SUMMARY

SUMMARY

There are signs of changing fortunes for the Value Investing philosophy, but the first precondition for Value managers to benefit is to have survived the style’s thirteen-year bear market. Fortunately the last decade has seen step changes in the tools available to investors to both better understand the portfolio risks being taken as well as improve investment processes to mitigate the headwinds. This article is intended as a ‘practitioner’s guide’ to the practical steps our team of has taken to achieve this, creating a fund with meaningful Value factor exposure that has also outperformed its core MSCI benchmark.

We will discuss three steps: i) using behavioural analytics to understand our human biases, ii) using risk analytics to fine-tune factor exposures to avoid unintended bets, and iii) managing the impact of various ESG risk factors that are often correlated with Value, for example in the energy or financials sectors.

Together, these have done much to mitigate the style-factor headwinds for the fund and, should we be on the cusp of a major cycle change, could provide useful ideas for Growth managers unaccustomed to sailing into the wind.

INCORPORATING ADAPTIVENESS IN A STYLE-DRIVEN INVESTMENT PROCESS

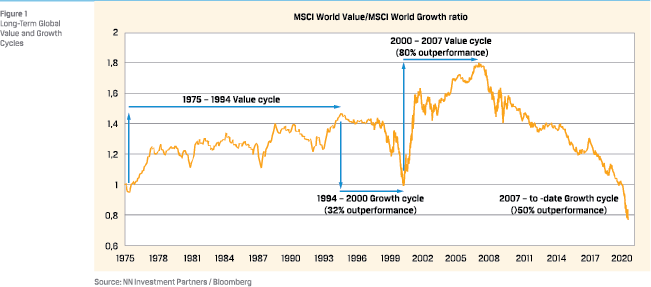

An important observation of Value / Growth cycles is that they can be very long term indeed. In fact we count only four since the mid-1970’s, with the longest being the Value cycle that started in 1975 and lasted almost two decades (see Figure 1). In each case a turn has required a major catalyst, large enough to change monetary, fiscal or foreign exchange policies and require investors to fundamentally rethink the key inputs for equity valuation. An example is the last cycle change in 2008 towards Growth where the global response to the unfolding financial crisis was a huge and creative expansion of central bank balance sheets. With interest rates going to zero or below and inflation expectations cratering the conditions were put in place for outperformance of long-duration equities – Growth stocks.

An important observation of Value / Growth cycles is that they can be very long term indeed. In fact we count only four since the mid-1970’s, with the longest being the Value cycle that started in 1975 and lasted almost two decades (see Figure 1). In each case a turn has required a major catalyst, large enough to change monetary, fiscal or foreign exchange policies and require investors to fundamentally rethink the key inputs for equity valuation. An example is the last cycle change in 2008 towards Growth where the global response to the unfolding financial crisis was a huge and creative expansion of central bank balance sheets. With interest rates going to zero or below and inflation expectations cratering the conditions were put in place for outperformance of long-duration equities – Growth stocks.

Consequently, any change in the current twelve-year trend of Growth outperformance would require these core assumptions to be challenged in a significant way again. The policy response to the COVID crisis, on top of the existing exceptionally loose monetary policy environment may be sufficient to provide this shock, once consumer behaviours and economies start normalising in a post-COVID environment.

Whether this happens or not, the point is that managers with a bias towards either of the two poles of Value or Growth need to have a strategy for coping with what historically have been extremely long periods when the style cycle turns against them. At the same time they need to remain sufficiently ‘true to style’ so as to fulfil the expectations of investors who have allocated capital to their funds. Amongst our own peer group we have noted dividend or value funds that have ‘survived’ this period by offering portfolio yields below that of the benchmark, or where Morningstar style analysis demonstrates movement into the ‘core’ or even ‘growth’ boxes. We would argue it is important to provide investors with the exposure they assume they have allocated to given the objectives of the fund rather than to deviate too far in order to chase performance.

COUNTERING BEHAVIOURAL BIASES

It is well established that investors, and consequently markets, rarely behave as would be predicted by financial theory and studying the impact of the behavioural biases of investors is a growing field of research. Arguably, behavioural finance is central to Value investing where implicitly investors believe the market is ‘wrong’ in core assumptions about a company causing it to trade below intrinsic value. This would never happen in an efficient market! But as well as exploiting the behavioural biases of others, value investors are prone to several biases of their own: expectation of mean reversion, overconfidence (the investor is right, the market is wrong), loss aversion, to name a few.

The first step in correcting for these is to understand those that a particular investor is susceptible to. The approach we took was to work with an outside consultancy, Essentia Analytics who specialise in assessing behavioural biases through the quantitative analysis of long histories of trade information. We have provided almost ten years of trade data either flagged as portfolio management trades (for example, investing or raising cash as a consequence of inflows or outflows), or ‘alpha’ trades where fund managers have actively decided to change portfolio positions. This includes scaling up or down in existing holdings as well as stocks bought for the first time, or sold completely from the portfolio.

The initial feedback sessions from Essentia covered their findings: what we do well as portfolio managers, and more importantly, where there is room for improvement. They then provide ongoing quarterly coaching sessions to measure where fund managers are making progress in correcting for inherent flaws and biases, often helped by real-time ‘nudge’ messages as reminder of emerging patterns that have previously turned out badly. The key to all of this – including not hurting portfolio manager egos in the process – is that all of the data is derived quantitively with very little subjective perspective. If the numbers say aspects of a behavioural bias result in positive or negative alpha, there is little room for argument.

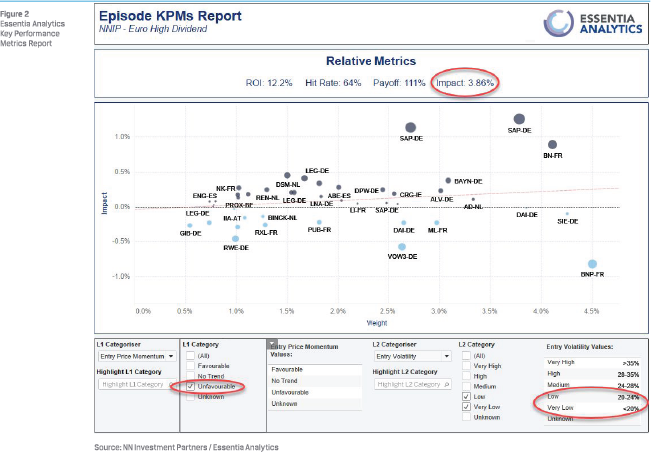

Some concrete examples might help illustrate this feedback in practice. Figure 2, taken from Essentia’s ‘dashboard’, plots the portfolio contribution (ie alpha) on the Y-Axis against the portfolio position size but allows the user to select different entry and stock criteria. On this chart we have selected ‘unfavourable’ price momentum and the two lowest quintiles of stock volatility. The aggregate ‘Impact’ figure shows that we have generated positive returns from buying low-volatility stocks with negative price momentum. In other words the fund managers have skill at spotting good quality companies that have underperformed to such a degree that their valuations are now highly compelling and may mean-revert. That’s quite a useful attribute for a value investor! But if we were to tweak the dashboard criteria we could show that over the same period the investors have lost money buying higher volatility stocks that are showing positive price momentum. In other words, when higher-beta names start to steam ahead the investors are too often tempted to jump aboard (exhibiting ‘herding’ behaviour) just before the move runs out of momentum. This information can then be used to double check entries in these circumstances, either forgoing the trade altogether or using smaller position sizing to reduce the risk.

Some concrete examples might help illustrate this feedback in practice. Figure 2, taken from Essentia’s ‘dashboard’, plots the portfolio contribution (ie alpha) on the Y-Axis against the portfolio position size but allows the user to select different entry and stock criteria. On this chart we have selected ‘unfavourable’ price momentum and the two lowest quintiles of stock volatility. The aggregate ‘Impact’ figure shows that we have generated positive returns from buying low-volatility stocks with negative price momentum. In other words the fund managers have skill at spotting good quality companies that have underperformed to such a degree that their valuations are now highly compelling and may mean-revert. That’s quite a useful attribute for a value investor! But if we were to tweak the dashboard criteria we could show that over the same period the investors have lost money buying higher volatility stocks that are showing positive price momentum. In other words, when higher-beta names start to steam ahead the investors are too often tempted to jump aboard (exhibiting ‘herding’ behaviour) just before the move runs out of momentum. This information can then be used to double check entries in these circumstances, either forgoing the trade altogether or using smaller position sizing to reduce the risk.

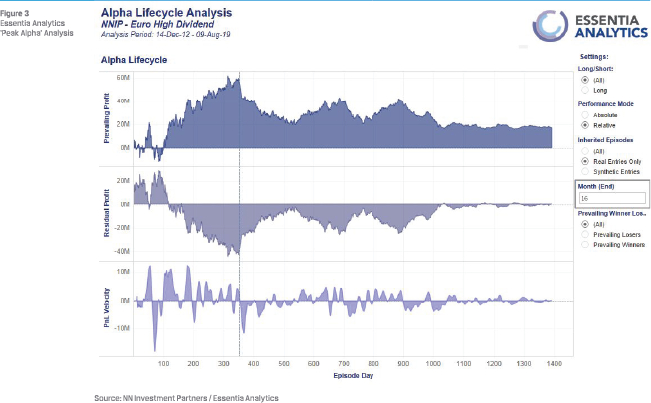

Figure 3 shows a different analysis and outcome – on average ‘peak alpha’ for this fund’s positions occurs 15-16 months after entry, and alpha decays quite quickly thereafter. Essentia now sends a ‘nudge’ email when holdings are reaching this maturity. This does not automatically trigger a ‘sell’ order – it is not a quant fund – but it does remind the investment team to perform a thorough analysis of the company’s investment case to be confident that there is further upside with fresh catalysts to play out, rather than just a ‘stale’ position in the portfolio.

Figure 3 shows a different analysis and outcome – on average ‘peak alpha’ for this fund’s positions occurs 15-16 months after entry, and alpha decays quite quickly thereafter. Essentia now sends a ‘nudge’ email when holdings are reaching this maturity. This does not automatically trigger a ‘sell’ order – it is not a quant fund – but it does remind the investment team to perform a thorough analysis of the company’s investment case to be confident that there is further upside with fresh catalysts to play out, rather than just a ‘stale’ position in the portfolio.

Other findings for the same fund have included that it holds losing positions too long, evidence of a ‘mean reversion’ and ‘loss aversion’ bias. By identifying the level of relative underperformance at which the stocks that are in this category tend to never recover from, it is effective at warning of the Value Traps most Value investors will be very familiar with. Again, the fund managers receive regular email ‘nudges’ about stocks that are exhibiting these Value Trap traits allowing additional work to be done to either regain confidence in the original investment decision or cut the position.

One of the consequences of working with Essentia is that the managers are more active in the portfolio and turnover has risen. While higher turnover is often a warning sign relating to over-trading (another behavioural bias) with its associated increased costs, Essentia’s analysis was able to isolate and measure the alpha from that additional activity and show that it has been significantly positive: in conclusion, incorporating an understanding of behavioural biases, both positive and negative into the investment process has added value.

COMPENSATING FOR PORTFOLIO FACTOR RISK

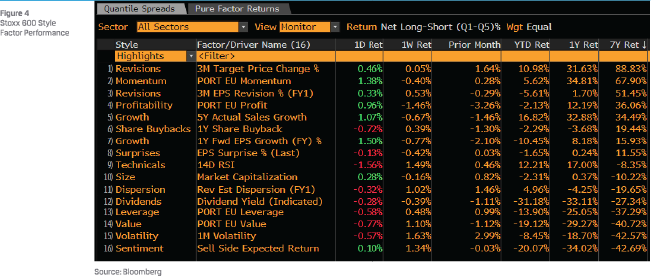

Factors can have high levels of correlation. Figure 4 shows performance of the main style factors from a Bloomberg analysis for the SXXP Index (Stoxx Europe 600), sorted over the last 7 years. It is notable how close the underperformance of Value has been with Volatility and Leverage, or on the upside Quality (revisions and profitability) with Momentum and Growth.

Factors can have high levels of correlation. Figure 4 shows performance of the main style factors from a Bloomberg analysis for the SXXP Index (Stoxx Europe 600), sorted over the last 7 years. It is notable how close the underperformance of Value has been with Volatility and Leverage, or on the upside Quality (revisions and profitability) with Momentum and Growth.

The linkage shown here between Value, Volatility or Leverage gives pause for thought. Is that inevitable? If a fund holding Value stocks underperforms, how much of that is because of the Value exposure, and how much because it is also correlated to other poorly performing factors? Is it possible to build a portfolio that has exposure to desired factors – in our case Value and Dividends, where we believe there are long-term persistent risk premia to be captured – and avoid exposure to ‘low quality’ factors such as Volatility and Leverage?

Modern risk-analysis tools allow this fairly surgical approach to factor exposure to be performed. Within the European equity team at NNIP a proprietary quant tool has been developed that allows factor scoring to be done across portfolios, but also at a single-stock or benchmark level. Third-party applications are also available and we also use the factor analytics available in Blackrock’s Aladdin system. In theory, a Dividend portfolio should already have a tilt to Value with a relatively lower exposure to Volatility and Leverage than a ‘pure’ Value portfolio. Dividend stocks show lower volatility by nature of the element of stock return delivered by (generally predictable) dividends, and exhibit lower leverage since they need to have reasonably solid balance sheets as a precondition of making distributions to shareholders.

However, without using more sophisticated analysis an investor can still end up with unintended factor bets. Using the proprietary tool or Aladdin, portfolio managers can check for the extent of factor risk in the aggregate holdings. If there are undesired exposures the tools can then drill down to a singlestock level to see if there are particular names in the portfolio that contribute disproportionately. The managers are then able to consider alternative stocks with factor scores that better suit the desired criteria.

However, without using more sophisticated analysis an investor can still end up with unintended factor bets. Using the proprietary tool or Aladdin, portfolio managers can check for the extent of factor risk in the aggregate holdings. If there are undesired exposures the tools can then drill down to a singlestock level to see if there are particular names in the portfolio that contribute disproportionately. The managers are then able to consider alternative stocks with factor scores that better suit the desired criteria.

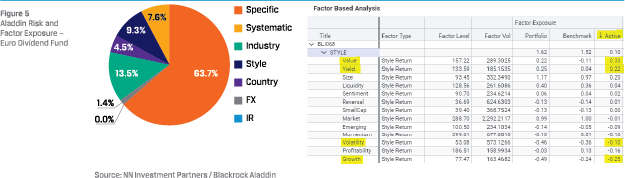

Figure 5 below, taken from Aladdin shows i) that fund style risk overall can be kept low (9.3% of the total tracking error), but with a meaningful positive exposure to the Value and Dividend (Yield) styles while being underweight Volatility and Growth. In fact it is offsetting Value and Dividend factor exposures against Volatility, when they are often correlated that help deliver the low overall style exposure.

USING ESG INTEGRATION TO ENHANCE RISK/RETURN CHARACTERISTICS

As the importance and relevance of Responsible Investing has risen, so has the level of sophistication with which it can now be incorporated into investment processes. At the level of ‘ESGintegration’ (for example, an approach consistent with ‘Article 8’ in the new EU Taxonomy on SRI) an analysis of the Environmental, Social and Governance factors that impact a company can be undertaken with an attempt to incorporate the results into a valuation framework. In some cases this is relatively straightforward: in modelling companies involved in relatively carbon-intensive businesses it is important – and possible – to estimate the increasing costs of emission compliance in opex and capex assumptions, including assumptions around future carbon credit or permit pricing. This isn’t always just a negative cost – for some companies it may be reasonable to assume higher market shares if, for example, they are ESG ‘leaders’ and that might give them a competitive edge in providing solutions to customers who are also having to meet higher ESG standards. For example, in the long-run commodities produced to the highest environmental standards may sell at a premium compared to those whose sourcing is less reliable, as manufacturers will be forced to demonstrate high ESG standards across their entire supply chain. A mining company that is able to deliver to those higher standards would deserve a valuation premium that might be delivered via a lower discount rate: realistic if the assumed financing costs for debt and equity will be lower for higher scoring ESG firms. The point throughout is to use a rigorous appraisal of the ways in which all three ‘E’, ‘S’, and ‘G’ factors might impact a firm’s financial performance and ensure that this is captured in valuation models. In terms of weathering the Value storm, this helps in two ways.

First, at a very company specific level this helps avoid unintended risk arising in a firm that scores poorly in ESG metrics. A traditional financial analysis approach might miss risks accruing from a poor track record in labour relations, environmental standards, or misalignment between minority and controlling shareholders, but using ESG-integration this can be reflected in the valuation model and target price for the security

Secondly, a Value approach can pressure investors towards a bias for entire sectors which trade ‘cheaply’ (however defined) as a result of long-term challenges or potential disruption often related to ESG risks – the Energy sector is a clear example. Oil and gas stocks have appeared attractive as measured by multiples or fundamentals for some time, but have persistently underperformed the broader market. By conducting a thorough ESG analysis of the sector, it is possible to estimate the costs at a company level of their likely path to energy transition and a level of investment in renewables that is consistent with global and European climate targets. This can then be compared with the companies own stated goals and targets, which is generally where market consensus is based. By factoring these Environmental transition costs into a valuation model, it would have been reasonably clear that the ‘fair value’ for these businesses was not necessarily reflected in market prices, or a more conventional valuation based on earnings multiples, dividend yields or a traditional approach to discounted cash flows, indicating that the sector was best avoided by investors.

COMPENSATING FOR SECTOR BIASES

The simplest way for a dividend fund to ensure that it delivers a yield advantage relative to the broader market is to set a minimum dividend threshold for stocks to exceed in order to qualify for selection in the portfolio – a quantitative dividend filter. However this can lead to structural and undesirable sectoral biases. For example, if an arbitrary cut off was set at 2%, only one stock would currently pass in the Information Technology sector of the MSCI EMU Index: Nokia. In an environment where the IT sector consistently outperforms, this would have a very detrimental effect on overall fund returns. An alternative approach to screening, which we have adopted in our funds, is to set the yield threshold at the sector average. For the IT sector, this reduces the threshold to, currently, 1.15% and brings many more IT sector companies in scope, if not the pure growth companies that do not pay a dividend at all. It also has the positive effect of further reducing the universe in relatively high-yielding sectors such as Communication Services (Telecoms) or Utilities which otherwise might crowd out other stocks. By applying this rule consistently across sectors, we can build an investment universe for a dividend fund that will deliver a yield-pickup relative to the market, while remaining diversified across sectors.

ADAPTIVENESS IS NOT A TOTAL PANACEA FOR STYLE HEADWINDS

Ultimately, being prepared to adapt an investment process while remaining true to core investment beliefs and promises made to fund investors, may help to offset style headwinds that would otherwise prove overwhelming. However, headwinds do remain. There are parts of the investment universe that remain ‘offlimits’ to a fund promising a Dividend or Value approach, and if these strongly outperform it can be difficult to compensate through other parts of the portfolio. Despite adjusting dividend thresholds to increase the investible universe of IT sector stocks for example, high-growth companies that do not pay a dividend, or pay a minimal dividend, are unlikely to be part of a Value / Dividend portfolio. Looking at the long-term Value / Growth performances shown in Figure 1 it is clear that headwinds can remain severe however adaptive an investment manager becomes. All that is left to do is to try and perform as well as possible in the parts of the market that remain investible.

in VBA Journaal door Robert Davis