The emergence and rapid growth of the European credit market has changed the alpha generating strategy of many investors, from duration and currency management to credit management. Credit teams have been established to analyse credits and new portfolio management models2 are available to quantify credit portfolio risk.

Most European credit portfolios consist of public debt. This is in sharp contrast with the US situation where a substantial part of institutional money is allocated to private debt. A broad definition of private debt is “the placement of a debt instrument directly with a limited number of investors”. Examples are:

- leveraged bank loans, which are the principal financing method for corporate merger & acquisition activity;

- corporate private placements issued by corporates of investment grade quality and placed via negotiated sale;

- private finance initiative (PFI), consisting of government-based contractual revenue streams derived from core infrastructure projects, e.g. hospitals, schools and road-building.

European investors’ interest in this asset class is increasing. The reason being that private debt offers great benefits for managing liability risk, as will be explained in this article.

Redefining risk

The focus of most institutional investors has long been on assets only. More specifically, the investment management process has been aimed at beating particular benchmarks. Although higher returns can only be expected by accepting more risk3, people were not concerned about risk as long as yearly returns were satisfactory. The negative equity performance during the beginning of this decade has changed this focus. The coverage ratios of pension funds dropped substantially and insurers came under pressure as a result of guarantee structures in their life products. Risk is on the agenda again and the definition has changed from asset only to an integrated asset-liability focus.

A useful measure is shortfall risk: what is the chance that the liabilities are no longer covered by the assets and by what amount? This question can lead to ambiguous results depending on how liabilities are discounted and the degree of duration mismatch4. Consider the case of higher interest rates and no equity investments:

- if liabilities are discounted at an actuarial rate, there would be no impact on the value of liabilities. Thus, if assets and liabilities have equal durations, a shortfall is the result.

- if liabilities are discounted at market rates5 and if assets and liabilities have equal durations, there is no impact.

- a more realistic situation is the use of market rates and a duration mismatch. For pension funds the duration of assets is often lower than the duration of the liabilities. Now, a surplus is the result.

One way to deal with shortfall risk is by defining the liability benchmark portfolio. This portfolio mirrors the cash flows of the liabilities and will lead to a minimum shortfall risk. Obviously, the question will arise as to what type of assets to use to mirror pension liabilities. If the liabilities are unconditional and fixed, the right asset would be risk-free fixed interest rate bonds. In case of indexation of liabilities, inflation-linked bonds must be used.

Credit from an ALM perspective

An argument against the liability benchmark portfolio is that, although the risk is minimised by using fixed income instruments, it could become very costly. In the past, pension funds allocated to equities to cash in on a risk premium, which would help lower the pension premiums and/or increase benefits6. Credit investments enter the equation here as a reallocation out of equities into bonds will diminish shortfall risk, because liabilities are better matched. And as credits offer a yield pick-up over risk-free bonds, the equity risk premium is only partly given up. In an extreme and oversimplified example: an investor with 40% in equities and 60% in government bonds, could replace the equity risk premium of 4% by investing 100% in credit bonds with an average credit spread of 160bp.

A credit portfolio must be constructed in such a way that the required additional return is generated, and the impact of a default is minimised. The return distribution of a single credit is heavily skewed: a limited upside, but a large loss in case of default. Still, by adding more names to a portfolio, the impact of a default will decrease, which shapes the return distribution more and more in the direction of a normal distribution. Due to the extreme skewness of credits, this can only be realised with a substantial number of bonds. As a rule of thumb, a minimum of at least a hundred names is needed7. Clearly, scale is a prequisite for managing credit portfolios in order to make the credit investment process economical and manageable.

Role of private debt

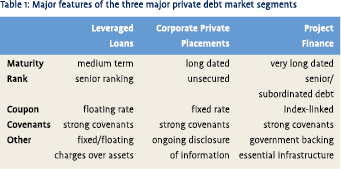

The number of exposures is only half of the story to reduce risk. Three sizeable sectors within private debt can be identified with interesting features for institutional investors (see table 1):

The number of exposures is only half of the story to reduce risk. Three sizeable sectors within private debt can be identified with interesting features for institutional investors (see table 1):

A quick glance already makes clear that private debt investments have features that are different from public debt:

- the maturity is often longer than public bonds;

- leveraged loans are secured and therefore rank higher than public debt, which is often unsecured;

- the existence of strong documentation and ongoing disclosure of information8; coverage, leverage and change of control covenants, restrictions on taking on more debt, paying dividends and selling assets and mandatory prepayments from a variety of sources including excess cash flow, asset sale proceeds and debt / equity proceeds.

The close relationship between the issuer and the investor makes it possible to negotiate these features, which offer greater flexibility in structuring the asset in line with the investor’s specific requirements.

It is not just the technical features that are important. From a portfolio management perspective, it is important to mention three additional characteristics of private debt. Firstly, the default correlation with other asset classes is often low. A good example is project finance. Thanks to the government backing that is often available, these deals can be considered anti-cyclical. Obviously, this aspect is less of a benefit with regard to leveraged loans and corporate private placements.

It is not just the technical features that are important. From a portfolio management perspective, it is important to mention three additional characteristics of private debt. Firstly, the default correlation with other asset classes is often low. A good example is project finance. Thanks to the government backing that is often available, these deals can be considered anti-cyclical. Obviously, this aspect is less of a benefit with regard to leveraged loans and corporate private placements.

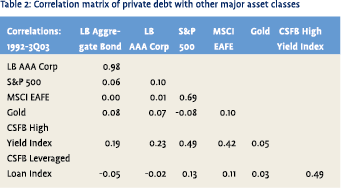

It should be noted that default correlation is something else than price correlation. Most correlation tables, like table 2, consider price correlation. It shows a remarkable low correlation with other asset classes, even with high yield bonds. Obviously, the fact that leveraged loans are floating rate assets, plays an important role.

Secondly, in order to achieve effective diversification, a wide dispersal of investments over regions, sectors and issuers is needed. The supply in the public market has improved in this respect, but private debt offers additional opportunities. Exposures can be taken to medium and small sized companies with different risk profiles and in different sectors than can be found in the public market.

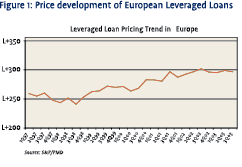

And thirdly, price volatility is often lower than in the public markets, and not because pricing is less efficient. It is important to acknowledge in this respect, that interest rate risk should not be mistaken for credit risk. Clearly, a leveraged loan has less price volatility than a comparable fixed bond, simply because it has a floating coupon. But, from the perspective of credit risk, pricing is also less volatile due to the better protection for the lender, which results in a much lower expected loss-given-default.

An often, heard argument against private debt is its lack of liquidity. And at times the additional spread to compensate for this appears to be meagre. But it is important to take into account the trade off between the credit spread and the superior protection offered in private debt when making the comparison with public bonds..

An often, heard argument against private debt is its lack of liquidity. And at times the additional spread to compensate for this appears to be meagre. But it is important to take into account the trade off between the credit spread and the superior protection offered in private debt when making the comparison with public bonds..

And is liquidity really that important? Two cases for liquidity are often used. Firstly, that liquidity is needed for active management, particularly for tactical asset allocation and sector rotation. Irrespective of the question of whether active management pays off, it is an asset-only approach again. Tactical asset allocation and sector rotation will increase shortfall risk, because the asset profile will deviate from the liability profile. The question here is how much shortfall risk is acceptable. In practise, this is often indirectly capped by exposure limits. It is hardly ever the case that whole asset classes or sectors are sold. Therefore, even if active management is pursued, there is room for a private debt buy-and-hold position.

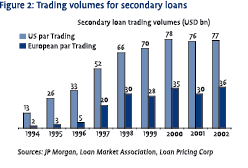

Secondly, at the stock selection level investors like to have the opportunity to sell when a specific name runs into trouble. This could be a problem, but we should not exaggerate the liquidity in public markets either. Besides, the liquidity in some areas of private debt, e.g. leveraged loans, is actually rather good9. More importantly, illiquidity is not a feature of a specific asset class, but the result of a bad story. To put it differently, there is always a fair price for a good story, but a perceived off-market price for a bad story. The only effective way to reduce the possibility of running into a bad story is by doing your homework, through solid credit analysis. Also in case you are confronted with a bad story, you want good protection by means of better covenants and information. Better covenants, in fact, create liquidity when we need it most. In times of credit deterioration, covenants offer an opportunity to step in. A good example is the prepayment event triggers in the documentation of corporate private placements.

Secondly, at the stock selection level investors like to have the opportunity to sell when a specific name runs into trouble. This could be a problem, but we should not exaggerate the liquidity in public markets either. Besides, the liquidity in some areas of private debt, e.g. leveraged loans, is actually rather good9. More importantly, illiquidity is not a feature of a specific asset class, but the result of a bad story. To put it differently, there is always a fair price for a good story, but a perceived off-market price for a bad story. The only effective way to reduce the possibility of running into a bad story is by doing your homework, through solid credit analysis. Also in case you are confronted with a bad story, you want good protection by means of better covenants and information. Better covenants, in fact, create liquidity when we need it most. In times of credit deterioration, covenants offer an opportunity to step in. A good example is the prepayment event triggers in the documentation of corporate private placements.

The market place for private debt is changing

The role of European banks as lender is changing due to mergers, Basle II and, in the case of German Landesbanken, withdrawn state guarantees. These developments will result in less lending capacity and new participants are welcome

In the US, institutional investors, such as pension funds, endowment funds and insurance companies, already have allocated a large proportion of their fixed income portfolios to private debt. US insurance companies allocate roughly 30% of their fixed income portfolio to private debt. European institutional investors are likely to follow. Just recently FitchRatings published a survey of European private placement investors. 86% of the interviewed investors stated that a pan-European private placement market is desirable and 67% believe that this market is likely to develop. Interestingly enough the majority of interviewed investors do not see benchmark and marking-to-market considerations as a barrier to market developments.

Many European issuers make use of the US private placement market, because of the restricted lending capacity of their traditional banking relationships and the liquidity of the US market. UK and European companies fund approximately $15 to $20 billion per annum by private placements in the US.

The reason for not turning to the European public debt market is that the issue size is often too small to be included in a public benchmark, as a result of which the placement process could be difficult and costly. On the other hand, US investors might demand an additional spread premium because they are less confident with non-US credits, especially regarding the uncertainty of forcing default in a foreign court. It is expected that, as more funds become available in the European private debt market, European issuers will make use of this development as it is only natural for them to issue Euro denominated debt instead of dollar denominated debt.

Summary

The focus of many investors has moved away from asset only returns to an integrated asset liability risk approach. Fixed income is an important tool to manage shortfall risk. Different areas within private debt can be seen as useful complementary building blocks to public debt. Access to a variety of exposures helps to diversify the portfolio, while the features can be better linked to specific liability profiles and stronger covenants help to mitigate the impact of defaults. The market place for private debt is changing. The lending capacity of banks will be reduced, while changing investment strategies at institutional investors will trigger demand.

In order to invest in private debt effectively, a specialised team of professionals is needed. Not only to be able to understand the specifics of the market place, but also to have access to deals, negotiate structures and monitor existing investments. For many end-investors it could be too costly to build up this capability. Outsourcing to a specialised asset manager is then recommended.

References

- Angbazo, L.A., Mei, J., and A. Saunders, Credit spreads in the market for highly leveraged transaction loans, Journal of Banking & Finance, no 22, 1998, page 1249-1282

- Bennett, T.L., Esser, S.F., and C.G. Roth, Corporate credit risk and reward, The Journal of Portfolio Management, spring 1994, page 39-47

- Carey, M., Credit risk in private debt portfolios, The Journal of Finance, Vol. LIII, No. 4, 1998, page 1363-1387

- Fitch, Bank loans and bond recovery study: 1997-2000, March 2001

- Fitch, Regimes, recoveries and loan ratings: the importance of insolvency legislation, October 1999

- FitchRatings, The Fitch survey of European private placement investors, March 2004

- Fredman, A.J., Reising, J.J., Explaining performance trends in leveraged loan investments, The Journal of Fixed Income, September 2001, page 83-94

- Grossfeld, M., The European secondary loan market, Balance Sheet, Vol. 7, No. 4, 2000, page 27-28

- Hood, L.R., Investment grade private placement loan spreads, The Journal of Fixed Income, December 1999, page 19-34

- Horsten, W.J., Obligatieleningen (1), Bank en Effectenbedrijf, juni 1999, page 42-45

- Hughes, M., Guarantees of loans and bonds, Butterworths Journal of International Banking and Financial Law, October 2000, page 349-355

- Hughes, M., Creating a secondary market in loans, Butterworths Journal of International Banking and Financial Law, September 1998, page 352-354

- The Royal Bank of Scotland & Prudential M&G, First European private placement conference, February 2004

- The Royal Bank of Scotland, Debt private placements, FT Understanding

- White, J., Lenarcic, K., A new institutional fixed-income security: are bank loans for you?, The Journal of Fixed Income, September 1999, page 80-87

Endnotes

- Defined as the timely and full payment of coupons and principal.

- For example Creditmetrics, CreditRisk+ and KMV.

- Nobel laureate Harry Markowitz introduced standard deviation as the measure of risk and developed the mean-variance optimisation. Despite the criticism that standard deviation is not a good reflection of risk due to fat tails found in empirical return distributions, this measure is still the basis of most models.

- It is common practice to have assets valued at market values.

- Internationally, there is a trend to evaluate liabilities at fair market values.

- This was based on a long term view, but the recent experience of negative equity returns and its damaging impact on coverage ratios, has shown that short term results are important as well. The introduction of IAS19 reinforces this line of thinking.

- Important to note is that given a hundred equal positions and a recovery rate of 50%, a single default leads to a loss of 50 basis points. This is still a painful experience in a credit mandate.

- An important initiative in the public market is “Improving market standards in the Sterling and Euro fixed income credit markets”. This initiative, supported by more than thirty institutional investors in Europe, aims for better covenants and better disclosure of information in order to push the development of the European credit bond market. Private debt could serve as a good example for many public deals.

- The Loan Market Association has launched different useful initiatives to improve liquidity and price transparency in the European loan markets.

in VBA Journaal door Eduard van Gelderen