Investment managers are very familiar with market-based benchmarks that are used in the context of traditional fixed-income and equity portfolios. These benchmarks reflect the strategic direction of the respective portfolios and play a crucial role in both the risk analysis of the portfolio and the performance evaluation of the manager. Moreover, these benchmark portfolios are based on well-defined rules and typically use tradeable market instruments. Therefore the benchmark portfolio is investable and could be replicated by the manager.1 This makes the benchmark portfolio a ’neutral’ point of reference that can be used in the evaluation of the manager.

Benchmarking LDI portfolios is different from benchmarking traditional portfolios in several ways. For example, using market caps for the index weighting, as is often done in traditional benchmarks, would be meaningless for benchmarking LDI portfolios as there is no connection between e.g. a pension fund’s duration and the average market duration. Moreover, every pension fund has its own specific liability structure. As a consequence customization is needed for LDI portfolios, making peer comparisons difficult. So benchmarking LDI portfolios is relatively challenging compared to using the familiar market-based benchmarks.

Cash flow benchmarks are probably the most widely applied form of liability benchmarking. In this article we contrast cash flow benchmarking with liability-based benchmarks. We will show that liability-based benchmarking is an important instrument in achieving strategic objectives and motivate that liability-based benchmarking can play a crucial role in assessing the quality of the LDI manager. The remainder of this article is structured as follows. We start with two sections where we discuss respectively cash flow benchmarks and liability-based benchmarks. Then we have a section on the benefits of liability-based benchmarking followed by a section where we provide an illustration of these benefits. In the last section we will draw some conclusions.

Cash Flow Benchmarks

The most straightforward form of liability benchmarking concerns a methodology where expected projected pension cash flows are discounted at some rate. The benchmark return is then measured by changes in the present value of these cash flows. Dutch pension funds often use the 6-month Euribor swap curve to discount the cash flows. The wide use of cash flow benchmarks might be explained by its simplicity. However, several questions can be asked with respect to this methodology.

The first question relates to the assumptions on the composition of the LDI portfolio. Discounting at the swap curve implicitly assumes that the LDI portfolio is composed of interest rate swaps combined with bank deposits or any other asset that generates floating rates (like asset-backed securities). It could very well be the case that an investment into bank deposits or asset-backed securities does not comply with the strategic objectives of the LDI portfolio or violates the investment restrictions. Actually, the methodology is rather ambiguous on the implicitly assumed composition of the LDI portfolio, while clarity and objectivity is needed.

The second question concerns an inconsistent valuation. The above-mentioned discounting ignores valuation issues, like basis risk, that arise in practice. Basis risk has become an important factor in the valuation of collateralized derivatives, like interest rate swaps, since the credit crisis. Put simply, the cash flows from a collateralized interest rate swap are discounted at the Eonia curve, resulting in a basis risk vis-à-vis the liabilities that are discounted at the 6-month Euribor curve. This risk can easily dominate the relative performance of the LDI portfolio, making manager evaluation challenging. So cash flow discounting on the basis of the 6-month Euribor curve results in valuations that are not market consistent. Therefore, cash flow benchmarks cannot be replicated by any real-life investment portfolio.

Liability-based Benchmarking

Liability-based Benchmarking

We would like to make a distinction between the above-mentioned cash flow benchmarks and the so-called liability-based benchmarks. In our view, a liability-based benchmark should reflect the investment and hedging objectives, incorporate the sponsor’s risk preferences and satisfy any investment constraint that will apply to the LDI portfolio. Only then we have a ’neutral’ benchmark portfolio that provides the sponsor and the manager with a fair performance yardstick. Sponsors can be confident that if the manager holds the positions underlying the benchmark, they will meet their liability schedules while satisfying their investment restrictions. Note that a liability-based benchmark is, contrary to the cash flow benchmark, not just about matching the duration profile of the liability cash flows. A liability-based benchmark also determines the collateral investments, which can be government bonds, credits or any other (fixed income) asset class that satisfies the sponsor’s strategic risk preferences and investment constraints.

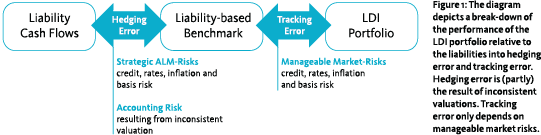

Liability-based benchmarks break down portfolio return relative to the liabilities in a hedging error and a tracking error (See figure 1).

- The hedging error risk comes from two sources. The first source of risk relates to inconsistent valuations. Liability returns are based on accounting values that ignore issues like basis risk (see above) while the liability-based benchmark returns are fully market-based. The second source of risk relates to strategic investment decisions with respect to credit, rate and inflation exposures that are based on strategic views.

- The tracking error risk is a pure market risk that is not impacted by different valuation-methodologies. As a consequence tracking error can be measured unambiguously and is manageable.

It is fair to say that in practice the application of a liability-based benchmark could be more challenging than only using a simple cash flow benchmark. The performance calculation of a liability-based benchmark requires the valuation of all its components. This can be a bond index where index providers offer an objective pricing but it can also be a portfolio of interest rate swaps where pricing is less trivial. In our experience, the valuation of a liability-based benchmark does not lead to insurmountable issues.

It is fair to say that in practice the application of a liability-based benchmark could be more challenging than only using a simple cash flow benchmark. The performance calculation of a liability-based benchmark requires the valuation of all its components. This can be a bond index where index providers offer an objective pricing but it can also be a portfolio of interest rate swaps where pricing is less trivial. In our experience, the valuation of a liability-based benchmark does not lead to insurmountable issues.

Benefits of Liability-based Benchmarking

Having a liability-based benchmark enables benchmarking on an apples-to-apples basis, as a liability-based benchmark is based on an investable portfolio with objective market values, just as the LDI portfolio. On the contrary, using a cash flow based benchmark would yield an unfair comparison, as the cash flow based benchmark cannot be replicated by any investment portfolio. So liabilitybased benchmarks enable manager evaluation on a fair basis and facilitate transparency towards sponsors. One could ask whether peer analyses are a solution for the unfair comparison that comes along with cash flow benchmarking. These peer comparisons can easily be made when there are multiple managers with identical objectives and constraints. However, a cash flow based benchmark by itself does not uniquely specify these objective and constraints. The problem is that a significant part of the performance relative to a cash flow benchmark comes from hedging error, which is not manageable. Therefore, these relative returns are not attributable to the manager but are rather based on ’noise’. So even managers that target hedging the same cash flow scheme cannot be compared in a reliable and meaningful way. This gets even worse when different managers with different cash flow schemes are compared.

So liability-based benchmarks make manager evaluation fair and meaningful. This will result in a much stronger emphasis on investment performance. In this context, it is remarkable to observe that for return-oriented portfolios, the past decades have exhibited an evolution of performance measurement from just measuring total return to measuring risk-adjusted return relative to a benchmark, while development of performance measurement of hedging portfolios has been more limited. This imbalance could be explained by an implicit assumption that hedging is a performanceneutral activity.3 Liability-based benchmarking facilitates a check on this assumption. Any basis point of relative performance can be explained and attributed to investment decisions. Moreover we strongly believe that the aforementioned change in behavior of the port- folio manager can result in a more efficiently managed LDI portfolio yielding a better investment performance. This contrasts sharply with an approach where LDI management is considered as a performance-neutral hedging activity relative to some cash flow benchmark where investment performance is only poorly measured (and therefore probably weakly managed).

As mentioned above, a liability-based benchmark gives the LDI manager a manageable target. Therefore, LDI calls for a portfolio-management approach as any other investment portfolio. This involves benchmarking, portfolio-analysis, portfolio-optimization, risk management, performance attribution and manager evaluation. As a liability-based benchmark is so similar to a standard benchmark, the portfolio management approach can easily be applied to the management of the LDI portfolio by means of standard portfolio management systems and methodologies. This will improve the quality of portfolio management and result in a more controlled investment performance.

Another benefit of a liability-based benchmark concerns the ability to incorporate strategic views. These views could relate to inflation, credit spread, liquidity premium or long term forward rates. In any of these cases, the strategic view should be one of the drivers for the composition of the liabilitybased benchmark. To give an example, we mention the decision with respect to the allocation to credits. A sponsor might have a preference for investing the capital of the LDI portfolio in credits. On the basis of some strategic asset allocation optimization, the sponsor could conclude that an allocation to credits is efficient from a return perspective. This conclusion should be reflected in the liability-based benchmark, optionally in combination with some risk budget for active management. Note that incorporating strategic views is very common in the case of the ’performance-seeking portfolio’ that is benchmarked relative to some composite equity index. Again, this contrasts with a cash flow benchmark where these views are not incorporated.

An Illustration on Manager Evaluation

In this section we will illustrate that performance evaluation of LDI portfolios relative to a cash flow benchmark can be very misleading. In our example we assume a pension fund that hires two external LDI managers. Both managers have exactly matched the duration-profile of the cash flow benchmark such that the annualized TE coming from rate risk is negligible. Both managers comply with the investment constraints that require that the capital is invested in short term government bonds and that interest rate swaps should be used to match the liability’s duration profile. For historical reasons, at the beginning of the year, manager A has a net positive market value while manager B has a net negative market value in the interest rate swaps. This difference in market value results in opposite basis-spread exposures: a basis-spread move will cause the managers performances to diverge. For a one-year period, this can easily cause a performance difference of 25bps. In such a scenario, one of these managers will outperform the cash flow benchmark and the other will underperform. Although both portfolios comply with the investment constraints and although both portfolios have a matching duration-profile, the portfolios returns can differ substantially. So assessing each manager’s quality on an individual basis by measuring their respective relative performances would yield wrong conclusions. But also a relative comparison of their performances will not offer a solution, as the difference in the performance in this example resulted from undefined risks.

Conclusions

We have mentioned several shortcomings of the widely applied cash flow benchmarks. These shortcomings are linked to the inability to replicate the performance of this type of benchmarks. Liability-based benchmarks offer several benefits that are very similar to benefits that come along with benchmarking in general. One of the most important advantages is a fair evaluation of the LDI manager, resulting in a stronger emphasis on investment performance and a more efficient portfolio management. We have also argued that liability-based benchmarks are capable of capturing the strategic investment policy. Although liabilitybased benchmarking is not as simple as cash flow benchmarking, we strongly believe that any pension fund will benefit from applying a liability-based benchmark.

Notes

- In practice replicating a benchmark can be challenging. However, if the benchmark is investable, tracking error can be attributed to investment decisions.

- Both authors work for ING Investment Management. Bas Peeters is Head of Structured Investment Strategies, Martin Prins Head of Strategy Research & Development.

- Besides, defining a meaningful measure that reflects the quality of the manager is not trivial.

in VBA Journaal door Martin Prins and Bas Peeters