Executive summary

We evaluate the impact of post-crisis regulations on homogeneity and risk taking in the banking sector through market-based indicators. In the past decade, many regulatory reforms have been implemented or are gradually being phased in. Higher capital requirements and stricter rules should make individual banks safer. However, safer individual banks do not necessarily imply a safer banking sector. If banks respond in a homogenous fashion to new regulations it may decrease the stability of the sector as a whole. Our analysis shows that there are indeed indications of such an increased homogeneity. Bank stock returns have become substantially more correlated over time. Furthermore, market indicators of risk based on bank equity and bank option prices also signal vulnerabilities. Regulation may be a factor of importance as it imposes restrictions that can yield a similar response by banks, for example with respect to their choice of activities, balance sheet structure, and risk management. We argue that market-based indicators provide forward-looking information about homogeneity and risk taking in the banking sector. This information is relevant for investors, analysts and regulators for making investment decisions and identifying new vulnerabilities in the financial system.

We evaluate the impact of post-crisis regulations on homogeneity and risk taking in the banking sector through market-based indicators. In the past decade, many regulatory reforms have been implemented or are gradually being phased in. Higher capital requirements and stricter rules should make individual banks safer. However, safer individual banks do not necessarily imply a safer banking sector. If banks respond in a homogenous fashion to new regulations it may decrease the stability of the sector as a whole. Our analysis shows that there are indeed indications of such an increased homogeneity. Bank stock returns have become substantially more correlated over time. Furthermore, market indicators of risk based on bank equity and bank option prices also signal vulnerabilities. Regulation may be a factor of importance as it imposes restrictions that can yield a similar response by banks, for example with respect to their choice of activities, balance sheet structure, and risk management. We argue that market-based indicators provide forward-looking information about homogeneity and risk taking in the banking sector. This information is relevant for investors, analysts and regulators for making investment decisions and identifying new vulnerabilities in the financial system.

1. Introduction

In the aftermath of the global financial crisis, regulatory authorities significantly increased the intensity and scope of regulatory requirements for financial institutions. Banking regulation has become more comprehensive and has widened in scope, reporting has become more granular, required capital and its quality have been enhanced, liquidity requirements have been introduced and macro prudential regulation and resolution mechanisms have been put in place. These regulatory reforms after the crisis were necessary to restore financial stability. On some metrics, this has worked, as financial markets have been going strong over the past years. Stock market highs reached before the financial crisis in many markets have been topped. One sector that has lagged the market however is the banking sector. Regulatory reforms together with the low interest rate environment and the emergence of fintech have put pressure on banks’ revenues, perhaps forcing them to add risk or increasingly adopt the same business model. An area of potential concern is the impact of regulation on homogeneity of business models and on incentives for risk taking. The banking sector may become more homogeneous if regulatory metrics are more detailed and binding. Similarities in responses of banks to regulation can lead to increased homogeneity, for instance when they induce banks to take similar risks. Homogeneity decreases the stability of the financial system when these risks materialize and hit banks simultaneously. Thus a more homogeneous and less diverse financial sector may be associated with higher systemic risks, even if individual financial institutions are better capitalised.

Market-based indicators provide information about homogeneity and risk taking

We review three market based indicators that yield some indication of increased homogeneity and risk taking. Section 2 shows indications of increased homogeneity as inferred from bank stock correlations. Section 3 explores signals in market information on the capitalisation of banks, and Section 4 explores signals in market information on the riskiness of banks. Section 5 offers a policy evaluation and concludes.

2. Market based measure of homogeneity in the banking sector

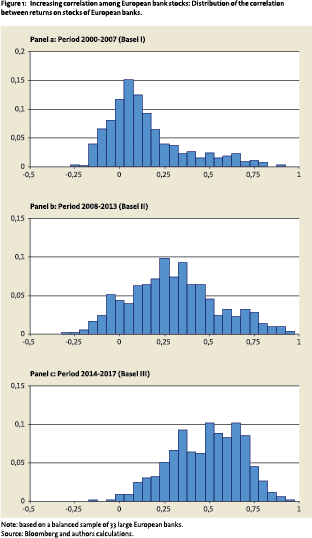

Financial markets provide useful information about the stability of the banking sector. For example, stock markets provide measures of value and option markets provide measures of risk, see Cochrane (2016). Price discovery in the market complements fundamental analysis, e.g., by providing early warning signals that were ahead of regulators in the last crisis. One way of assessing homogeneity in the banking sector is through the correlations of stock returns. Figure 1 shows the empirical distribution of correlations between monthly stock returns for pairs of banks, for three consecutive time periods. The analysis is based on a balanced sample of 33 large European bank stocks. This means that there are ½*33*32=528 unique pairs of bank stocks. The shift in the distribution to the right shows that stock returns have become substantially more correlated over time. In contrast, the mean correlation between the 50 largest European corporations remained roughly similar across these three periods.

The first period shown in Figure 1 corresponds to the Basel I regime, during which the mean correlation between the stock returns of the banks was 6 percent. The Basel I framework was fairly risk insensitive and requirements were low compared to later standards. Under Basel II, the average correlation increased to 26 percent, and under Basel III the correlation increased even further to 48 percent. In contrast, the average correlation between the returns on the 50 largest European corporations remained similar across these three periods (DNB, 2018).

Regulation offers one possible explanation for the increased correlation between bank stocks. The more banks are exposed to similar regulatory constraints, and the more those constraints are binding, the more banks may behave in a similar fashion. Friedman and Kraus (2011) refer to this as regulatory homogenization. Banks, for example, may be tempted to collectively offer products that deliver a high return on equity for a given regulatory capital charge. Also, banks may discontinue products and activities that are subject to a relatively unfavourable capital charge. Moreover, in Europe the Single Supervisory Mechanism has reduced national differences in regulation and supervision of large banks.

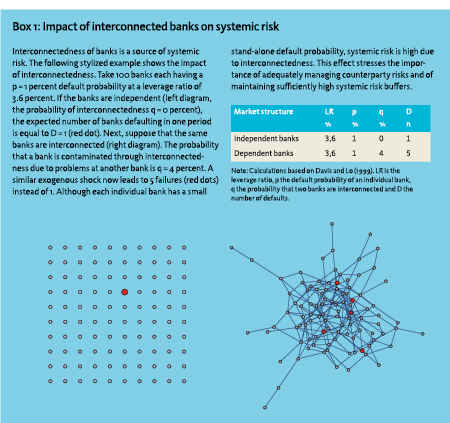

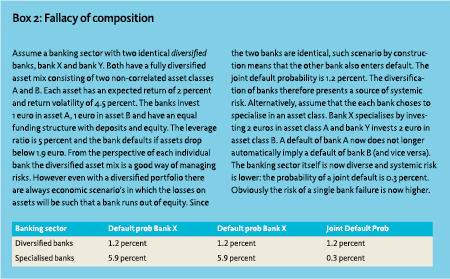

However, also factors unrelated to regulation can give rise to increased homogeneity. Banks and the financial system as a whole have become more interconnected over time. This could lead to spillover effects between banks irrespective of regulation. Interconnectedness of banks thereby is an important driver of systemic risk, as discussed in Box 1. Furthermore, banks may over time have reduced bank-specific risks by diversifying their activities, for example by engaging in (cross-border) mergers and take-overs. As this increases their joint default probability, diversification strategies may be a systemic concern (see Beale et al. (2011) as well as Box 2). In addition, a lack of transparency before the financial crisis may have led investors to believe that banks were quite different from each other. Having gone through the experience of the financial crisis, and due to enhanced transparency requirements, investors may now have become more aware of the homogeneity of the banking sector.

Homogeneity is a key concern for financial stability

The stronger co-movement between bank stock returns may point to an increase in systemic risk. If returns on a single bank stock are low, a high correlation implies that it is more likely that returns on other bank stocks are low as well. As a result, the joint default probability increases. Tighter regulatory requirements and diversification strategies aim at making individual banks safer. One might therefore deduce that the banking sector as a whole automatically becomes more resilient too. However this could be a fallacy of composition, which is the erroneous belief that what is true of the parts must be true of the whole. Safer individual institutions do not automatically imply that the sector as a whole is also safer. Homogeneity among financial institutions should therefore be a key concern for financial regulators that aim to promoting the stability of the financial system as a whole (see also Haldane and May (2011), DNB (2015) and WRR (2016)).

The stronger co-movement between bank stock returns may point to an increase in systemic risk. If returns on a single bank stock are low, a high correlation implies that it is more likely that returns on other bank stocks are low as well. As a result, the joint default probability increases. Tighter regulatory requirements and diversification strategies aim at making individual banks safer. One might therefore deduce that the banking sector as a whole automatically becomes more resilient too. However this could be a fallacy of composition, which is the erroneous belief that what is true of the parts must be true of the whole. Safer individual institutions do not automatically imply that the sector as a whole is also safer. Homogeneity among financial institutions should therefore be a key concern for financial regulators that aim to promoting the stability of the financial system as a whole (see also Haldane and May (2011), DNB (2015) and WRR (2016)).

3. Regulatory versus market based capitalisation of banks

Another area where the market provides valuable information is on bank capital ratios, see Cochrane (2016). The amount of capital affects the risk that a bank can take, its loss absorption capacity and its profitability level, and in addition has an influence on investors’ confidence.

Another area where the market provides valuable information is on bank capital ratios, see Cochrane (2016). The amount of capital affects the risk that a bank can take, its loss absorption capacity and its profitability level, and in addition has an influence on investors’ confidence.

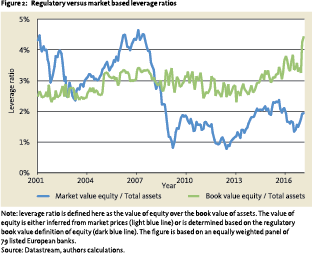

More diversity reduces systemic risk

There exist notable differences between regulatory capital ratios and market participants’ assessment of the capitalisation of the banking sector. Figure 2 plots the regulatory versus the market based leverage ratio of the banking sector in twelve European countries. The leverage ratio is either defined as the regulatory book value of equity over assets or the market value of equity over assets. Based on the regulatory measure of bank equity, the capitalisation of the euro area banking sector has considerably improved since the financial crisis. Banks have increased their regulatory capital significantly. By comparison, the leverage ratio based on the market value of bank equity is significantly lower than the pre-crisis level, and did not improve much since 2009. Hence, market participants may have become less optimistic about future bank profits or may believe that banks are more prone to risk compared to the pre-crisis period. In addition, market participants may react to overall economic uncertainty without having changed their views about banking fundamentals specifically.

There are plausible reasons for the different assessments of the capitalisation of the banking sector. Firstly, regulatory capital ratios based on the book value of equity reflect historical developments. By contrast, capital ratios based on the market value of equity reflect future profit opportunities. These opportunities are uncertain, as future economic events are hard to predict, with bank business models being affected, for example, by the development of fintech and by changes in financial regulation. Secondly, expected future profits for shareholders may have been reduced by bail-in measures, if these measures reduce the likelihood that governments will bail out banks in the future.

There are plausible reasons for the different assessments of the capitalisation of the banking sector. Firstly, regulatory capital ratios based on the book value of equity reflect historical developments. By contrast, capital ratios based on the market value of equity reflect future profit opportunities. These opportunities are uncertain, as future economic events are hard to predict, with bank business models being affected, for example, by the development of fintech and by changes in financial regulation. Secondly, expected future profits for shareholders may have been reduced by bail-in measures, if these measures reduce the likelihood that governments will bail out banks in the future.

Both approaches towards measuring bank capitalization have advantages and drawbacks. Regulatory capital ratios have the advantage that they are less likely to be inflated by overly optimistic market expectations of profit opportunities. This measure reflects the amount of losses that a bank can absorb from an accounting perspective. However, an unintended effect of using book values is that regulatory ratios may provide only a noisy signal about the actual stability of the banking sector. During times of crisis, this noisiness may impair the confidence of market participants in regulatory capital ratios, and may thereby increase the vulnerability of banks to herding and contagion effects. At the same time, interventions of bank supervisors to stabilise the banking sector may be delayed when supervisors respond to book value measures of capitalization. In this case, the situation can occur where banks continue to meet their regulatory capital requirements, but have already lost the confidence of the market.

4. Market based indicators of risk

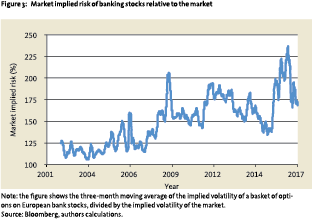

Next to information on capital ratios, the market also provides information on risk. Bank risk can for example be assessed by analysing bond prices, CDS spreads or option prices. Options prices are a direct indicator of (risk-neutral) default probabilities whereas bond prices and CDS spread are also affected by recovery rates. Figure 3 shows a time series of the implied volatility of an equally weighted basket of at-the-money options written on five large European bank stocks (ABN Amro, BNP Paribas, Deutsche Bank, ING, Santander and UniCredit). For ease of reference, this implied volatility is expressed relative to the implied volatility of the market (VSTOXX). A ratio of 100 percent implies that the volatility of the bank stocks is the same as the market’s volatility. The trend in the ratio is positive. Judging from the risk implied by option prices, market participants therefore consider banks, relative to the market, to be considerably riskier than they were at the start of the financial crisis (see also Sarin and Summers, 2016). The bail-in measures may affect this assessment. Furthermore, as banks are highly leveraged institutions, even a small response to new regulations may have an amplified effect on bank risk.

5. Conclusion and policy evaluation

The indications of increased banking sector homogeneity presented in this article may be a sign of an increase in systemic risk. Homogeneity among financial institutions is a key concern when it comes to financial stability. Regulators and supervisors, as well as risk managers and analysts, can benefit from taking market information into account when assessing risks. The information needed to do so is readily available for bank stocks and derivatives that are traded on a regulated market. Stock markets can provide measures of correlation and capitalization, while option markets provide additional measures of risk. More diversity at the banking sector level reduces systemic risk. Heterogeneity will benefit when banks balance the drawbacks of diversification across countries and sectors against activities in which they have a competitive advantage (see also DNB, 2015). Furthermore, early identification of homogenous responses to policy proposals should be an integral part of the regulatory design process.

Literature

- — Beale, N., D.G. Rand, H. Battey, K. Croxson, R.M. May, and M.A. Nowak (2011), Individual versus systemic risk and the regulator’s dilemma, Proceedings of the National Academy of Sciences, 108(31): 12647–12652.

- Cochrane, J. (2016), A better choice, https:// johnhcochrane.blogspot.com, The grumpy economist.

- Davis, M. and V. Lo (1999), Infectious Defaults, Quantitative Finance, 1: 382-387.

- DNB (2015), Perspective on the structure of the Dutch banking sector, www.dnb.nl.

- DNB (2018), Proportional and effective supervision, www.dnb.nl.

- Friedman, Jeffrey and Wladimir Kraus (2011), Engineering the financial crisis, Systemic risk and the failure of financial regulation, University of Pennsylvania Press.

- Haldane, A. G. and R.M. May (2011), Systemic risk in banking ecosystems, Nature, 469(7330): 351-355.

- Sarin, N. and L. Summers (2016), Understanding bank risk through market measures. Brookings Papers on Economic Activity: 57-109.

- WRR (2016), Samenleving en financiële sector in evenwicht.

Notes

- Dirk Broeders, Senior Strategy Advisor at De Nederlandsche Bank (DNB) and Professor of Finance at Maastricht University, Jacob Dankert, Strategy Advisor at DNB, Roel Mehlkopf, Advisor at Cardano and Research Fellow Netspar, Mark Mink, Senior Economist at DNB.

- This article is written in a personal capacity and adapted from DNB (2018).

in VBA Journaal door Dirk Broeders (ml), Jacob Dankert (l), Roel Mehlkopf (r), Mark Mink (mr)