INTRODUCTION

There can be no mistaking the effects that climate change has had on communities around the world in 2021. There are plenty of examples. Heavy rainfall has caused widespread flooding and landslides in The Netherlands, Australia and wide tracts of the US. There have been ferocious wildfires and droughts in California, Greece and Australia, while the hottest-ever temperature in Europe was recorded in August: 48.8°C in Sicily. We believe climate risks are misunderstood and mispriced by participants in real estate markets.

There can be no mistaking the effects that climate change has had on communities around the world in 2021. There are plenty of examples. Heavy rainfall has caused widespread flooding and landslides in The Netherlands, Australia and wide tracts of the US. There have been ferocious wildfires and droughts in California, Greece and Australia, while the hottest-ever temperature in Europe was recorded in August: 48.8°C in Sicily. We believe climate risks are misunderstood and mispriced by participants in real estate markets.

Because extreme weather events have a significant effect on how the value of real estate evolves over time, we have incorporated a consideration of future climate risks into our long term investment process for global real estate companies. Using a large amount of climate data enables us to obtain insight into the physical climate risk that properties are exposed to, now and in the future. In this article we look at how we incorporate extreme weather events today and changes in the future into our global property investment process.

A LOOK UNDER THE HOOD

We believe the real estate market is inefficient and that there are valuation discrepancies to be found, both at the company level and at the level of the individual properties in their portfolios. Besides company level factors, our bottom-up investment process also focuses on finding real estate companies that are undervalued or overvalued relative to the quality of the underlying properties that they own. One factor that drives our decision making is that we are convinced that the impact of climate risk on the value of real estate is not yet fully appreciated by the broad market, and that this leads to mis-pricings.

We examine a variety of factors at the company level. In our view, the three most important factors are the quality of its management team, its balance sheet (leverage) and its ESG policy. Moreover, we also assess the quality of its underlying properties, considering two aspects: the physical condition of the buildings, which accounts for around 20-30% of the score we assign them, and their locations, which account for the remaining 70-80%.

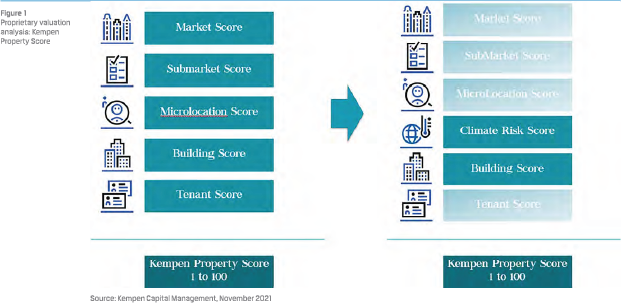

Since 2012 we have used a data-based valuation model to assess the quality of each individual building that forms part of a listed or private property universe, wherever it is located in the world. For each individual building our model calculates a property score, which ranges from 1 to 100, and was until recently derived from five sub-scores based on:

- the market in which the building is situated

- the sub-market

- the precise micro-location

- the quality of the building

- the quality of the tenant(s).

Over the course of nearly a decade, we have built up a database that contains all this information for nearly 500,000 properties around the world.

Subsequently, this property score is used as a direct input in the valuation exercise where physical and location quality are of utmost importance. Part of the exercise is to estimate the capital expenditure (required investments in the building in order to achieve market rents) and the rental growth prospects over the lifetime of the building. The more a location is attractive, in combination with a low climate risk profile (to be elaborated on further in the next sections), the higher the future demand from tenants and hence, the higher the resulting valuation will be. This is why the future prospects of a location are so important for us to understand.

GREAT DATA, GREAT INSIGHTS

High-quality forward looking data about extreme weather events is crucial if we are to be able to accurately quantify climate risk. We decided that data has to have three essential characteristics if it is to be used in our real estate investment process: it has to be comprehensive, reliable, and comparable. What’s more, we look to use global data because we invest in real estate from around the world.

In our search for climate risk data, we looked at three types of organisations providing this kind of information: academic institutions, global reinsurers and non-governmental organisations (NGOs). After much research, we found that academic institutions generally focus on a single type of natural disaster, such as earthquakes or tornadoes. It was a similar story for NGOs, and an additional drawback was that these bodies tend to concentrate exclusively on the regions in which they operate rather than on a global basis. Thanks to the nature of their activities, reinsurers around the world turned out to be well placed to provide data on all the most relevant types of natural disasters, whilst having a global coverage.

As part of our search we investigated the climate data from Munich Re’s Location Risk Intelligence Platform. Munich Re is one of the world’s leading providers of reinsurance, primary insurance and insurance-related risk solutions. This global company is strongly data-driven, like us. Over the past 40 years it has systematically collected data that can be used to assess the climate risk that individual locations around the world are exposed to, and are likely to be exposed to going forward. As far as we have been able to ascertain, no other institution possesses such high-quality data with such a vast reach. We officially entered a partnership with Munich Re at the start of 2021.

The climate risk data in Munich Re’s database comes from two sources: external data from the Intergovernmental Panel on Climate Change (IPCC) coordinated climate modelling projects and internal proprietary natural catastrophe models. Munich Re calibrates these natural catastrophe models using claims data from their reinsurance business. The combination of these two data sources results in a proprietary dataset containing estimates about the climate risks, frequency and severity facing all properties around the world. It classifies 12 types of natural disaster, including flooding, wildfires, hailstorms and high winds. In addition, information is available on non-climate related natural hazards, such as earthquakes and volcanic eruptions.

From our perspective, one of the biggest advantages of Munich Re’s datasets is that they represent a business tested view of today’s risks, as well as an ideal basis for factoring in potential future risks. Future risks are based on the three main scenarios set out by the IPCC (2013, p. 23): the Representative Concentration Pathway (RCP) 2.6 (1.6 degrees of global warming1), RCP 4.5 (2.4 degrees of global warming) and RCP 8.5 (4.3 degrees of global warming). This enables projections of climate risk to be made up to the year 2100.

INTEGRATING THE DATA INTO OUR INVESTMENT PROCESS

INTEGRATING THE DATA INTO OUR INVESTMENT PROCESS

Resuming with our valuation model (as explained in paragraph 2), we recently added a sixth sub-score to our model: an assessment of the climate-related risk each building is exposed to (see figure 1). This is based on two factors: the preparedness of the building itself to cope with weather events, and the attractiveness of its location. For example, a building located close to where a river could regularly cause flooding will be at high risk of damage. This damage could be severe if the building is not properly protected against flooding, for example by the construction of embankments. We would assign such a building a low climate risk score. On the other hand, a better located building, where the climate risk is lower, will be assigned higher rental growth estimates and, hence, a higher valuation.

WE BELIEVE CLIMATE RISKS ARE MISUNDERSTOOD AND MISPRICED BY PARTICIPANTS IN THE REAL ESTATE MARKETS

Integrating Munich Re’s climate risk data into our model helps us calculate more accurate valuations for each building because it enables us to assess the potential impact of future climaterelated events on the properties. The model also enables us to conduct sensitivity analyses under the different climate scenarios from the IPCC. Furthermore, we have an instrument that, should the situation evolve differently to what scientists are predicting today, allows us to incorporate these new assessments into the building level valuation exercise and identify, as early as possible, potential stranded assets.

Let’s give an example of this. In 2020, a large US hotel chain was told by an insurer that the amount it would pay out for each natural disaster that hit its hotels was to be reduced. On top of that, the chain would have to pay the first 5% of the claim itself from now on. The company’s properties included a hotel in the US Virgin Islands, on which Hurricane Irma had wreaked enormous damage in 2017, forcing it to close. The company has since sold this hotel due to its limited insurability but this only transfers the issue to another owner and does nothing in the larger picture to help fight climate change.

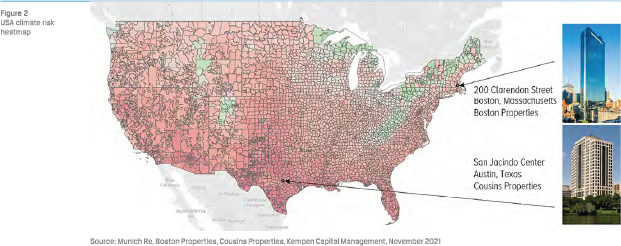

To get an idea of how incorporating an assessment of climate risk affects valuations for an entire real estate market, we applied Munich Re’s data to the US and Australian office markets. Incorporating climate risk in our valuation process for the entire US office market results in valuations that are on average 3.3% lower than our previous valuations that did not incorporate climate risk. For Australia the average reduction is 3.7%. Some areas, like the Northeast of the United States (see figure 2), might become more attractive and could even see valuation uplifts.

To get an idea of how incorporating an assessment of climate risk affects valuations for an entire real estate market, we applied Munich Re’s data to the US and Australian office markets. Incorporating climate risk in our valuation process for the entire US office market results in valuations that are on average 3.3% lower than our previous valuations that did not incorporate climate risk. For Australia the average reduction is 3.7%. Some areas, like the Northeast of the United States (see figure 2), might become more attractive and could even see valuation uplifts.

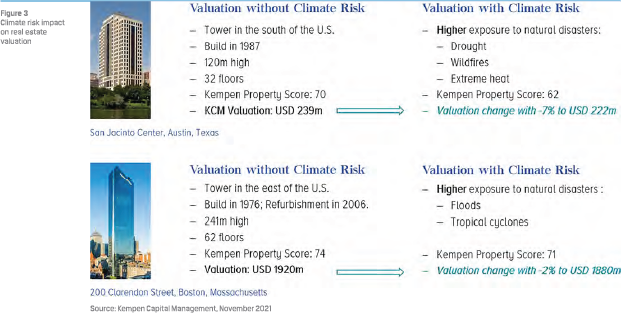

As well as enabling us to value a whole market taking into account climate risks, we can determine values for each of the individual 500,000 buildings in our database. For example, let’s consider two office blocks in the US (see figure 2): one in Boston, Massachusetts and the other in Austin, Texas.

A comparison of the two buildings (figure 3) shows us that the office building in Austin (climate risk score: 47) is exposed to higher climate risk than the one in Boston (climate risk score: 58). These scores impact the overall property score which is a direct input for our rental growth estimates: incorporating climate risks results in the value of the office in Austin falling by 7%, and that of the building in Boston by 2%. This clearly demonstrates how crucial the climate risks affecting a particular location can be on a building’s valuation.

A comparison of the two buildings (figure 3) shows us that the office building in Austin (climate risk score: 47) is exposed to higher climate risk than the one in Boston (climate risk score: 58). These scores impact the overall property score which is a direct input for our rental growth estimates: incorporating climate risks results in the value of the office in Austin falling by 7%, and that of the building in Boston by 2%. This clearly demonstrates how crucial the climate risks affecting a particular location can be on a building’s valuation.

As a result of the relatively high exposure to climate risk of the office building in Austin, we calculate that investment or capex in the building, as a percentage of operating income, needs to increase by 3 percentage points to 25.5%. This is necessary to better protect the building against climate change, reduce the need to pay higher insurance premiums and minimise the risk of vacancies resulting from tenants not wanting to rent a building that is poorly protected against adverse weather.

The data leaves no doubt in our minds that current real estate company valuations fail to take any account at all of future climate risk. What’s more, our lower valuations for the US and Australian office markets show that while examining climate risk at a global level is useful, it is not enough. The examples of the office buildings in Boston and Austin show that detailed understanding of climate risks at a local level is vital if we are to arrive at more precise valuations.

As investors, we are of course most interested in the impact of climate risk on future valuations. In our model we assume that the IPCC’s RCP 4.5 (+2.4 degrees) scenario is the most likely to pan out. We believe RCP 2.6 is too optimistic (given CO2 emissions are still increasing) and RCP 8.5 too pessimistic. Our valuation model applies an investment horizon of 40 years and the RCP 4.5 scenario for 2050 corresponds best to this. The lower valuations that we calculate for the US (a valuation impact of –3.3% on average) and Australian (–3.7%) office markets are based on this scenario and timeline.

The advantage of this methodology is that we can also conduct analyses using different scenarios, such as RCP 8.5 (+4.5 degrees). After all, we cannot exclude the possibility that the world’s efforts to combat climate change turn out to be inadequate. Under the RCP 8.5 scenario, the current valuation of the office building in Austin is 16% lower and that of the office building in Boston 9% lower. These are considerable differences from the valuations we calculated under the RCP 4.5 scenario; – 9 percentage points lower for the building in Austin and 7 percentage points lower for the building in Boston.

It is interesting to see what real estate companies will do now the potential effects of climate risks on buildings they own are becoming clear. They run the risk that some of their properties will lose a considerable amount of value over the long term.

They have two options: sell the property in question (which merely transfers the problem to another owner), or invest in climate-proof renovation for those properties in locations that are subject to considerable climate risk.

One example is the Australian city of Brisbane. The city’s prestigious business district, known as the Golden Triangle, is home to a large number of modern office buildings close to the Brisbane River. In recent decades the river has regularly burst its banks, causing severe flooding and an enormous amount of damage. A question for engagement arises: what actions are the owners of these office buildings taking now that the climaterelated risks their properties are exposed to are manifesting themselves ever-more frequently?

INCORPORATING CLIMATE RISKS IN OUR VALUATION PROCESS FOR THE ENTIRE US OFFICE MARKET RESULTS IN VALUATIONS THAT ARE ON AVERAGE 3.3% LOWER THAN OUR PREVIOUS VALUATIONS

Another option is to build on sites exposed to fewer climate risks. This is exactly what some property developers in the US are now doing – they are increasingly looking to build new properties inland rather than in coastal regions. The question is whether this is sensible given that inland areas of the US are going to be confronted with higher temperatures over the coming years. Our partnership with Munich Re can help in this respect: we have been able to pinpoint what should be relatively climate-safe regions for real estate up to the year 2100.

AN ACTIVE APPROACH

Real estate managers have two options when it comes to climate risk: ignore it or adopt an active approach to it.

Ignoring it would involve continuing along the same path and viewing climate risk as non-existent or negligible because it cannot be quantified properly. Managers adopting this approach need to consider how they will respond to their clients and other stakeholders when they start to ask questions about the impact of climate change on the value of their investments. Moreover, several of the largest countries around the world are putting in place regulatory requirements forcing companies to report on climate risks.

We have chosen a more active path. Thanks to our partnership, we have incorporated global climate risks into our investment process, enabling us to calculate more realistic real estate valuations and generate better investment returns, now and for the rest of this century. This means we can enter informed dialogues with real estate companies to discuss their vision, long-term investments and contribution to sustainability. By engaging with real estate companies on climate risks we can work together to create sustainable buildings.

With special thanks to Jonathan Meagher & Jürgen Schimetschek for their contribution.

Literature

- IPCC, 2013, Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge University Press, New York. Available at: https://www.ipcc.ch/ site/assets/uploads/2018/02/WG1AR5_all_final.pdf

Noot

- Compared to preindustrial times (1850-1900).

in VBA Journaal door Lucas Vuurmans