Introduction

Introduction

Fundamental changes in industries can offer interesting opportunities for investors to earn attractive risk-adjusted returns. The combination of a major regulatory change and the fall-out from the financial crisis result in such opportunities for investors in the European insurance sector.

The investment case for insurance debt

The insurance sector has a very favourable default record, with global defaults well below the 0.5% level even when looked at on a 21 year weighted average basis.2 Still, many investors hesitate to enter the insurance investment universe, which could be based on lack of understanding about how insurance works. Insurance is a large scale industry that deals in something complicated and intangible that sounds unpleasant – risk. Insurance companies aim to make profit from purposely taking risk. They receive a premium payment for this, but that is before the risk has emerged, so there can be little certainty that the premium charged will be enough to cover the risk. To put this another way, if I sell insurance, I sell a product before I know for sure what my cost of sales will be. Add to this the fact that the insurance industry is steeped in jargon that can make the business seem obscure, it’s little surprise that investors are cautious. However, investors should consider that business of insurance also has fundamental attractions. For example, insurance is a highly liquid business. Sales revenue in the form of insurance premiums can be invested to earn extra investment income before most costs of sales are incurred. Insurance companies are financed mainly by premiums of policy holders. Insurance companies are not exposed to “run on the bank” scenarios, and this can make some insurance investments more attractive credits than their bank counterparts.

Regulation requires insurers to maintain regulatory solvency financing.3 Many of the more than 54004 insurance companies in Europe are generally too small to attract major institutional lenders and are faced with a structural decline in available financing sources. Since the financial crisis began in early 2008, banks have tightened lending criteria and reduced the amount of finance they are willing to extend as they have sought to reduce risk and repair their balance sheets. This problem persists. Even in April 2013, forecasts by the International Monetary Fund warned that a drastic contraction of European bank balance sheets during the (then) next 18 months could jeopardise financial stability and economic growth in Europe and beyond.5 With increased cost sensitivity, banks have also appeared reluctant to spend time and money on detailed analysis of smaller lending proposals for complex counterparties. However, many of the smaller insurers have well developed stable businesses, often in localised home markets. This presents opportunities to investors to fill a growing gap, and support fundamentally strong issuers through privately negotiated debt at attractive terms. We conservatively estimate that there are almost 400 smaller European insurers that already face a capital shortfall below the regulatory Solvency Capital requirement. These can selectively be considered for capital financing from a diversified insurance debt portfolio. Hence, an investment opportunity emerges for an investment manager with expertise in insurance business and in structuring of debt finance, both bonds and loans.

We would like first to define some of the terms we use in this article, and then distinguish between private debt and conventional debt as seen in the public bond markets. The key difference about private debt is that, additional to the privacy of the transaction between borrower and lender, it is entered into without any specific intention to offer it to the market. For discussion purposes in this paper, we say that private debt will have an issue size of less than Euro 100 million. Debt other than what we are calling private is debt that is usually offered in the form of a bond issue of size at least Eur 100 million, but often much larger. This debt will be traded on the open market, often via an exchange, and can be referred to as liquid debt.

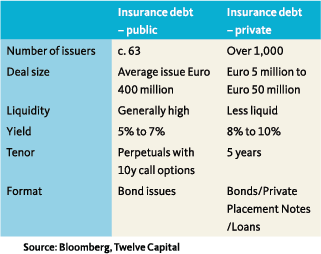

The estimated size of the larger issue insurance debt market relative to the potential private debt market is shown below:

The estimated size of the larger issue insurance debt market relative to the potential private debt market is shown below:

The table shows that the private debt market is characterised by a larger number of issuers whose borrowing requirements are smaller than in the public debt market. In the table we refer to the ‘liquidity’ of both types of debt. This refers to ready availability of debt for purchase on the one hand, and the existence of potential buyers in the market on the other. Ideally this should mean that a holder would be able to sell the debt, albeit possibly in a series of transactions, without causing the price to fall. Liquidity is important to investors as they will at some stage wish to exit their investment without suffering a loss in value as a result of their desire to exit. Smaller issues of debt tend to be less liquid, but with higher yields. In contrast, the public debt market consists of issues, sometimes multiple issues, by companies with scale, high profile and financial strength that allows them ready access to capital markets and which will often experience widespread investor demand for their bond issues. The issuing of debt by these larger players is managed and underwritten by multiple investment banks working together.

So we see a large universe of insurance companies that have a need for amounts of financing that are too small for either the bond or loan markets. With an increasing shortage of finance for smaller insurance entities broadly coinciding with expected adoption of the EU Solvency II standards for

A private debt portfolio could help to fill financing gaps for insurers and offer investors a yield in the 8% to 10% range

insurers,6 smaller insurers need to consider taking smaller financings via loans and private placement bonds. A potential portfolio of smaller insurance financing instruments could be diversified by risk type and by financing structure. This could provide attractive returns for investors as an alternative to corporate debt and can help smaller insurers who need to enhance their regulatory capital solvency ratios.

Our research shows that a target return of 300 basis points above the yield seen on insurer issued debt being traded on the open market, therefore providing a yield in the 8% to 10% range. This is both very attractive in the current yield environment, and for borrowers is strongly competitive with other sources of financing. With the demand for regulatory solvency capital being driven by the expected formal roll out of Solvency II regulation, combined with banks reluctance to supply financing in relatively small amounts to complex credits, the investment case is compelling, particularly with the attractive risk/reward ratio given extremely low historic default levels of insurance companies in Europe.

Investment universe

Investment universe

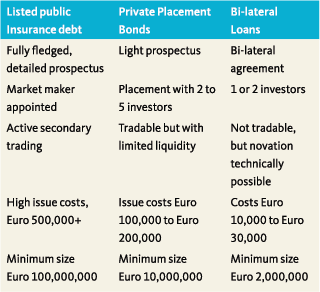

Bonds are fixed income securities designed to be tradable and are issued to multiple investors either publicly or on a private placement basis. These securities carry a unique identifier, the International Securities Identification Number (ISIN), and some are listed on regulated exchanges. In contrast, loans are privately arranged

The insurance sector has a very favourable default record, with global defaults well below the 0.5% level

agreements typically involving a sole lender or a syndicate of several lenders. Although there is some buying and selling of loans between financial institutions, these are generally private transactions between institutions and on a relatively small scale and only in the world’s major financial centres. Conservatively, therefore, loans need to be considered as largely illiquid. Concerning issue size and administrative detail, we can contrast large issues of public debt with smaller issue placement bonds and bi-lateral loans. Demand from insurance borrowers is for tenor of five to ten years for regulatory capital purposes.

Potential borrowers

Smaller insurers are likely to need to raise finance to support Solvency II capitalisation levels (regulatory capital). These borrower needs can potentially produce a larger volume of smaller transactions around the Euro 5 to 10 million level, though some larger transactions up to Euro 100 million are possible. These insurers generally have stable long-term track records and well-established positions in geographic or niche markets and are likely to be equally suited to loans or privately placed bonds.

It can be observed that credit ratings assigned by the rating agencies tend to give much weight to the absolute size of an insurers balance sheet. This has some logic, because a small balance sheet might limit the diversification potential of an insurance business. Another consideration is that an insurance business has many ‘moving parts’, and most insurance analysts will have seen that a strong or weak aspect in an insurer’s credit profile can often be offset by other counterbalancing characteristics in the same profile. Detailed and in depth analysis is needed to make a sound assessment of the relative strength of an insurer.

Syndicates in the Lloyd’s insurance market7 are also potential borrowers as they seek to finance strategic growth and expansion into new lines of business, or initiate financing of new ventures and M&A. Syndicates can be expected to require a smaller number of larger transactions around the Euro 40 million levels.

The borrower needs described for European insurers are to a large extent replicated in the established markets of Australia, New Zealand and Japan, where it can be expected that controls will become more stringent and there will be on-going need for financing of restructurings, mergers, and even spin-offs from larger groups.

Screening and analysis

For individual financing transactions, prior to transaction execution there should be extensive examination of the credit integrity of the borrower company together with detailed enquiry into underwriting assumptions and modelling. This involves on site visits, interviewing of underwriters and stress testing of modelling results. Credit and legal analysis is supplemented by direct contact with management. All pre-transaction analysis and due diligence must be maintained during the life of the transaction, with annual in-depth credit analysis and timely delivery of management information specified in the financing documentation.

Smaller insurers often do not have credit ratings from the ratings agencies, which may be a concern for investors. Such smaller insurers might however have internal ratings assigned, for example, by a specialist investment manager. It is possible to counter absence of rating by a rating agency by means of close relationships with insurer borrowers. An insurance investment manager will already carry out its own credit analysis of insurers, legal analysis of their bond issues, and will meet regularly with insurers’ senior management to understand each issuer’s insurance business, its challenges and its opportunities. Legal due diligence is crucial, as we see that even in the large issue bond market, every bond has different potential loss absorbency characteristics. Other areas of due diligence and focus are determination of the proper establishment, incorporation and good standing of the borrower/issuer, examination of insurance licences where applicable, verification of capacity to enter into the funding transaction, and the execution of the loan or bond agreement including extensive representations, warranties and potential lender protection covenants.

For the manager of such a private debt portfolio, the required skill set – for identification of appropriate borrower insurers, credit analytical due diligence, organisation of the issue process, and structuring of the transaction – is far greater than the expertise necessary for market purchases of public debt.

Portfolio implementation

A private debt portfolio consisting of smaller insurer financings can offer diversification by geography and risk type to fixed income investors and an attractive addition to corporate debt. The financing transactions together can form a diversified portfolio of loans, private placement bonds, and on-the-market bonds of smaller issue size and with semi liquid characteristics. Such a debt portfolio could help to fill any financing gaps for insurers and offer investors returns at a premium over traded debt. Vital to the financing would be a highly experienced investment team including finance, underwriting and credit professionals specialising in insurance investment.

The portfolio should of course be managed for diversification and avoidance of concentration; both risk location and risk type should be diversified, and exposure to single issuers limited to a percentage of net asset value. Importantly, the portfolio liquidity must be matched with the liquidity of the underlying investments.

We recognise that there will be some elevated level of volatility, to the extent that instruments in the portfolio are traded, coming from correlation with credit markets. The interest rate risk should be managed by maximising the amount of floating rate financings in the portfolio.

From a portfolio construction perspective one could consider initial investments to be out to fiveplus years, with tenor increase for future transactions dependent on investor appetite. Already for less liquid market bonds, brokers are often able to provide individual pricing. Loans and private placement bonds can be carried at par plus accrued. In the case of any non-payment of interest, the transaction would be written down, but with par value restored when arrears of interest are repaid.

Conclusion

Fixed income investment in private debt of insurers is a highly complex activity with risks around market pricing in addition to the challenges to understand both the complexity of issuers credit profiles and the variations in legal terms between bonds. Banks have become reluctant to meet these challenges, as they face a need to strengthen their own balance sheets.

An investment manager with a combination of expertise in specialised insurance credit and first hand underwriting expertise can combine these competencies to develop a diversified investment opportunity that provides attractive yield for investors while contributing to capacity enhancement in the European insurance market.

Notes

- Andrew Townend is a Partner and insurance bond Portfolio Manager with Twelve Capital, an independent investment manager specializing in insurance related investments. Ruurd Haan is Director and Oscar Pesch is Partner with XS Investments, a firm dedicated to introducing institutional relationships to a select number of specialist investment managers, like Twelve Capital.

- Source: Standard & Poor’s 2012 Annual Global Default Study and Rating Transitions.

- See separate section for background information on regulatory financing of insurance companies.

- According to the European Insurance Federation January 2013, there were 5,456 insurance companies in Europe at the end of 2011.

- Source IMF Global Financial Stability Report published 17.04.2013

- Solvency II refers to EU Directive 2009/138/ EC, which codifies and harmonises EU insurance regulation, and is primarily concerned with the amount of capital that EU insurance companies must hold to reduce the risk of insolvency. The formal implementation date for the Directive has not been confirmed by the EU, but is widely expected to be 1st January 2016.

- A Lloyd’s Syndicate is a group of underwriters on the Lloyd’s insurance market who together stand surety for any insurance claims that may arise from risks they have underwritten.

in VBA Journaal door FLTR: Ruurd Haan, Andrew Townend and Oscar Pesch