This article challenges the continuing discussion among institutional investors about investing in active versus passive products and factor investing. I call this discussion obsolete and will be asserting that the major obstacle facing institutional investors is not the lack of alpha generating capacity of active managers but rather the investor’s ill-conceived process of portfolio construction. Herding behaviour, lack of awareness of the literature and a predominant focus on risk management induce widespread underappreciation of active management by institutional investors. Their scepticism is unwarranted as success in active management can be created, although it does not come easily. Constructing desired exposure to equity return factors with specialist active managers holds the key to successful active management that asset owners should be seeking to exploit.

From active to passive

From active to passive

After a slow introduction in the early 2000’s of coresatellite investing, passive investing – i.e. the active decision to invest in passively held benchmark products – has become mainstream. Today institutional investors must justify why they employ actively managed portfolios, instead of passive investing. Disappointing net alpha and, more importantly, a focus on cost control, has led many institutional investors to put passive investing at the core of their equity portfolios. Dutch pension funds regulator DNB, for instance, assigns a ‘code red’ to the few pension funds who apply active management within their equity portfolios. These funds are faced with stiffer regulatory oversight which seems to have turned active management into an unattractive proposition. The case for passive investing is clear: a wealth of academic research showing the aggregate inability of active managers to beat their benchmarks after cost; see for instance Fama and French (2010).

Active or Passive? ‘In my experience, there exists no contradiction in combining active and passive management. On the contrary, combining both leads to greater portfolio robustness’

The empirical fact that, for the cross-section of active (equity) managers, alpha is a zero-sum game does not imply that alpha generating managers do not exist. Kasperczyk, Sialm and Zheng (2005) describe how managers with concentrated portfolios, equipped with some sort of information advantage, achieve above average returns. Cremers and Petajisto (2009) develop their measure of active share that allowed for measuring portfolio concentration and suggested to provide guidance for relative performance. More recently Kasperczyk, Van Nieuwerburgh and Veldkamp (2014) argue that successful active equity managers generate outperformance by exploiting stock picking skill during periods of economic boom and market timing skill during economic busts. Cremers and Pareek (2016) discover that high active share managers who patiently hold stocks outperform more trading oriented high active share managers. In his latest research publication Cremers (2017) provides evidence that skill, conviction and opportunity matter in achieving outperformance, largely in confirmation of the findings by Kasperszyk et al (2014).

Active share has gained popularity among investors as it seems to provide guidance in seeking alpha generating investment strategies. This, however, cannot be taken for granted since there is no causal direct and positive relationship between the level of active share and the likelihood of generating outperformance. High active share can easily be ‘manufactured’ without producing much or any alpha. A manager, for instance, with no particular stock selection skill may create a concentrated portfolio with high active share but without any alpha strength or regularity. The fact that Cremers (2017) continues to refine the interpretation of active share indicates that high active share is a necessary but not a sufficient condition for generating positive excess returns. Purely focussing on active share would therefore be misguided. However, a useful complementary approach to exploiting the active share measure happens to exist.

Forgotten but relevant: The Fundamental Law of Active Management

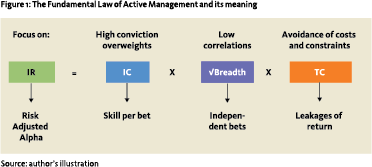

The Fundamental Law of Active Management (FLAM) represents an insightful strand of the finance literature when it comes to explaining active performance. Grinold (1989) introduce this active return attribution methodology, that allows for decomposing the information ratio, i.e. the risk adjusted net excess return from active management (IR), into a measure of skill and a measure of uncorrelated positions. This alpha attribution methodology is subsequently refined by Clarke, de Silva and Thorley (2002) who add the transfer coefficient, a factor capturing any leakage from excess return caused by constraints, transaction costs and fees.

While the FLAM is not so much a prescriptive model for success in active management, it is instrumental in illuminating the vital components that active managers need to master to gain riskadjusted outperformance. These three components are:

While the FLAM is not so much a prescriptive model for success in active management, it is instrumental in illuminating the vital components that active managers need to master to gain riskadjusted outperformance. These three components are:

- Pure security selection skill that translates into alpha

- The number of uncorrelated or independent positions

- Sources of alpha leakage.

The FLAM is defined and explained by the following (Figure 1).

In this figure, IC stands for information coefficient and TC for the transfer coefficient. IC refers to the alpha that a manager or a portfolio generates based on pure selection skill. Breadths refers to the number of independent or uncorrelated positions (or bets) against a representative benchmark.

The transfer coefficient TC measures the leakage from alpha due to cost, fees and implementation shortfall. TC reaches one when no leakage occurs and approximates (but does not reach) zero when leakage is extremely high. All three FLAM components should be interpreted as being benchmark relative. Success in active management can only be achieved by managers who are better than average in mastering the three components.

In a recent article Ding and Martin (2017) show that the FLAM formula as we currently know it is flawed and that its econometric interpretation deserves substantial refinement. They provide an alternative formula that appears to be robust after rigorous empirical testing. In their formula, they measure IC or skill through the level of the estimation errors between the ex-ante and ex-post excess returns for each position. Furthermore, they capture breadth through the distinct behaviour of equity return factors and their volatilities, which translates into another element of IC. Despite these important refinements, the original identity of the FLAM remains useful in reflecting the importance of:

Sources of value added, i.e. information advantage over others;

Sources of value added, i.e. information advantage over others;- Concentration of positions that are lowly or even unrelated to the benchmark portfolio;

- Strict turnover management to avoid cost leakage;

- Minimizing constraints that limit or even prohibit exploiting opportunities relative to the benchmark portfolio.

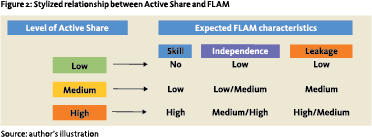

When properly used, the concepts of FLAM and active share appear highly complementary in portfolio construction that includes active management. The relationship between the FLAM and Active Share can be stylized as follows (Figure 2).

In figure 2, for each level of active share there is a qualitative assessment of how a portfolio of active managers profiles against the FLAM components. This is not an empirical truth but merely an indication for relationships that hold in most cases. It is important to note that figure 2 and all following figures are not about individually selected active managers but about portfolios that are constructed of such managers.

Considering portfolio construction, it is possible to create a medium active share portfolio out of high active share managers, but not vice versa. Concentrated or polarized portfolios should be expected to contain elevated levels of ‘pure skill’, as the managers of such portfolios are more likely to be specialists exploiting equity market niches. They purposely rather than opportunistically position their portfolio away from benchmark positions (or ignore these all together). Their trades may be relatively costly, in case their tendency to concentrate makes their portfolios lean towards less liquid stocks. The opposite holds for highly diversified portfolios.

From all that investors could have learned from both empirical research and highly successful active managers, it should be clear that the active manager universe offers sufficient alpha opportunities that are worthwhile employing; see for instance Fama and French (2010) and Kasperczyk et al (2014). While it remains a zero-sum game for the cross section of managers, there is ample evidence that successful active strategies can be identified. If this is true, then why are investors not chasing successful active managers but are they investing passively instead?

Missing link: the power of combining concentrated portfolios

Not all institutional investors favour passive investing. There are investors who make serious attempts to exploit active management and they invest in selecting good managers. They work with long lists of active managers, either derived from an external manager research database that they subscribe to or from earlier experiences or recommendations by peers (or any combination). In many cases the selection of each individual manager focusses on gaining actively managed exposure in a risk-controlled fashion. This is achieved through constraints that the investor defines for each mandate. A pre-defined tracking error constraint is widely used, often complemented with some further constraint of scope: a specific risk premium, limitation of financial instruments, a region, industry or any other categorical identifier.

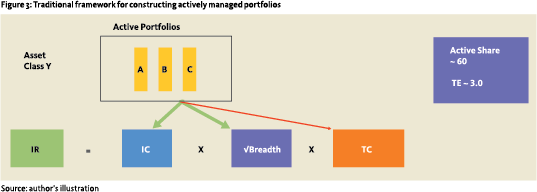

As the constraints are applied to each selected manager within the portfolio, the characteristic of the portfolio can be mapped as follows (Figure 3).

As the constraints are applied to each selected manager within the portfolio, the characteristic of the portfolio can be mapped as follows (Figure 3).

Figure 3 shows how the portfolio is constructed by bringing together two or perhaps three not too dissimilar managers who are given identical constraints. The tracking error constraint forces each manager to position his portfolio close to the benchmark positions. Inevitably managers A, B and C exhibit medium active share. Each of the manager’s portfolios exhibits medium active share and a tracking error that is in line with the desired tracking error for the portfolio. The resulting portfolio will benefit from diversification effects and show low to medium active share and a (slightly) lower tracking error.

The Figure 3 portfolio is a typical institutional diversification strategy that will not produce much alpha. This is by design, since the medium level of active share of each component rules out much or all of the impact of the IC and the breadth that is required to deliver meaningful outperformance. The high diversification that results from the tracking error constraint, limits the scope for making independent bets. Although turnover is likely to be low, unavoidable transaction cost and management fees push the TC down from one. The resulting portfolio is likely to disappoint. Each manager has medium active share – assumed here to be 60 – and thus holds a relatively diversified portfolio that results in a low tracking error – here assumed to be 3.0%. Constraining each individual manager to the same levels of constraint as in the overall portfolio inevitably results in a portfolio with uncompelling FLAM characteristics. Unfortunately, this is widespread practice among investors and it results in portfolios that produce low information ratios. It should come as no surprise that investors in such portfolios after a few years of mediocre experience decide to throw in the towel and go passive. What such investors do not seem to realize is that it is their poor portfolio construction process that is largely responsible for achieving the disappointing outcome.

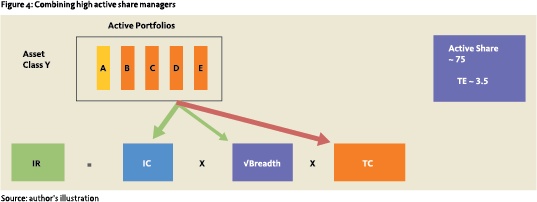

An alternative way of creating an actively managed portfolio is depicted in figure 4.

An alternative way of creating an actively managed portfolio is depicted in figure 4.

The portfolio exhibited in figure 4 is constructed by bringing together several high active share managers, coloured in amber. These specialist managers are deliberately selected to hold concentrated portfolios and thus to employ a high tracking error. Some managers may not even look at the client’s stated benchmark. Combining such high active share managers leads to a portfolio that has high active share too, although its level will be lower than that of the individual managers. As the selected managers are specialists, the positions within each individual portfolio are likely to be highly correlated. In FLAM terms: each portfolio is likely to have few independent positions and thus has low breadth.

When the selected managers are all experts in similar or highly adjacent areas of the market, combining them will result in a high tracking error portfolio. Low diversification between the positions of each manager prevents the tracking error from shrinking. It changes when managers are selected in unrelated fields of expertise. In that case the portfolio tracking error will be lower than the weighted average of the manager’s tracking error. Each manager generates high IC while their concentrated equity positions exhibit low correlation with the positions taken by the others. This leads to high(er) breadth. Constructed this way, the portfolio is more likely to produce outperformance. The specialist manager’s transaction costs may be relatively high, particularly when they trade in less liquid stocks. The leakage that trading would cause can be managed by limiting turnover. Specialist managers must have some sort of information advantage over others. That allows them to be patient investors who can afford to follow their process and focus on their area(s) of skill even when it is out of favour in the short term.

To many investors, a portfolio that consists of up to five high active share managers appears over-diversified. In practice, many institutional investors do not employ more than two to three managers within the portfolios that they create to gain active exposure to a specific market or market segment. Employing more managers is often seen as useless and overly expensive. This is indeed a valid argument for ‘figure 3 type’ portfolios in which each manager’s portfolio is diversified (i.e. exhibit medium or low active share and low tracking error) and adding managers merely results in stapling dependent positions. But the over-diversification argument does not hold for ‘figure 4 type’ portfolios in which high manager diversification results in highly effective concentrated and independent positioning. Practical experience with ‘figure 4 type’ portfolios at Russell Investments have convinced me that, both from a theoretical and a practical viewpoint, this is the only viable way of creating robust actively managed portfolios that allow the investor to consistently generate alpha. Not because each of the managers will constantly deliver strong alpha, but rather because the inevitable but unpredictable short-term underperformance by one manager will be (more than) compensated by the others. Arranging positions independence is the magic to constructing robust net alpha generating portfolios.

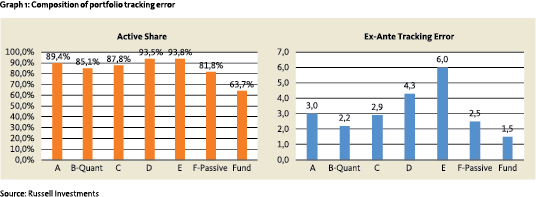

Graph 1 shows the levels of active share and tracking error for each individual manager as well as for the aggregate portfolio.

Graph 1 shows the levels of active share and tracking error for each individual manager as well as for the aggregate portfolio.

The left-hand panel of graph 1 shows the active share levels per manager and of the resulting portfolio, shown here as ‘fund’. As can be seen all managers have high active share while the portfolio has medium active share. The right-hand panel shows the tracking errors of the managers and the fund. All tracking errors appear low in absolute terms, which is a consequence of the current moderate level of overall market volatility. In more normal market environments these numbers will show higher. As can be seen, the tracking error of the portfolio is considerably lower than any of the managers. This result can only be achieved by creating diversification between the positions that the managers take.

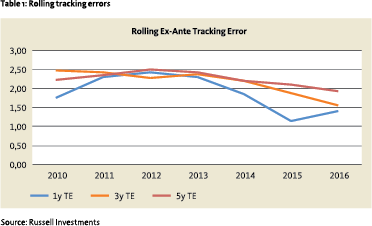

Table 1 shows the rolling 12, 36 and 60 months values of the fund’s tracking error.

Table 1 shows the rolling 12, 36 and 60 months values of the fund’s tracking error.

The tracking error levels appear consistently low, although the rolling one-year numbers are higher in the years prior to 2014, reflecting higher overall stock market volatility. During those years, the individual tracking errors of the managers were evidently higher as well.

The strength of a ‘figure 4 type’ portfolio is that it effectively diversifies away idiosyncratic risk. It does so, because a combination of high tracking error and high active share managers results in a low tracking error portfolio with medium active share. Importantly, it maintains the alpha skills of each manager that it combines to their assigned weights. While seemingly risky by the look of its individual components, the portfolio itself will appear well behaved given the low tracking error. It produces decent alpha by employing high active share managers who exploit their distinct information advantage in combination with their forwardlooking views that allow them to act as patient investors.

This, however, is not a universal truth as the diversification effect does not appear automatically. Its appearance crucially depends on the style diversification within the portfolio. As mentioned before, the investor should avoid attracting managers with identical skill sets in identical segments of the market. It reduces the independence of their positions and dilutes the alpha generating capacity of the portfolio. Explicit style diversification between selected high active share managers is yet another necessary condition for creating robust alpha generating portfolios. This is where factor investing comes into play.

Using equity return factors to select active managers

The theme of factor investing is dominated by five widely accepted equity return factors: (low) volatility, value, size, momentum and quality. While factor investing has a long history, its inclusion in institutional portfolios is still relatively limited. Short term instability of factor pay-offs is one element of its slow adoption. The asset management industry has produced overwhelming refinements to the five well-known factors, probably to charge higher fees. Cochrane (2011) was first to warn about the ‘zoo of factors’ and recent studies by Harvey, Liu and Zhu (2016) and Hou, Xue and Zhang (2017) convincingly argue that many of these refined additional ‘proven’ factors exhibit serious methodological shortcomings. Both studies re-examined previously published studies that proofed factor-relationships based on statistical significance. Applying higher, but still common, standards for scientific testing led to broad-based rejection of such ‘proven’ relationships. The matter appears serious enough for Harvey (2017), as the current president of the American Finance Association, to publish an article in which he reminds the members of the rules of the game in scientific testing.

These findings should serve as a wake-up call to investors, who should avoid refinement and complexity when it comes to applying factor preferences to their portfolio construction process.

A focus on equity return factors is a great venue for increasing breadth. Factor investing holds a key to creating independence between manager portfolios. It can serve to remedy the major challenge in portfolio construction: achieving high breadth. Specialist managers do not produce high breadth; they produce high IC. High(er) breadth can be created by selecting managers across a set of preferred equity return factors. Each of the proven equity return factors is exposed to – often uncorrelated – performance cyclicality. The resulting irregularity of factor payoffs offers a great venue for achieving skill independence at the portfolio level.

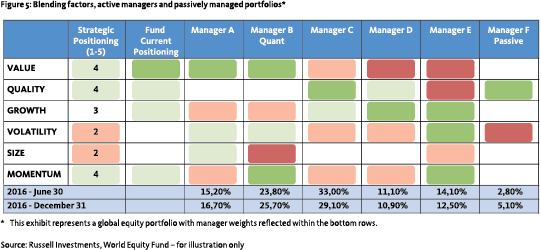

A factor distribution is a natural starting point for combining active managers. It turns the portfolio construction process into a matrix optimization exercise. Figure 5 shows an example of a matrix portfolio, which has factors in the rows and specialist portfolios in its columns.

Building the matrix starts with the investor’s beliefs in the available equity return factors that feeds a preferred long-term factor weighting scheme. Each desired factor exposure is then populated with a carefully selected high active share manager, who is an expert in the factor that he seeks to exploit. It is important to note that this can only be achieved through the availability of holdings-based portfolio data at the manager level, together with strong analytical tools.

As any specialist manager is likely to cover more than just one return factor, the matrix offers the solution for populating the desired factor exposures. The investor selects a number of high conviction active managers and he determines their weights by optimizing their contribution to the desired multi-factor mix. In practice, this can be achieved by bringing together 4 to 5 active managers, most of which will be high active share fundamental managers who, in aggregate, populate most of the desired factor exposure. Missing factor exposure can then be completed by adding one or more passive factor completion portfolios that offer specific factor exposure at low cost. Such factor completion portfolios can be created for acquiring exposure to, for instance, the quality factor, by creating a portfolio of high dividend paying stocks that can easily be constructed without having to employ an expensive active manager. As mentioned, a holdings-based database of manager positions is an indispensable instrument for construction the matrix portfolio.

As any specialist manager is likely to cover more than just one return factor, the matrix offers the solution for populating the desired factor exposures. The investor selects a number of high conviction active managers and he determines their weights by optimizing their contribution to the desired multi-factor mix. In practice, this can be achieved by bringing together 4 to 5 active managers, most of which will be high active share fundamental managers who, in aggregate, populate most of the desired factor exposure. Missing factor exposure can then be completed by adding one or more passive factor completion portfolios that offer specific factor exposure at low cost. Such factor completion portfolios can be created for acquiring exposure to, for instance, the quality factor, by creating a portfolio of high dividend paying stocks that can easily be constructed without having to employ an expensive active manager. As mentioned, a holdings-based database of manager positions is an indispensable instrument for construction the matrix portfolio.

The matrix methodology constitutes a very robust equity return factor portfolio. It is robust, because the high active share managers are specialists who are managing a diversified set of concentrated style portfolios that, taken together, have low correlation between the positions. The passive ‘manager F’ in the portfolio matrix is a passively held positioning strategy that completes the missing quality factor exposure. Figure 5 is a ‘live’ example of how a matrix portfolio can be constructed and it generates very robust net alpha.

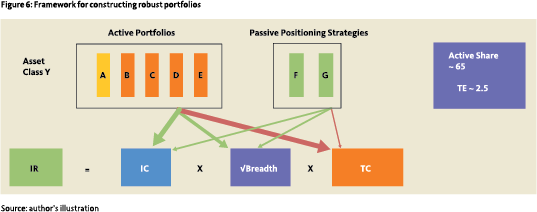

Schematically this portfolio has the following identity (Figure 6).

Schematically this portfolio has the following identity (Figure 6).

It consists of four fundamental high active share managers, one quant medium active share manager and two passively managed factor completion portfolios. In aggregate, this well diversified portfolio exhibits medium active share and a very low tracking error. The concentrated active managers (in amber) contribute to IC and TC while the factor diversification serves to (further) increase breadth. The medium active share manager (in yellow) is a quant manager who plays a role in mitigating the high factor exposure of one high active share managers. The green coloured passive portfolios complete any missing factor exposure and therefore serve to provide the desired beta exposure at low cost. The portfolio construction matrix is a novel way of combining empirical insights from various strands of the financial markets literature. Methodologically, it seems in compliance with the revised version of the FLAM formula as recently proposed by Ding and Martin (2017). More importantly, this ‘live’ approach shows that it can be put to practice.

Alpha: lost and found

One intriguing aspect of this analysis is that it paves the way for a rehabilitation of alpha. This is good news, as stripping out the alpha from the mathematical regression equation has always felt unnatural. Within the current low yield environment any addition to return is more than welcome. All of this is not to suggest that alpha comes easy. Applying a matrix approach as suggested in this article requires abundant availability of data and insight. One can only assess the true characteristics of a matrix portfolio as presented by having detailed insight in the underlying holdings of each contributing sub-portfolio. This requires analytical capabilities to effectively design, construct and manage such a matrix portfolio. While alpha remains a zero-sum-game in aggregate, successful active managers do exist and can successfully be combined in portfolios that exhibit low risk.

The purpose of this article is to uncover some elementary aspects of building robust actively managed portfolios. Also, it shows that there is no controversy in combining active and passive management and integrating this with multi-factor preferences. A modern approach to equity portfolio construction goes beyond the discussion about active versus passive and return factors.

It appreciates that these are all desirable building blocks for portfolio design and construction. Counter to the current practice of siloed allocation to these building blocks, investors should be integrating these building blocks to enhance the robustness of their equity as well as fixed income portfolios.

Institutional investors owe it to their principals that they adapt to new insights and take advantage of new and methodologically sound ways to improve the outcomes of their investment process. Rigid continuation of strictly separated allocations to the building blocks of investment seems obsolete and in denial of available insights. This article is not a mere theoretical exposition of current scientific insights but it can be implemented and it is. As such it urges for a revision of investor’s best practices.

Literature

- Clarke, R., H. de Silva and S. Thorley (2002): “Portfolio Constraints and the Fundamental Law of Active Management”, Financial Analysts Journal, September/October.

- Cochrane, J.H. (2011), Presidential Address: “Discount Rates”, Journal of Finance, 66(4), 1047-1108.

- Cremers, M. and A. Petajisto (2009): “How Active Is Your Fund Manager? A New Measure that Predicts Performance”, The Review of Financial Studies, 22 (9), 3329-3365.

- Cremers, M. and A. Pareek (2016): “Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently”, Journal of Financial Economics, 122.

- Cremers, M. (2017): “Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity”, Financial Analysts Journal, 73(2), 61-79.

- Ding, Z. and R.D. Martin (2017), ‘The fundamental law of active management: Redux’, Journal of Empirical Finance, Volume 43, 91-114

- Fama, E.F., and K.R. French (2010): “Luck versus skill in the cross section of mutual fund returns”, Journal of Finance, 65 (5), 1915-1947.

- Grinold, R.C. (1989): “The Fundamental Law of Active Management”, Journal of Portfolio Management, Spring 1989, 30-37.

- Harvey, C.R., Liu, Y and H. Zhu (2016): “… and the Cross-Section of Expected Returns”, Review of Financial Studies, 29(1), 5-68.

- Harvey, C.R. (2017): “Presidential Address: The Scientific Outlook in Financial Economics”, Journal of Finance, 72 (4), 1399-1440.

- Hou, K., C. Xue and L. Zhang (2017): “Replicating Anomalies”, The Ohio State University Fisher College of Business Working Pater No. 2017-03-010,

- Kasperczyk, M., C. Sialm and L. Zheng (2005): “On the industry concentration of actively managed equity mutual funds”, Journal of Finance, 60, 1983-2012.

- Kacperczyk, M., S. Van Nieuwerburgh and L. Veldkamp (2014): “Time-Varying Fund Manager Skill”, Journal of Finance, 69 (4), 1455-1484.

Note

- Fons Lute is a client portfolio manager at Russell Investments in London and Amsterdam. The views expressed are the author’s and cannot be attributed to Russell Investments. The author wishes to thank Ramon Tol, Ronnie Sabel and two anonymous reviewers for their useful comments and suggestions.

in VBA Journaal door Fons Lute