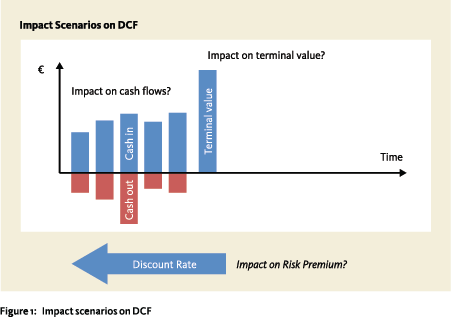

Investment decision making methodologies like Discounted Cash Flow (DCF) require forecasts. However, what if the future cash flows are highly uncertain? Disruptive scenarios have been used for more than four decades to “think the unthinkable” and to make uncertainties explicit. For internal decision making of the company, DCF has been supplemented with the real option theory, to value uncertainty. However, scenario analyses and real options are rarely used in analyst reports meant for external investors. Most investment analyst reports still use forecasts and DCF as the basis for their buy-sell-hold advice. In this article, we shall show that this choice of methodology underestimates or even totally negates specific “known” downside risks and, at the same time, also misses opportunities for future “upside” risks. This has implications for asset owners, asset managers and investment analysts.

The investment community has been taken by surprise many times

The investment community has been taken by surprise many times

The list of “unexpected” financial crises is long: the first oil crisis in 1973, the Black Monday in 1987, the long Japan crisis, the 1997 Asian financial crisis, the Dot-com bubble in 2000 and the financial and currency crisis starting in 2007. Those who were caught by surprise like to state that “nobody saw the crisis coming”, as former president Wellink of the Dutch Central Bank said in 2011 about the Dutch financial crisis of 2008.2 And even when authorities or experts sounded a warning against bubbles, like Fed president Alan Greenspan3 and Nobel prize winner Robert Schiller4 did, using the term “Irrational Exuberance” in advance of the dot-com bubble collapse in 2000, nobody seemed to have taken the warning seriously or acted on it. Therefore, the “surprised investment community” has to deal with two elements: first, to be able to see disruptions early, and second, to be able to act on that foresight.

What if DCF assumptions are highly uncertain?

Analyst reports are the “fortune tellers” of the investment communities. They form the underlying analytical basis of many investment decisions and the Discounted Cash Flow (DCF) methodology is used in most analyst reports.5 And in turn, DCF requires a forecast of future inward cash flows, outward cash flows and the terminal value of the investment beyond the projection period. This methodology relies on multi-year forecasts. And all forecasting methods, including the use of expert judgement, statistical extrapolation, Delphi and prediction markets, contain fundamental weaknesses.6 Forecasting is not meant to highlight the potentially high impact of rare events. Forecasting often has the explicit assumption of ceteris paribus or “all else is equal”; but what if all else is not equal?

Ceteris non paribus, what if all else is not equal

The reason the investment community is taken by surprise is that the dominant methodology they use was not designed to highlight surprises, but was built around the assumption that all else is equal. DCF works well in a stable environment. If nothing changes, the past can be used to forecast future cash flows and the residual value. Further, the historic weighted average cost of capital, that is used to calculate the net present values of all these items, can also be used as an indication for future cost of capital. However, we have seen in the past decades that disruptions do occur. The larger context sometimes does change, and at great cost. The Financial Crisis Inquiry Commission had estimated that by April 2010, of all mortgagebacked securities Moody’s had rated triple-A in 2006, 73% would be downgraded to junk.7 The problem was that historic data were not a sound indication of the future. A few key external factors had changed. For one, the Fed had increased their interest rates from 1% in 2004, to just over 5% in 2006. The geopolitical context had influenced economic factors like inflation and interest rates, which in turn had an influence on property prices. This time, all else was not equal. And as a result, all investment reports, which assumed all this to remain unchanged, got their valuation drastically wrong. Diversification hardly saved investors, as sectors and geographically dispersed areas started to move as one.

To see the unthinkable, one needs to first think the unthinkable

For many, a house price collapse was not foreseen, because it did not happen in the previous two decades. And because of that, it was not thought of as a plausible scenario. Even worse, economic predictions often explicitly assume all else to be equal, and therefore rule out discontinuity by definition. So, in order to not be surprised, one needs to explicitly consider changes in the investment context as a possibility. Scenario thinking was developed to do just that.8 It was Herman Kahn of the Hudson Institute, who developed the art and science of “Thinking about the unthinkable”9 during the cold war. In those days, a thermonuclear war was something that many feared. Yet, that same fear often prevents us from truly and actually thinking about it. But since the impact of a nuclear war was so great, it simply could not be ignored. The problem was, however, that the scientists lacked historic data about a large scale nuclear war. It had not happened before, so they had no data. To overcome this hurdle, scenario thinking was used to explore possible future disruptive events. The aim was not to predict, but to explore possible consequences and options for dealing with them. This scenario methodology significantly helped governments and companies to deal with uncertainty in their decision making.

For many, a house price collapse was not foreseen, because it did not happen in the previous two decades. And because of that, it was not thought of as a plausible scenario. Even worse, economic predictions often explicitly assume all else to be equal, and therefore rule out discontinuity by definition. So, in order to not be surprised, one needs to explicitly consider changes in the investment context as a possibility. Scenario thinking was developed to do just that.8 It was Herman Kahn of the Hudson Institute, who developed the art and science of “Thinking about the unthinkable”9 during the cold war. In those days, a thermonuclear war was something that many feared. Yet, that same fear often prevents us from truly and actually thinking about it. But since the impact of a nuclear war was so great, it simply could not be ignored. The problem was, however, that the scientists lacked historic data about a large scale nuclear war. It had not happened before, so they had no data. To overcome this hurdle, scenario thinking was used to explore possible future disruptive events. The aim was not to predict, but to explore possible consequences and options for dealing with them. This scenario methodology significantly helped governments and companies to deal with uncertainty in their decision making.

Scenarios make uncertainties explicit

Forecast-based valuation methodologies are designed to reduce complexity and uncertainty. That characteristic makes decision making much easier. Once a decision maker knows what the future cash flows are, he also knows what to do. DCF based on forecasts leads to simple yes or no answers. The investment is either positive or negative, given a required return on capital. Scenario based methodologies are designed to do the opposite. They are meant to make uncertainty explicit. And sometimes this has led to great results.

The importance of real options in uncertain contexts

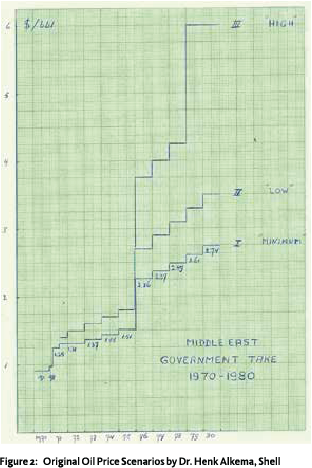

Shell prepared for a possible oil crisis two years before it actually happened.10 Dr. Henk Alkema wrote the now famous set of scenarios that thought through the different consequences of the “Tehran Agreement”, which kept oil prices stable and low during the sixties.11 Several oil price scenarios were described, based on in-depth analyses of possible strategies of oil producing countries, the price of alternatives and on possible responsive strategies by oil consuming countries. But more importantly, these scenarios were used by the committee of managing directors to develop options. Based on the historically low oil price of the sixties, many of the oil fields in the North Sea were assumed to be worthless. However, in a high oil price scenario, these fields would become profitable. These fields had “option value”, and the scenarios made that value visible. At the same time, investments in refinery capacity, that seemed “sure bets” given the historic volume growth, all of a sudden became risky. An increase in oil price could lower the volume growth, and as a result could lead to downstream overcapacity. This risk would not have been visible, had Shell used only one forecast in its investment analyses. The scenarios made the value explicit of having a cancellation clause in their contracts regarding ordered new refinery capacity, and so they did. What Shell did in the early seventies was what is now known as creating a real call option on North Sea oil and a real put option on its downstream business. The oil price shock happened three years before the Tehran Agreement ended. So as a forecast, the scenarios were completely wrong. But the scenarios helped Shell to develop the options that protected them from downside risk and helped them gain additional upside.

Shell prepared for a possible oil crisis two years before it actually happened.10 Dr. Henk Alkema wrote the now famous set of scenarios that thought through the different consequences of the “Tehran Agreement”, which kept oil prices stable and low during the sixties.11 Several oil price scenarios were described, based on in-depth analyses of possible strategies of oil producing countries, the price of alternatives and on possible responsive strategies by oil consuming countries. But more importantly, these scenarios were used by the committee of managing directors to develop options. Based on the historically low oil price of the sixties, many of the oil fields in the North Sea were assumed to be worthless. However, in a high oil price scenario, these fields would become profitable. These fields had “option value”, and the scenarios made that value visible. At the same time, investments in refinery capacity, that seemed “sure bets” given the historic volume growth, all of a sudden became risky. An increase in oil price could lower the volume growth, and as a result could lead to downstream overcapacity. This risk would not have been visible, had Shell used only one forecast in its investment analyses. The scenarios made the value explicit of having a cancellation clause in their contracts regarding ordered new refinery capacity, and so they did. What Shell did in the early seventies was what is now known as creating a real call option on North Sea oil and a real put option on its downstream business. The oil price shock happened three years before the Tehran Agreement ended. So as a forecast, the scenarios were completely wrong. But the scenarios helped Shell to develop the options that protected them from downside risk and helped them gain additional upside.

Spot the blind spot: Hidden risk and the value of having options

Rather than assuming ceteris paribus, scenarios provide a way to make potential changes in context variables explicit. And although this way of thinking was used in practice since the 1970s, it wasn’t until the eighties and nineties that finance researchers developed the real option analyses using scenarios.12 Since then, more and more organisations, both public and private, have developed scenarios to highlight potential future risks and potential value. It has been applied in almost all sectors, ranging from the military to banks and from Water management to Telecom. Although scenarios and real option-based strategies are often not public because of their sensitive nature, some have become well known examples, like the Apple switch from PowerPC to Intel microprocessors and the Rabobank’s use of scenarios to prepare for the credit crisis.

In 2005, Steve Jobs announced during the World Developers Conference that a small team had prepared Apple computers to run on both PowerPC and Intel microprocessors.13 Since the midnineties, all Apple computers had PowerPC microprocessors and Intel was inside their greatest competitors’ machines running on Microsoft Windows. However, Jobs was concerned that if technological progress by Intel became simply too great, he needed to be able to make the switch. In order to have this agility, Apple had secretly prepared for this, as he called it, “just in case scenario” five years in advance. The option to also run on Intel processors was already being built secretly in a version of Mac OS X. This provided Apple with a real put option on PowerPC as a supplier and a real call option to quickly switch to Intel. What had been “unthinkable” for the industry, was a mere question of proper risk management to Steve Jobs. Once the risk of being locked into the PowerPC roadmap became clear, he could simply make the switch by just exercising the options he had already built in.

Another example of a company using scenarios and options to prepare for disruptive situations is Rabobank. In January 2008, well before the fall of Lehman Brothers and even that of Bear Stearns, Bert Bruggink, the then CFO of Rabobank announced that he had safeguarded the bank against the crisis.14 The Rabobank got €30 billion in mortgages ready as security for ECB loans. Bert Bruggink stated in the press: “We anticipate a worst case scenario. I do not assume that we will need it, but at least we are ready.” He had created a real call option, based on scenario thinking. The scenarios depicting a credit crisis and a following housing crisis were made as early as in 2002 and were even publicly available in a book in 2005.15 The value of that real call option became apparent, when the credit crisis materialised fully. Next to having this real call option, the bank exercised inherent real put options, when it declined a request for a $500 million loan to Bear Stearns on March 6 200816 (one week before it had to be saved by the Fed). By the end of 2008, Rabobank reported a record profit of € 2.8 billion.

These are just two other examples of how scenarios have helped to not only think the unthinkable, but also how their combination with real options have helped companies to act on that foresight.

Application of scenarios and real options in analyst reports

The business environment is relatively stable most of the time. Shocks and disruptions don’t happen every day. Forecasting is still very valuable in the short term. However, investors with a longer horizon (years or even decades), cannot negate possible changes in the context. They simply happen too often and their impact is too great. Since the financial crisis, analysts’ assessment of fundamental risk has improved, through the use of scenario-based value estimates.17 However, most analyst reports are still geared towards one single point forecast. It ends with either a buy, sell or hold advice. The combination of explicit uncertainty through scenarios with DCF valuation can help investors understand both the potential downside risk and the upside potential of an investment. This will also help investors monitor for factors in the business environment and spot “connected risk”18 in their portfolio.

On a company level, scenarios highlight the importance of good governance. Is the company prepared for disruptions? Does it have a process to analyse scenarios and does it have the real options to deal with the uncertainties? And does it have an early warning system to know when to exercise its real options in a timely matter? If not, the investor needs to be aware of this, and has a choice. He can either take the risk, if the risk premium embedded in the market valuation allows for it, or he can use financial options to deal with the risk (both up- and downside) highlighted through the scenarios.

Implications for asset owners, asset managers and investment analysts

The assumption that nothing disruptive will happen works in the near term, but investors with longer horizons can no longer exclude drastic changes in the business environment. This has implications for asset owners, asset managers and investment analysts.

For asset owners like pension funds, this implies that they will determine which “externalities” should be taken into account; not only because they will want to be aware of future potential risks and opportunities, but also because they have to. For example, the European Insurance and Occupational Pensions Authority (EIPA) has currently applied generic financial shock scenarios for stress testing purposes and is also working with generic scenarios, to stress test carbon asset risk.

In turn, this requires of asset managers that they integrate scenario-based valuation methods in their investment decision making. Some disruptions are balanced out on a portfolio level and on a longer time horizon. Bad conditions for A are often positive ones for B. That is the whole point of diversification.19 However, some shocks get channelled and amplified through the financial networks.20 To deal with these, portfolio-level scenarios need to be considered. These top-down scenarios can be used to assess the impact of the scenarios on all individual investments, and can help to identify connected risk and early warning signals to help see the risk materialise early on. Top-down scenarios can also be used to have real or financial option strategies in place, to minimise downside risk and maximise potential upside risk.

For investment analysts, this requires a new way of working. As stated, scenarios and real options have been applied for decades to deal with uncertainty on a company level. They have helped individual companies from the bottom-up to take advantage of larger disruptions in the business environment. However, the application of scenarios-based valuation in analyst reports is relatively new.

Next step: better engagement regarding uncertainty

The next step would be to confront bottom-up scenario analyses by investment analysts on a company level with top-down scenario approaches, as part of the “engagement” processes by asset managers on behalf of asset owners. Investment analysts might be able to see and articulate potential disruptive scenarios and can help both companies and investors to prepare for them. In turn, companies and investors could take up the responsibility of sharing their insights regarding possible future developments that they find important. This could help all parties involved to be better prepared for the future, at all levels. This will not prevent disruptive scenarios from occurring, but could make the investment community as a whole less surprised and more resilient against inevitable future shocks.

Footnotes

- Ir. Paul de Ruijter is executive lecturer at Nyenrode Business Universiteit and Managing Director of De Ruijter Strategy.

- Niemand had crisis voorzien, Wellink quote tijdens de parlementaire enquête in: Trouw, 2 december 2011.

- The age of turbulence, Alan Greenspan, Penguin, 2008.

- Irrational exuberance, Robert J. Schiller, Princeton University Press, 2000.

- Efthimios G. Demirakos, Norman C. Strong, and Martin Walker (2004) What Valuation Models Do Analysts Use? Accounting Horizons: December 2004, Vol. 18, No. 4, pp. 221-240.

- The limits of forecasting methods in anticipating rare events, Paul Goodwin and George Wright, Technological Forecasting and Social Change, March 2010.

- The Financial Crisis Inquiry Report. National Commission on the Causes of the Financial and Economic Crisis in the United States. 2011.

- Writing on the wall, Scenario Development in Times of Discontinuity, Philip van Notten, Maastricht University, 2005.

- Thinking about the unthinkable, Herman Kahn, Horizon Press, 1962.

- Planning as learning, Arie de Geus, Harvard Business Review, March-April 1988.

- Scenario based strategy: Navigate the Future, Paul de Ruijter & Henk Alkema, Taylor & Francis, 2014.

- Scenarios, Real Options and Integrated risk management, Kent D. Miller, H. Gregory Walller, Long range planning, February 2003.

- Keynote by Steve Jobs, Worldwide Developers Conference, June 6, 2005.

- Rabo dekt zich in tegen crisis, Financieel Dagblad, 1 februari 2008.

- Oog voor de toekomst, Philip Idenburg et al, Scriptum, 2004.

- International Finance: transactions, policy and Regulation, Hal S. Scott, Foundation Press, 2009.

- Can analysts assess fundamental risk and valuation uncertainty? An empirical analysis of scenario-based value estimates, Peter Joos, Joseph Piotroski, Suraj Srinivasan, Journal of Financial Economics, September 2016.

- Verbanden die niemand ziet, Paul de Ruijter in FD Outlook, September 2012.

- Diversification and systemic risk, Louis Raffestin, Journal of Banking & Finance, September 2014.

- Systemic Risk, Contagion, and Financial Networks: A Survey, Matteo Chinazzi, Giorgio Fagiolo, June 2015.

in VBA Journaal door Paul de Ruijter