Finance theory argues that investors can earn risk premiums by investing in assets that are not risk free, such as stocks (equity risk premium), government bonds (term premium) and corporate bonds (default premium). Theoretical portfolios, such as the Fama and French (1992) factors, are often used to gauge the economic magnitude of these premiums. The closest practical proxies to these theoretical portfolios are passively managed mutual funds, which have the objective to track index returns at low cost. The most popular examples of passive funds are classic index funds and the more novel Exchange Traded Funds (ETFs). ETFs undoubtedly constitute one of the most successful financial innovations of recent times. Since the introduction of the first ETF less than twenty years ago (State Street’s SPDR on the S&P 500 Index, launched in 1993), ETFs have managed to attract more than $1,100 billion in assets, managed via over 2,300 different funds (source: Blackrock ETF Landscape Global Handbook Q3 2010).

But do passive funds such as ETFs live up to their promises? In this paper we argue that practical issues such as costs, taxes, and liquidity, may prevent passive fund investors from capturing theoretical risk premiums in reality. Because the impact of these factors varies across funds, we conclude that, like actively managed funds, passive funds should be critically scrutinized by means of a thorough due diligence process. In addition, we recommend to benchmark the performance of actively managed funds against passive funds, instead of theoretical constructs which may project return levels that are not necessarily attainable in reality

Index Choice

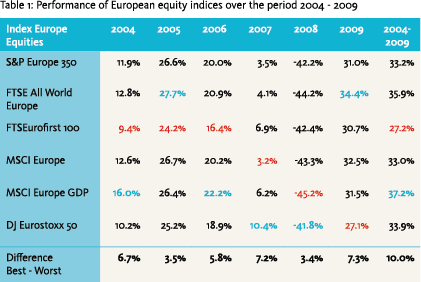

Our first argument is that there might be substantial return differences between theoretical risk premiums and returns generated by passively managed funds because of benchmark index choices. In table 1 we illustrate this issue by showing the 2004-2009 calendar year gross total returns of a number of different European equity indices used by passive funds. Each index aims to represent the European equity market, but the indices differ in the number of constituents and the weighting scheme applied. For this set of indices we observe performance spreads per calendar year varying between 3% and 7%. Over the total six year period, the return spread accumulates to 10%. These large dispersions illustrate that the index choice is an important decision, which can easily result in performance differences comparable to those observed between active managers. The dispersion is also large in comparison to the maximum expected equity premium of 4% (per annum, arithmetically) prescribed by the Dutch parliamentary committee on equity return expectations.

An important aspect in the choice of an index is the number of index constituents. If investors aim to capture a risk premium they should select a well-diversified index, because otherwise they run the risk of a company-specific return adversely affecting the index return. For example, in Table 1 on page 14, the Eurostoxx 50 is much less diversified than the MSCI Europe, which currently has over 400 constituents. Another example is the trend in corporate bond markets to create socalled “liquid indices”, such as the iBoxx $ Liquid Investment Grade Top 30 or the iBoxx $ Liquid High Yield Index, which consists of 50 names. These indices have the advantage of a higher degree of investability, but at the expense of higher idiosyncratic risk as compared to more broadly defined indices.

Another aspect to consider when choosing an index is efficiency. For example, Noronha and Singal (2006) estimate that because of arbitrage around the time of index changes, investors in funds linked to the S&P 500 and Russell 2000 indices lose between $1 billion and $2 billion a year for the two indices combined. The opportunity for arbitrage arises around index rebalancing moments, when, within a short period of time, passive managers predictably buy (sell) large volumes in securities that are added to (or removed from) the index, thereby causing temporary price pressure.

Costs

Second, costs are an important reason why passive fund returns deviate from theoretical risk premiums. For example, Carhart (1997) documents a negative one-to-one relation between fund performance and expenses. It is therefore important to look at for example the Total Expense Ratio (TER) when selecting a fund, as these costs go directly at the expense of the expected return of investors. ETFs and index funds have built a reputation to offer “cheap” access to various asset classes, but considerable variation can be observed in their reported TERs. For example, the Lyxor ETF on the MSCI U.S.A. reports a TER of 0.35%, while the BNY Mellon S&P 500 index fund reports a TER of 1.15%, i.e., almost four times higher. Hortaçsu and Syverson (2004) also document a wide variety in expense ratios among passive index funds tracking the S&P 500 index for U.S. investors.

It should be noted here that the Total Expense Ratio does not include all costs incurred by a fund, thereby providing a too optimistic picture. For example, the definition of TER does not include transaction costs, such as commissions, bid-ask spreads (or swap spreads in case of a swap-based replication strategy) and the market impact of trades executed by funds.

Taxes

Third, another hurdle in capturing risk premiums is the presence of taxes, which are also not included in the TER. Investors can be confronted with taxes at various stages of the investment process. For example, the investor in a fund may have to pay taxes on dividends distributed and/or on capital gains realized by the fund. Trading activity of the fund may also be taxed, such as stamp duty in the United Kingdom. Furthermore, dividend income received by the fund may be subjected to dividend withholding taxes which cannot be reclaimed. Blitz, Huij, and Swinkels (2010) find that European equity index funds underperform their benchmark index by their expense ratio plus the worst-case dividend withholding tax effect, with both effects having a roughly similar impact on fund performance. For example, for European investors looking for exposure to the U.S. equity market the performance drag due to dividend withholding taxes is approximately 60 basis points on an annual basis (2% dividend yield times a 30% dividend withholding tax rate). A fund can potentially reduce the impact of dividend withholding taxes by making use of international tax treaties, depending on its country of domicile. Because of the large impact of dividend taxation on performance, it is important to determine if funds succeed in reclaiming all or part of the withheld dividends.

New providers in the market for passive funds, such as Deutsche Bank (x-trackers) and ThinkCapital in the Netherlands, explicitly mention superior dividend tax efficiency as one of their competitive advantages. However, the empirical evidence is still too short to determine if these funds are indeed able to deliver better results.

Liquidity

Liquidity

Fourth, liquidity of the individual securities is also a factor affecting the ability to capture theoretical risk premiums in actual investment returns. Passive investors, particularly investors in ETFs, should be aware of two issues. First, the less liquid the constituents of an index are, the harder it is to track that index due to higher transaction costs which are not reflected in paper indices. For this reason it is, for example, harder to track an emerging market equity index than tracking a European equity index. Similarly, it is more challenging to track a high yield corporate bond index than an investment grade corporate bond index. The problems caused by illiquidity may be amplified in case the fund is confronted with large inflows or outflows: the larger the quantity of illiquid securities a fund needs to trade, the more costly it will be and the longer it may take to invest the inflows, leaving the fund underinvested and thus exposed to additional tracking error. Liquidity problems might be the reason for the iShares iBoxx $ High Yield Corporate Bond ETF to lag its benchmark index by 3.78% over the calendar year 2009 even though its benchmark index is called the iBoxx $ Liquid High Yield index. This suggests that tracking the entire high yield market passively would probably result in even larger deviations from the performance of the theoretical benchmark index. We refer to Houweling (2010) for a detailed analysis of the performance of ETFs tracking high yield benchmarks, showing that the underperformance can be as large as 6% per annum.

Also, liquidity may affect trading of the ETF itself. ETFs trade as individual stocks and the market price of the ETF should be maintained close

Passive funds should be critically scrutinized ...

to the value of the underlying assets by so called Authorized Participants, who can convert the fund into its underlying assets or create new ETFs by buying the underlying assets. During times when liquidity dries up, investors buying or selling an ETF can be faced with price deviations from the net asset value. During such periods trading costs of ETFs, e.g., bid-ask spreads, are usually also wider than during normal market conditions. Although direct trading costs should matter only marginally for truly passive buy-and-hold investors, they are important to investors who use passive funds in a more active way, e.g., for tactical asset allocation purposes. These active investors may also negatively affect the performance of buyand-hold investors, in the case bid-ask spreads are smaller than the actual transaction costs incurred by the fund.

Tracking Error

Tracking Error

Fifth, passive fund returns may fall short of theoretical risk premiums because of tracking error. We can broadly distinguish between three main approaches used by asset managers to track the returns of an index: (i) full replication: the asset manager buys exactly the same stocks and in the same quantity as in the benchmark index, (ii) statistical replication: the asset manager buys a subset of the stocks in the benchmark index aimed at following the index as closely as possible, e.g. using mean/variance optimization, and (iii) swap-based replication: the asset manager buys certain securities and in addition engages in a swap contract swapping the return on these securities against the benchmark index return. Ex ante, the tracking ability can be expected to be better for funds that follow full replication or swap-based replication, while the return of index funds which follow statistical replication may deviate more from the index they track, particularly if the algorithm fails to adequately capture the actual market dynamics.

To illustrate, consider the popular iShares MSCI Emerging Markets ETF (EEM). This fund only uses around 300 stocks to replicate an index consisting of around 750 stocks. Over the year 2009, it reports a total return of 71.80%, while over the same period the index returned 78.51%, implying an underperformance of almost 7%. The Vanguard Emerging Markets Index Fund (VEIEX) aims to fully replicate the index, which results in a better tracking result. Nevertheless, with a reported return of 76.28% over the same period it still underperformed by over 2% during a single year. This may be more than an investor is willing to tolerate from a passive fund. In fact, active managers have been dismissed for smaller underperformances. These examples illustrate that tracking broadly diversified indices can be challenging.

Counterparty Risks

Sixth, we would like to address counterparty risk. A fund may be capturing exactly the risk premium an investor is looking for, but still not be attractive to that investor if it takes on undesirable counterparty risk. If an index tracker uses the swap-based replication approach, it signs into a contract with a counterparty to exchange the expected return on its investments (e.g., LIBOR when the assets are invested in cash) against the return on the benchmark index. The counterparty typically charges a fee for taking over this risk from the index tracker. Depending on the return difference, the counterparty either has to pay to the fund or vice versa. During the financial crisis the industry learned the hard way that sometimes counterparties default and hence cannot pay the amount due from a swap. Counterparty risk may also play in role in two other ways. First, cash investments of the fund may involve counterparty risks, when the cash is invested in securities which contain default risk. These investments can be made either directly or indirectly through money-market mutual funds. Second, securities lending activities employed by the index tracker tend to result in counterparty risks. In 2009, the press reported that several large investors experienced substantial losses as a result of their securities lending programs. It depends on the index tracker how risks and rewards of securities lending are shared between the investor and the asset management company delivering the service.

Concluding Remarks

Capturing risk premiums is not a matter of simply picking the first passive fund that presents itself. In this article we provide an overview of key issues which should be actively investigated by investors before selecting an index representing a particular risk premium and a fund to track the selected index. Our analysis implies that capturing risk premiums by investing in passive funds requires a thorough due diligence process, not unlike the processes that are used for the selection of active funds. In other words, all outsourced investment services should be subjected to careful scrutiny. Our results also suggest that the performance of a group of pre-defined investable passive investment products can be used to estimate the size of risk premiums in practice and as an appropriate benchmark for evaluating the value being added by actively managed funds.

References

- Blitz, D.C., Huij, J., and Swinkels, L. (2010), The Performance of European Index Funds and Exchange-Traded Funds, SSRN working paper no. 1438484 (forthcoming European Financial Management)

- Carhart, M.M. (1997), On Persistence in Mutual Fund Performance, Journal of Finance, Vol. 52, No. 1, pp. 57-82

- Fama, E.F. and French, K.R. (1992), The Cross-Section of Expected Stock Returns, Journal of Finance, Vol. 47, No. 2, pp. 427-465

- Hortaçsu, A., and Syverson, C. (2004), Product Differentiation, Search Costs, and Competition in the Mutual Fund Industry: A Case Study of S&P 500 Index Funds, Quarterly Journal of Economics, Vol. 119, No. 2, pp. 403-456

- Houweling, P. (2010), High Yield ETFs are Not Low-Cost, LowTracking Error Alternatives to the Robeco High Yield Bonds fund, Robeco Center of Knowledge publication, available on http:// www.robeco.com/quant.

- Noronha, G., and Singal, V. (2006), Index Changes and Losses to Index Fund Investors, Financial Analysts’ Journal, Vol. 62, No. 4, pp. 31-47

in VBA Journaal door f.l.t.r. Laurens Swinkels, Patrick Houweling, Joop Huij and David Blitz