Introduction

Introduction

Financial markets worldwide have changed dramatically in recent years due to technological improvements. Not long ago, the majority of the stock market volume was executed manually on the exchange floor through hand signaling and shouting. Nowadays, most orders are executed at great speed by fully automated systems. Fast trading platforms are able to accept, execute, and reply to orders in less than one millisecond. And speed is not the only element that has changed. According to conventional wisdom the great majority of equities are traded on public exchanges, such as the New York Stock Exchange (NYSE) or Euronext. For instance, five years ago nearly 80 percent of the capitalization of U.S. equities was executed by the NYSE. However, the Securities and Exchange Commission (SEC) recently estimated that the NYSE currently executes only 26 percent of the volume in its listed stocks. The remaining volume is split among more than 10 public trading platforms, more than 30 dark pools, and numerous internalizing broker-deals.3 A similar increase of execution on alternative trading platforms is also visible in Europe, where the Markets in Financial Instruments Directive (MiFID) has increased competition between exchanges and alternative trading platforms.

Technological innovations and the altered equity market structure have opened the door for new types of professional market participants, such as high-frequency traders (HFTs). HFT in this respect is the use of computer algorithms to automatically and instantaneously make trading decisions, submit orders, and manage those orders after submission in a market-neutral and non-directional way.4 According to estimates of the SEC, HFTs nowadays represent more than 50 percent of U.S. equity market volume, up from 30 per cent in 2005.5 In Europe, consensus of market estimations regarding the current market share of HFT in equity volume is between 30 and 40 percent.6 These estimations highlight the fact that the scale of HFT is significant and growing worldwide. With its rise, HFT has attracted a lot of attention

“The liquidity enhancing role of high frequency traders is not undisputed.”

and has been, justified or unjustified, linked with events of market turbulence such as the ‘flash crash’ of May 6, 2010. On that day, U.S. equity markets experienced a significant price movement, as S&P 500 index futures dropped more than 5 percent in five minutes, only to rebound almost entirely within the next 15 minutes.7 Although the SEC investigation concluded that the flash crash incident was not directly caused by HFT, it acted as a catalyst and many market participants started to question its merits and its impact on the equity market structure.8 Among these market participants are institutional investors such as insurance companies and pension funds, who may find it increasingly difficult to execute large orders on public trading platforms without significantly impacting the price, as high-frequency traders submit large numbers of trading orders and subsequently push down the average transaction size on these venues. Furthermore, high-frequency traders can extract trading surplus from other investors by exploiting their speed advantage in a profitable manner.9 Therefore, institutional investors increasingly turn to less transparent trading platforms such as dark pools, which are less prone to these developments as they only disclose order information after trades are executed.

This paper explores the possible consequences of high-frequency trading, specifically in equity markets, for long term institutional investors such as insurance companies and pension funds, and suggests four practical lessons for these investors. The next section provides a broad overview of highfrequency trading, while section 3 discusses the possible impact of high-frequency trading on financial markets. The practical lessons for institutional investors are addressed in section 4. Finally, section 5 describes the conclusions.

What is high frequency trading?

High-frequency traders (HFTs) can generally be characterized as professional traders who utilize algorithmic techniques to generate orders with an extreme short investment horizon (often milliseconds). Maximizing the speed of market access and the number of executable trades is a major component of their trading strategy. Hence, HFTs invest in high-speed connections and sophisticated algorithms for generating, routing and executing orders. For this purpose, HFTs generally rent socalled server racks which provide the opportunity of locating the trade server in the same building as the exchange (co-location). Specific characteristics of HFT include (i) a trading strategy that focuses on exploiting arbitrage opportunities within or across asset classes, (ii) a market-neutral approach10 in which overnight exposures are limited, (iii) a very short average holding period varying from several seconds to minutes and (iv) the submission of numerous orders that are usually cancelled shortly after submission (the order-to-transaction ratio of high-frequency traders can easily be 100- to-1 or more).

In practice, however, high-frequency trading is typically not a single strategy in itself, but the use of sophisticated technology to implement various traditional trading strategies.12 Some HFT strategies involve a ‘delta-neutral’ approach to the market (ending each trading day in a neutral position to reduce exposure to overnight market risks), while other strategies are not neutral and sometimes acquire net long and net short positions.13 Hence, high-frequency traders can operate as market maker, directional trader or as both.

The market impact of high-frequency trading

Technological innovations have led to a dramatic change in the worldwide equity market structure in recent years. In Europe, this development was amplified by the introduction of the Markets in Financial Instruments Directive (MiFID) in 2007, which aimed to increase efficiency and competitiveness of European capital markets. The implementation of MiFID has created a competitive market for order execution by stimulating competition among trading venues. This not only increased the number of trading venues, but also created new market making and arbitrage opportunities for high-frequency traders. Subsequently, many of the new trading platforms such as multilateral trading facilities (MTFs), have developed a mutually dependent relation with HFT market makers, who act as the principal supplier of liquidity on these venues.14 HFTs can, for instance, enlarge the scope of traded securities on a multilateral trading facility by introducing trade execution in a new financial instrument (in return for a quoted spread). As such, an important benefit attributed to HFT is their role in fostering competition between trading venues and liquidity providers. This has led to a narrowing of market (bid-ask) spreads and a reduction of brokerage commissions, thus reducing trading costs per trade for all market participants.15 Another beneficial result of HFT is its impact on the price discovery function of financial markets. Academic literature generally finds a positive influence of HFT on the price discovery of stocks, as mispricing of financial assets can be arbitraged away within milliseconds.

The liquidity enhancing role of high-frequency traders, however, is not undisputed. Academic evidence on the relation between enhanced liquidity and HFT, for instance, is mixed.17 Moreover, the recent flash crash incident has raised questions concerning the ‘robustness’ of the liquidity provided by HFTs. In this respect, it is important to note that high-frequency traders operating as market maker do so in a manner significantly different from the traditional market makers (such as specialists on public exchanges). HFT market makers do not face the significant trading obligations that applied to traditional manual market makers and that were designed to promote fair and orderly markets and fair treatment of investors.18 Today, the obligations that apply to most registered market makers are minimal. In fact, nowadays many liquidity providing firms are not even registered as market maker. As such, so-called ‘shadow market makers’ such as HFTs may easily leave the market in case of unexpected market-moving events (which are difficult to program), thereby reducing liquidity when it is needed the most.

“... a dramatic change in the worldwide equity market structure ...”

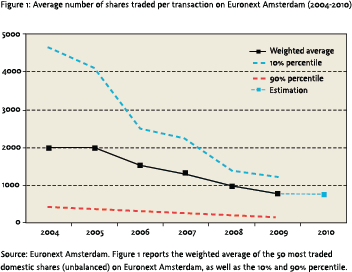

Another important outcome of the changed equity market structure and increased competition between trading platforms is the fragmentation of market liquidity over many trading venues. The increased competition between trading venues created arbitrage opportunities for HFTs, who started executing large numbers of trades with high speed on many trading venues. In this respect, the emergence of high-frequency traders contributed to a decline in the average size of trade orders, as the rise in trades outpaced the rise in share volume. The SEC, for instance, documented a rise in the number of average daily trades in NYSE-listed stocks from 2.9 million trades in 2005 to 22.1 million trades in 2009, versus a rise in average daily share volume from 2.1 billion shares to 5.9 billion shares in the same period. As a consequence, the average trade size in NYSE-listed stocks dropped from 724 shares to 268 shares between 2005 and 2009, which represents a 63 percent decline.19 Moreover, a similar trend is visible in Europe. Figure 1 displays the average number of shares traded per transaction on Euronext Amsterdam and reports a decline in the average number of shares traded per transaction from 1.969 in 2004 to 768 in 2009. In 2010, the estimated outcome was 741, indicating a 62 percent decline in the average number of shares traded per transaction in the last six years.20 Note that the top 10 percent largest trades show an even steeper decline in the average shares involved in each transaction.

Another important outcome of the changed equity market structure and increased competition between trading platforms is the fragmentation of market liquidity over many trading venues. The increased competition between trading venues created arbitrage opportunities for HFTs, who started executing large numbers of trades with high speed on many trading venues. In this respect, the emergence of high-frequency traders contributed to a decline in the average size of trade orders, as the rise in trades outpaced the rise in share volume. The SEC, for instance, documented a rise in the number of average daily trades in NYSE-listed stocks from 2.9 million trades in 2005 to 22.1 million trades in 2009, versus a rise in average daily share volume from 2.1 billion shares to 5.9 billion shares in the same period. As a consequence, the average trade size in NYSE-listed stocks dropped from 724 shares to 268 shares between 2005 and 2009, which represents a 63 percent decline.19 Moreover, a similar trend is visible in Europe. Figure 1 displays the average number of shares traded per transaction on Euronext Amsterdam and reports a decline in the average number of shares traded per transaction from 1.969 in 2004 to 768 in 2009. In 2010, the estimated outcome was 741, indicating a 62 percent decline in the average number of shares traded per transaction in the last six years.20 Note that the top 10 percent largest trades show an even steeper decline in the average shares involved in each transaction.

These numbers appear to confirm that the tradable size on public exchanges has decreased significantly. This development, in combination with the ability of high-frequency traders to extract trading surplus by exploiting their speed advantage, has made it increasingly difficult for institutional investors to execute (large sized) orders on public exchanges. For the execution of their (large sized) trades, they therefore increasingly turn to alternative trading platforms such as dark pools, which are less prone to these developments as they only disclose prices after trades are executed.

These numbers appear to confirm that the tradable size on public exchanges has decreased significantly. This development, in combination with the ability of high-frequency traders to extract trading surplus by exploiting their speed advantage, has made it increasingly difficult for institutional investors to execute (large sized) orders on public exchanges. For the execution of their (large sized) trades, they therefore increasingly turn to alternative trading platforms such as dark pools, which are less prone to these developments as they only disclose prices after trades are executed.

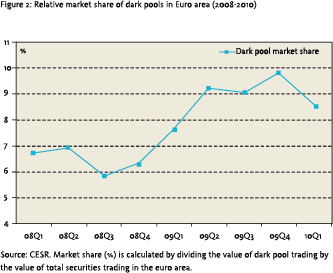

The interaction between dark pools and public trading markets also introduces new challenges. Figure 2 indicates that the share of securities traded on dark pools in Europe has increased to approximately 9 percent in recent years. So, in normal times, dark pools generally execute a substantial proportion of the trading volume. During volatile circumstances such as the ‘flash crash’, however, trading on dark platforms appears to drop significantly, thereby forwarding the flood of (sell) orders to the public markets (stock exchanges). This raises the interesting question whether public markets are able to handle nearly all the order flow in tough times, while being bypassed by large volumes in normal times.

Four lessons for institutional investors

The emergence of high-frequency trading has had a profound impact on the equity market structure in recent years. Liquidity, for instance, may change instantaneously causing real losses in the execution of large orders. In order to address the more complex market reality, regulators are working on a number of steps. For instance, the SEC has recently adopted circuit breakers for individual stocks, which intervene in the trading operations when securities or futures markets fluctuate too much within a certain time period.22 In Europe, the European Commission is currently working on the Review of MiFID, which involves a number of proposals aimed at the potential new risks that increased use of HFT could pose to financial markets. These proposals focus on the strengthening of risk controls among high-frequency traders and trading venues, fair and equal offering of co-location facilities and a reduction of excessive order volume by introducing a cap on the ratio of orders to transactions.23 Moreover, both Europe and the U.S. are reviewing whether (high-frequency) traders that provide significant liquidity to a market should be subjected to similar conditions as ‘traditional’ market makers with obligations to provide quotes and liquidity. Although these proposals will contribute to the mitigation of part of the risks that increased use of HFT might pose, institutional investors need to be aware of the broad consequences that the emergence of HFT might have for their portfolio management process. In this context, we suggest four lessons for institutional investors.

Ensure adequate liquidity management

The fragmentation of market liquidity over different trading venues as well as the rise of highfrequency trading has significantly reduced the tradable size on public exchanges. In managing this development, institutional investors have reduced their average trade order size. However, this has put upward pressure on transaction costs. In order to circumvent a rise in trading costs, institutional investors may increasingly opt to trade on dark pools. In this respect, it is important for institutional investors to incorporate the possibility of an illiquidity shock in dark pools, which might occur during volatile market conditions. Hence, executing trades via dark pools places a higher demand on liquidity management in terms of adequacy and professionalism. Regularly simulating and evaluating stress scenarios could provide a useful tool in this risk management context to prepare for liquidity short falls.

Moreover, the emergence of high-frequency trading also makes it harder for (institutional) investors to adequately establish the underlying level of market liquidity. Certain high-frequency trading strategies might provide ‘ghost liquidity’, which can result in an unclear representation of the real depth of the market order book (and of the real supply and demand in the market). Hence, traditional indicators for market liquidity such as trading volume might not necessarily be reliable. In order to establish a realistic image of market liquidity on a certain trading venue, institutional investors need to monitor a wide array of liquidity measures such as bid-ask spreads, price volatility, turnover ratio and the order-to-transaction ratio. Market depth is important to assess carefully, as it refers to the volume of trades possible without moving prevailing market prices.

Monitor the order transaction process

Monitor the order transaction process

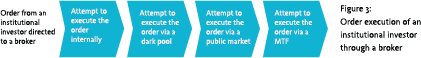

With regard to the implementation of their investment strategy and the rebalancing of their investment portfolios, institutional investors typically depend on brokers for the execution of orders. Figure 3 displays the way in which an order is generally executed by a broker. Note that the order execution process is dependent on the specific market conditions at the time of the execution.

In general, brokers will first try to match incoming orders internally through so-called broker crossing systems. If there is insufficient internal liquidity, brokers will generally turn to dark pools for the execution of the order. Although dark pool liquidity increased in recent years, they may be unable to provide sufficient liquidity for very large orders under certain market conditions. In this case, the broker will opt for a public exchange or a multilateral trading facility. However, at public markets, large order execution might be more prone to high-frequency trading strategies such as predatory trading. By means of predatory trading, HFTs exploit regularities in the investing behavior of other investors by acquiring positions a fraction earlier.24 An example might be predictable quarterly rebalancing strategies. Predatory trading is

“... HFT has stimulated the process of fragmentizing market liquidity over many trading venues.”

more difficult within dark pools as price quotes are not publicly displayed, making it harder to observe trading patterns.

Hence, institutional investors need to be aware of their order execution chain and the possible impact of HFT on an efficient execution of orders. This has, e.g., to do with the optimal order size. Large trades may need to be divided into smaller orders, as HFTs have become better able to detect trading patterns and how to profit from these. This may result in higher trading costs for pension funds and may subsequently force pension funds to improve their way of executing large orders with minimum market impact. Moreover, institutional investors need to be aware of the technical capabilities as well as the limitations of the trading systems of their brokers. In general, the changes in the equity market structure have made it increasingly important for institutional investors to define a clear policy regarding the order execution chain.

Hence, institutional investors need to be aware of their order execution chain and the possible impact of HFT on an efficient execution of orders. This has, e.g., to do with the optimal order size. Large trades may need to be divided into smaller orders, as HFTs have become better able to detect trading patterns and how to profit from these. This may result in higher trading costs for pension funds and may subsequently force pension funds to improve their way of executing large orders with minimum market impact. Moreover, institutional investors need to be aware of the technical capabilities as well as the limitations of the trading systems of their brokers. In general, the changes in the equity market structure have made it increasingly important for institutional investors to define a clear policy regarding the order execution chain.

Be aware of (technological) capabilities of counterparties

The fragmentation of market liquidity forces institutions to reduce their average trade order size in order to avoid having a significant price impact on traded securities. As a consequence, institutional investors are generally required to execute a high(er) number of transactions. This might require the use of an automated trading system, which increases the vulnerability to HFT strategies. For instance, certain highly sophisticated high-frequency (low-latency) strategies are primarily focused on identifying trading patterns or less sophisticated algorithmic trading rules used by other market participants.25 These low-latency strategies continuously improve or modify their trade algorithms in order to combat the threat of the strategy being reverse engineered by competitors. So due to the rapid technological improvements, it is important for institutional investors to be aware of the technical capabilities of counterparties and other market participants aimed at predatory trading.

Prevent market manipulation and reduce reputation risk

Long term investors might not only be influenced indirectly by HFT, but may also invest in highfrequency driven (hedge) funds or through their broker. Regulators are still discussing whether some HFT strategies violate existing rules against fraudulent, market manipulation or other improper market behavior. There is an ethical and legal side to HFT which could imply a reputation risk for institutional investors. They should therefore be aware of unintentional market manipulation and contribute to prevent such behaviour. This may invoke collaboration initiatives between pension funds and other institutional investors to coordinate activities aimed at this goal.

Conclusions

Technological improvements as well as regulatory reforms have significantly altered financial markets worldwide in recent years. The new equity market structure has opened the door for new types of professional market participants such as high-frequency traders and alternative trading venues such as dark pools. With its emergence, high-frequency trading (HFT) has attracted a lot of attention. HFT is credited with accelerating the price-discovery process, limiting market frictions and reducing transaction costs. However, HFT has also stimulated the process of fragmentizing market liquidity over many trading venues. This has introduced new challenges and risks for institutional investors who rely on well functioning financial markets. As a consequence, they are required to diminish their trade order size or trade on alternative (‘dark’) trading platforms to avoid significant market impact. We suggest several areas where institutional investors can contribute to controlling risks involved in HFT and ensure an efficient order execution across trading platforms.

Noten

- The authors would like to thank Paul Cavelaars, Lode Keijser and Sven Stevenson for useful suggestions.

- Dirk Broeders and David Rijsbergen work in the Supervisory Strategy Department at De Nederlandsche Bank (DNB). This article is written in a personal capacity and does not reflect any DNB position or policy. Robin Vogelaar is a student at Erasmus University Rotterdam.

- The numbers are obtained from the speech by SEC Chairman Mary Schapiro ‘Strengthening our Equity Market Structure’, September 7, 2010. Dark pools are automated trading platforms, in which transactions are executed by matching blocks of buy and sell orders of anonymous traders. As such, the price and volumes of orders are not displayed before a transaction is executed on the system. Hence, dark pools are dark in the sense that they lack pre-trade transparency.

- Hendershott, T. and Riordan, R., (2009), ‘Algorithmic Trading and Information, Working Paper NET Institute 09-08.

- Exact figures on the size of HFT are not (yet) available. This can primarily be explained by the fact that most trading platforms are not yet capable of distinguishing high-frequency traders from other algorithmic traders.

- Autoriteit Financiële Markten, (2010), ‘High frequency trading’, November 2010.

- Approximately 2 billion shares with a total volume of over $56 billion dollars were traded during these 20 minutes. See SEC Report, ‘Findings Regarding the Market Events of May 6, 2010’, September 30, 2010.

- SEC Report, ‘Findings Regarding the Market Events of May 6, 2010’, September 30, 2010. For the catalyst effect see for example ‘‘Flash crash’ delivers clear messages’, Duncan Niederauer, Financial Times, May 26, 2010 and ‘’High-frequency trading under scrutiny’’, Financial Times, July 28, 2009.

- HFTs can exploit their speed advantage by executing (and cancelling) orders so as to position their orders at front of the order book queue and intermediate in market transactions for a short period of time. See A. Cartea en J. Penalva (2010), ‘Where is the Value in High Frequency Trading?’, SSRN Working paper, for different HFT strategies focused on extracting trading surplus.

- Market-neutral strategies are often attained by taking matching long and short positions in different stocks.

- See SEC Report, ‘Findings Regarding the Market Events of May 6, 2010’, September 30, 2010.

- See European Commission (2010), ‘Review of the Markets in Financial Instruments Directive (MiFID)’, 8 december 2010.

- Jovanovich and Menkveld (2010) find that HFTs in the role as market makers do not always succeed in returning to a neutral position, but conclude that a tendency of reducing positions at the end of a trading day does exist. Jovanovich, B. and Menkveld, A.J., (2010), ‘Middlemen in Limit-Order Markets’, Preliminary version of the paper, June 12, 2010.

- Autoriteit Financiële Markten, (2010), ‘High frequency trading’, November 2010.

- The temporary short-selling ban on financial stocks in 2009 might support this view. As HFTs could not properly arbitrage financial stocks, they stopped providing liquidity in these stocks. Several studies show that spreads of financial stocks subsequently widened by 40 percent and volumes decreased substantially after the short-selling ban was enacted. See for example the IMF Global Financial Stability Report, April 2010, Chapter I (Annex 1.2).

- Hendershott, T. and Riordan, R., (2009), ‘Algorithmic Trading and Information, Working Paper NET Institute 09-08. It is important to note, however, that HFTs generally use arbitrage trading strategies that solely focus on the relative mispricing between assets (classes), and not so much on the relation between price and fundamental value of a security.

- See for example Hendershott, T., Jones, C.M., and A.J. Menkveld, (2008), ‘Does algorithmic trading improve liquidity?’, Journal of Finance, forthcoming, WFA 2008 paper, and Venkataraman, K., (2001), ‘Automated versus floor trading: an analysis of execution costs on the Paris and New York Exchanges’, Journal of Finance 56, 1445-1485.

- These included affirmative obligations to provide liquidity and to promote price continuity, as well as negative obligations that exclude trading in ways that would exacerbate price movement. Note, however, that traditional market makers have possible methods to get around these obligations, such as quoting stub quotes. See the speech by SEC Chairman Mary Schapiro ‘Strengthening our Equity Market Structure’, September 7, 2010.

- See SEC (2010), ‘Concept release on equity market structure’, Concept release no. 34- 61358.

- The estimate for 2010 is based on the average number of shares traded per transaction on Euronext Amsterdam in december 2010, which was subsequently scaled up to a yearly estimate.

- See SEC Report, ‘Findings Regarding the Market Events of May 6, 2010’, September 30, 2010.

- Note the difference with broad market circuit breakers, which are longstanding and apply across securities and futures markets in many parts of the world.

- See European Commission (2010), ‘Review of the Markets in Financial Instruments Directive (MiFID)’, 8 december 2010.

- Predatory trading refers to the practice of HFTs to quickly determine regularities in the buying behaviour of institutional investors or other large buyers. In case several parts of an order have been executed, HFTs start to build positions in the same security to exploit further executions.

- Autoriteit Financiële Markten, (2010), ‘High frequency trading’, November 2010.

in VBA Journaal door Dirk Broeders, David Rijsbergen and Robin Vogelaar